Company Tax Rate 2020 Malaysia Calculator

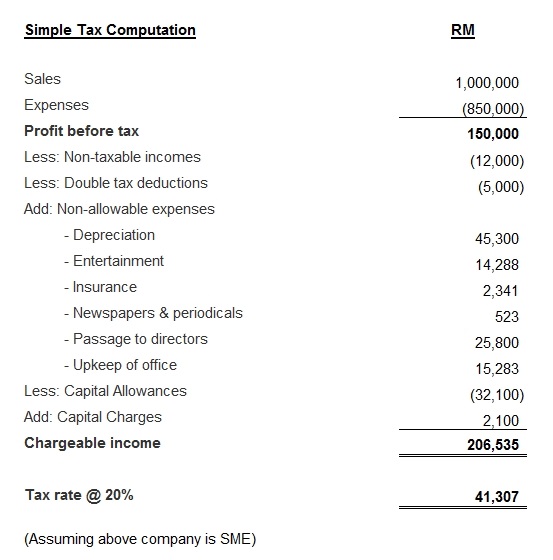

Malaysia corporate income tax calculator for ya 2020 assessment of income in malaysia is done on a current year basis.

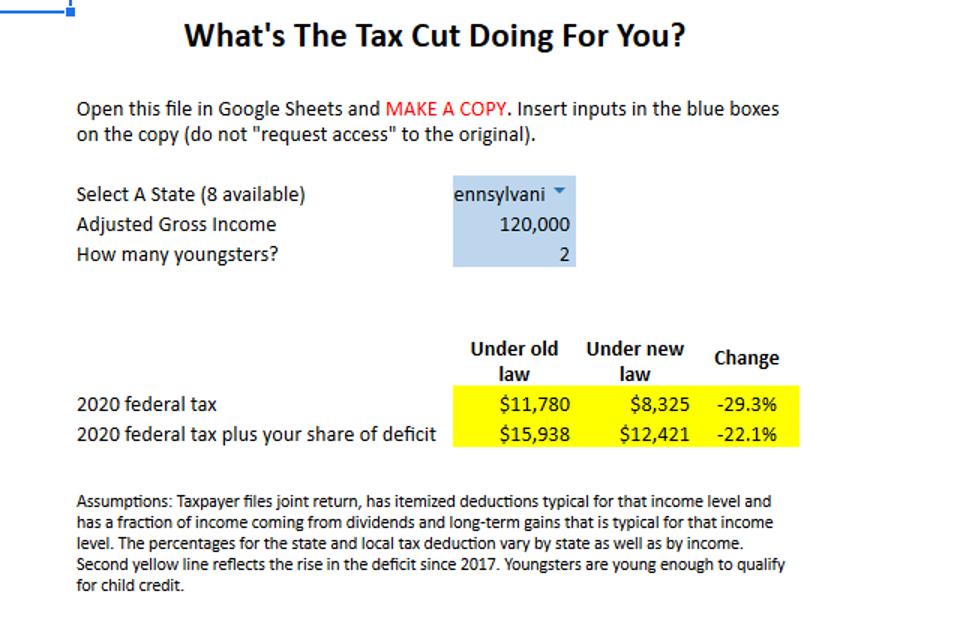

Company tax rate 2020 malaysia calculator. Calculations rm rate tax rm 0 5 000. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes. With paid up capital of 2 5 million malaysian ringgit myr or less and gross income from business of not more than myr 50 million. Cit rate for year of assessment 2019 2020.

On the first 5 000 next 15 000. As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs and deductibles available. Resident company other than company described below 24. Corporate tax rate in malaysia averaged 26 21 percent from 1997 until 2020 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015.

