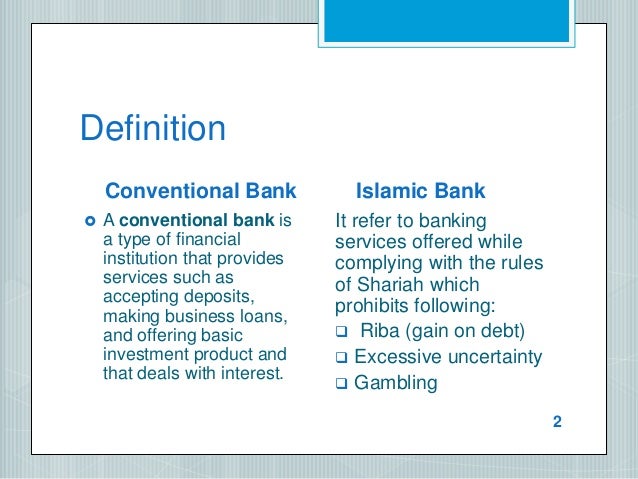

Definition Of Islamic Banking And Conventional Banking

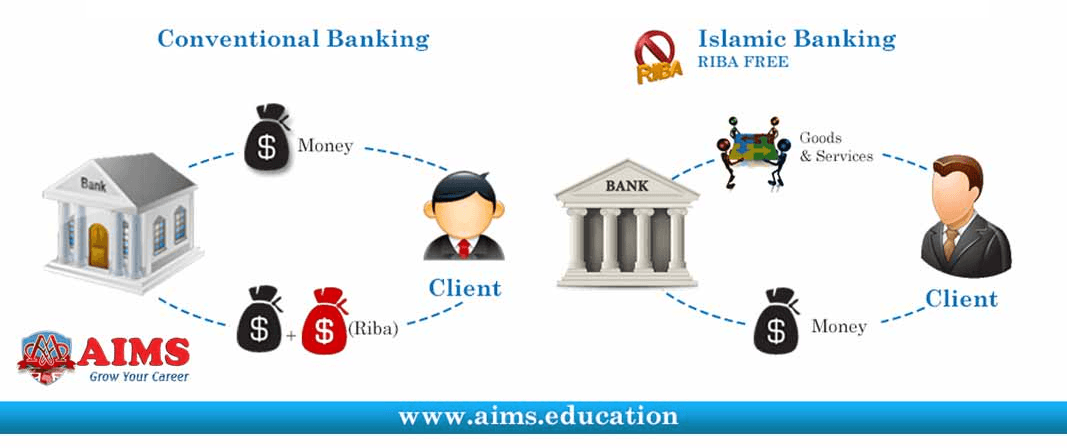

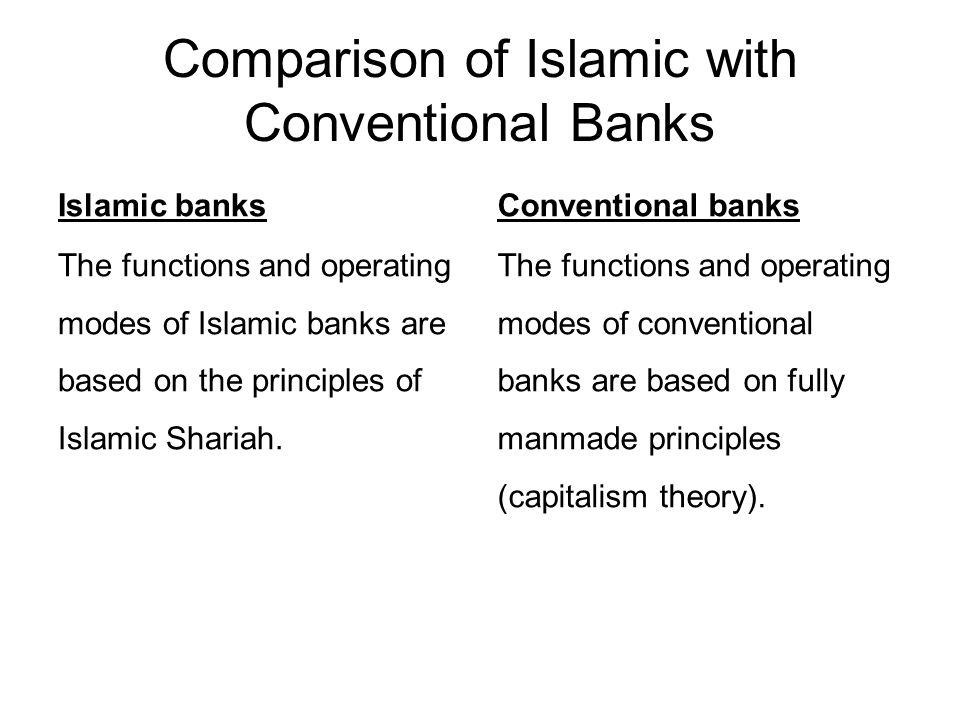

Islamic banking on the other hand uses islamic teachings and syariah laws in their banking products which levy profit rates instead of interest rates.

