Banking Sector In Malaysia

It serves as the country s central bank responsible for promoting monetary and financial stability.

Banking sector in malaysia. Islamic banking scheme deposit by type and holder. Islamic banking system. Capital buffers including ccb for the banking sector as a whole correspondingly strengthened further by 8 3 to rm134 8 billion 2016. Bank negara malaysia table 2 1 by dividend reinvestments and capital injections.

While foreign banks been present in malaysia from the inception of the modern banking industry in the country domestic banks have come to dominate the country s banking sector. Islamic banking scheme loans by type and sector. The malaysian banking sector comprised 54 banks as at the end of 2017. Islamic banking scheme loans by purpose and sectors.

It has excess capital of rm121 billion versus rm39 billion in 2008 and is capable of withstanding potential credit and market losses. The country s financial institutions are governed by the bank negara malaysia which was established in 1959. Credit card operations in malaysia should read as investment banks. Malaysia is one of the fastest growing economies in the region one of its economic progress major contributor is its innovative and growing financial sector.

Today malaysia has 27 commercial banks 11 investment banks and 18 islamic banks. Data from 2019 shows that the banking sector had a total capital ratio of 18 4. Retail banking in malaysia coronavirus covid 19 sector impact. The sector recorded a common equity tier 1 capital ratio of 14 4 and gross impaired loan ratio of 1 6 in february this year.

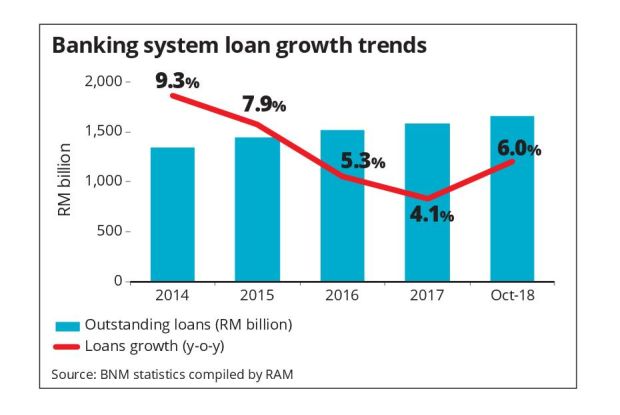

The origin of the banking sector in malaysia goes back to the existence of the british merchant communities in penang and singapore dating back to the 19th century which is also known as the straits settlement penang s strategic location and port facilities became a launch pad for banks. The balance sheet of the banking sector expanded by 4 3 for the year. Its banking sector remains well capitalized retains profitability and continuously improving.