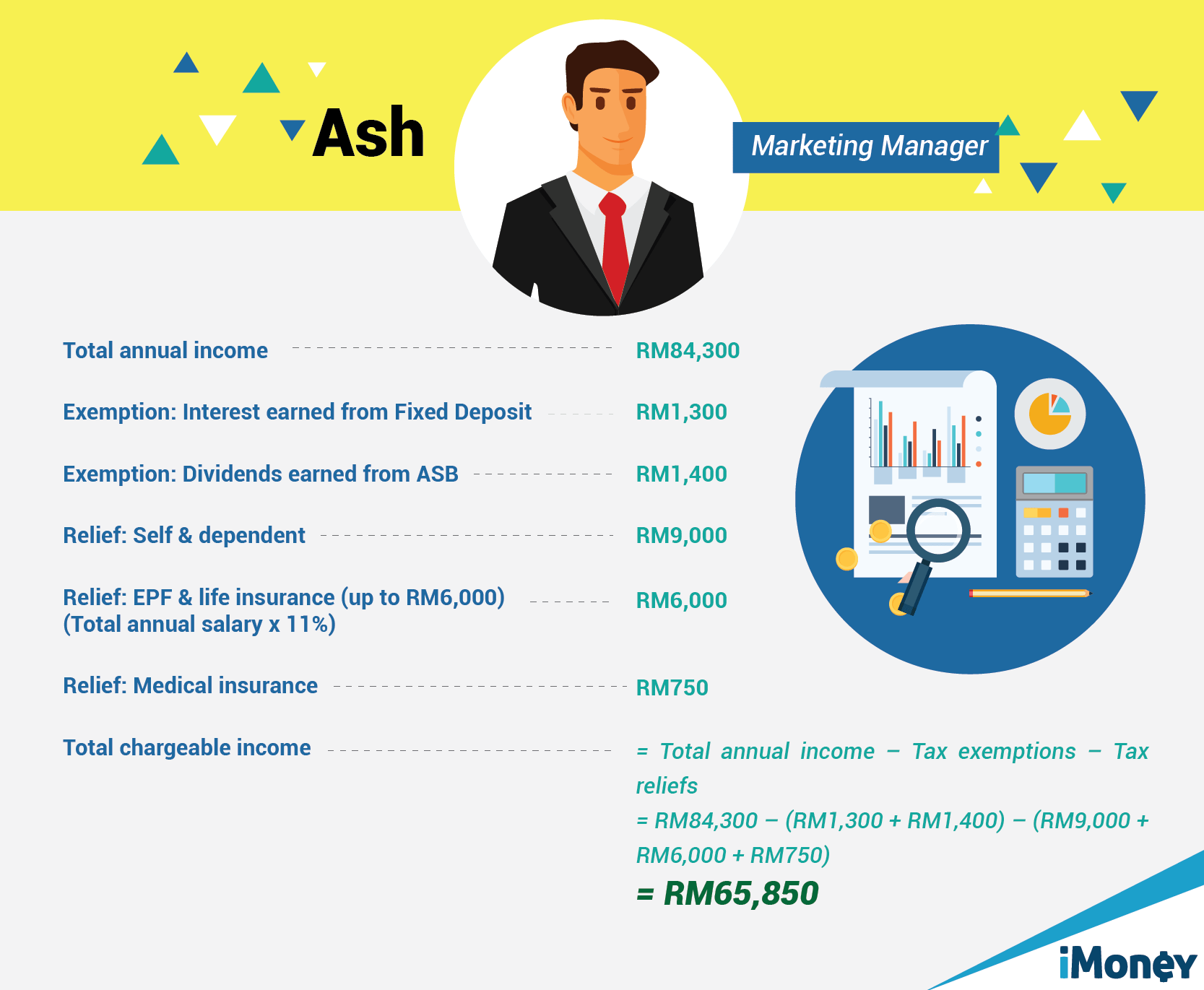

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you. That does not control directly or indirectly another company that has paid up capital of. It is important to note that the burden of computing tax liabilities accurately is on the company and accordingly tax payers are expected to compute taxes while obeying taxation laws and guidelines issued by the malaysian inland revenue board irb. The system is thus based on the taxpayer s ability to pay.

Malaysia personal income tax calculator for ya 2020 malaysia adopts a progressive income tax rate system. This means that low income earners are imposed with a lower tax rate compared to those with a higher income.