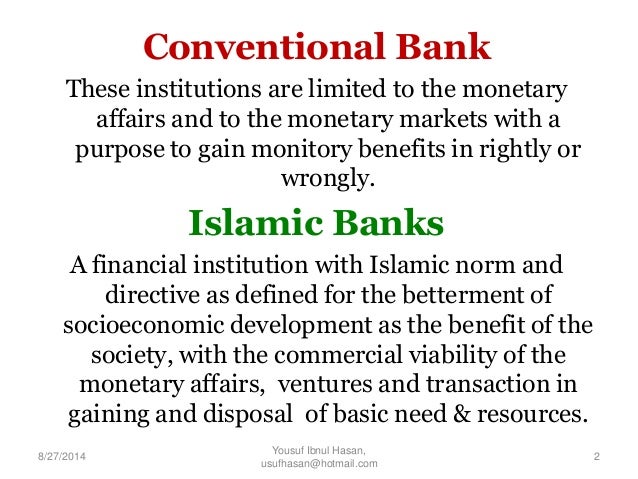

Definition of islamic banking and conventional banking. An islamic banking is not only banker but also a partner in business. The history of banking is as old as 2000 bc when there were trading system and the gold coins. There are different banking systems in the world but the most famous ones are conventional banking and the islamic banking. Income through interest 3.

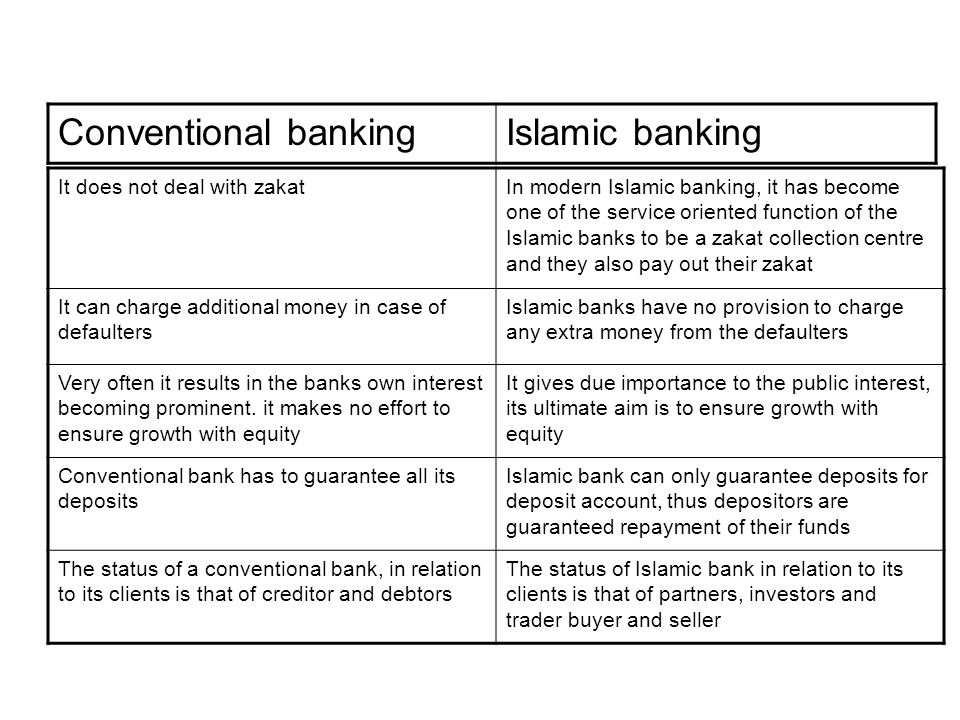

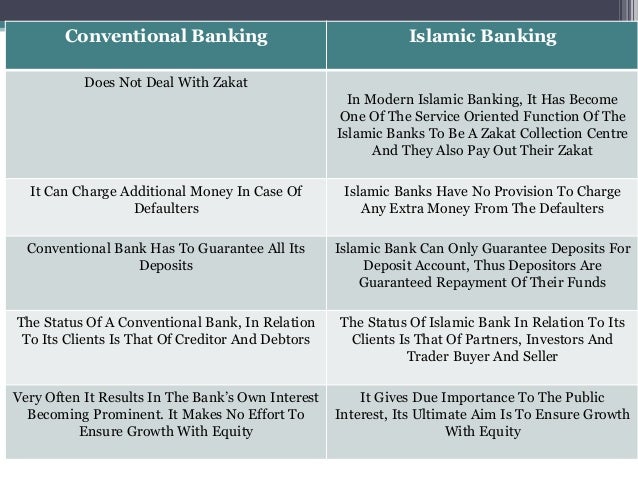

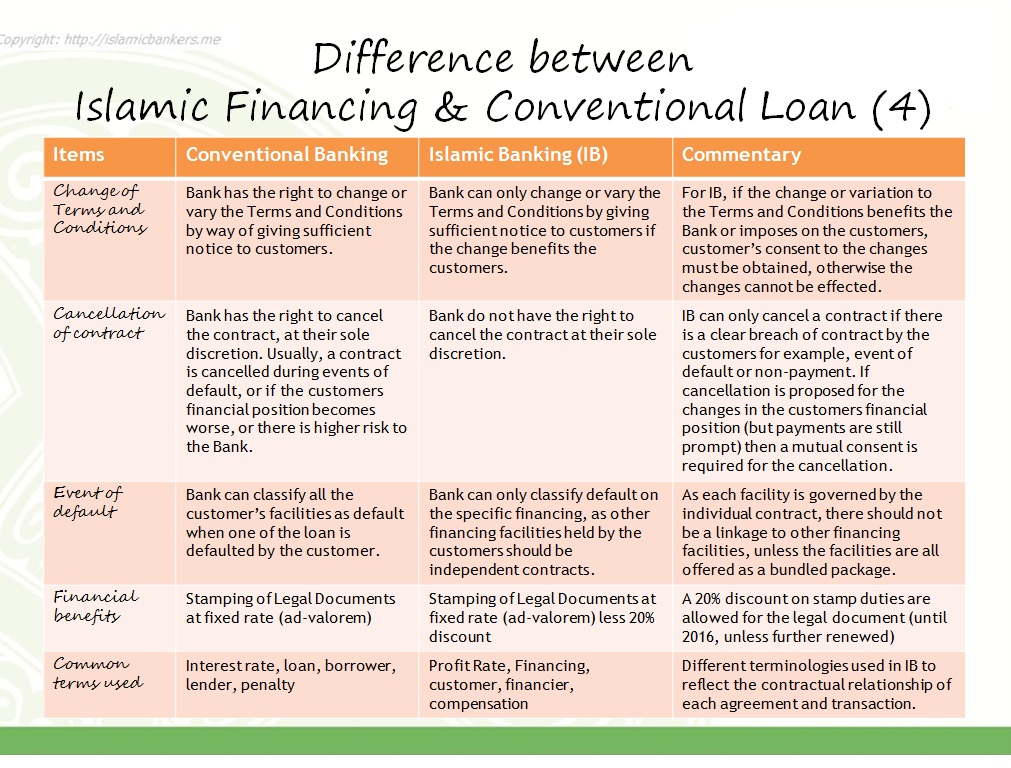

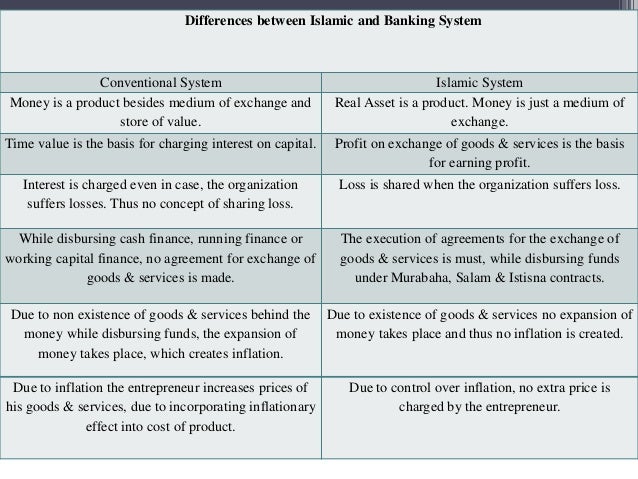

Late payment charges on delayed payments and shall constitute bank s income. Interest in completely prohibited in islamic banking. In islamic banking profit are distributed out of profit earning by bank for the month as per decided weightages. On the other hand conventional banking is.

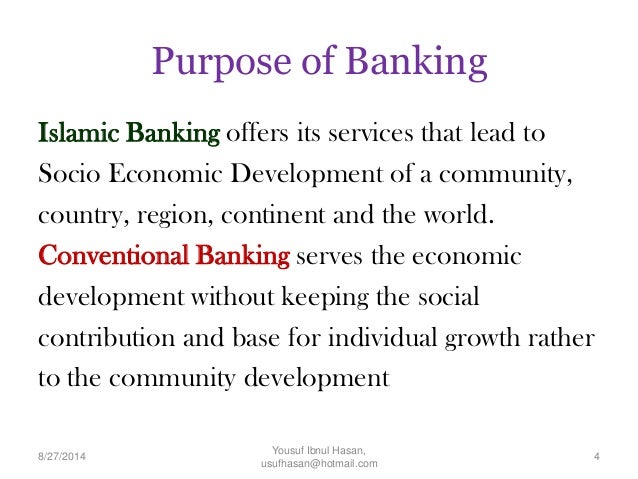

For example you cannot take a loan for a wine shop. The bank does not have the responsibility of profit loss of the customer. Islamic banking and conventional banking the difference between the two articles and news about islamic banking and islamic insurance. Islamic banking is an ethical banking system and its practices are based on islamic shariah laws.

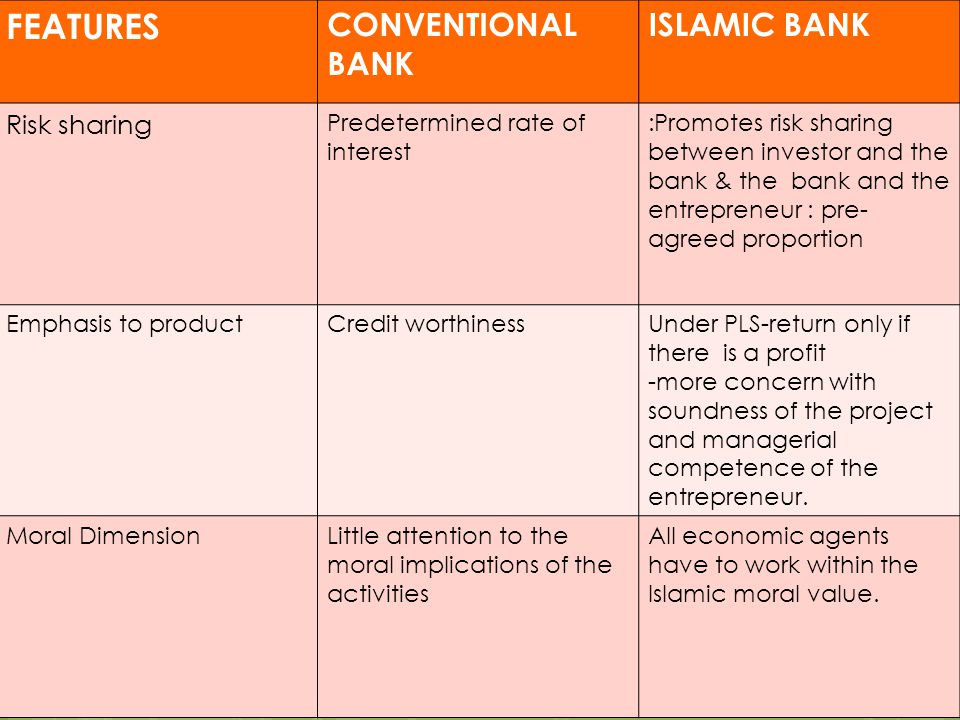

Islamic bank keeps all matter in transparent with its participator and share in financing profit at pre agreed ratio of investment profit not on the application of rate on principal interest like in the conventional banking. Islamic banking takaful. It is a participatory banking in capital and profit loss. The banks borrow to lend.

Islamic banks offer financing leasing facilities to their clients to fulfil their business requirements on the basis of following. The main function of conventional bank can be summed up in one sentence. It is asset based financing in which trade of elements prohibited by islam are not allowed. Conventional banking loan contracts characteristics.

In conventional bank the relation between customer and banker is nothing but debtor and creditor. Many have come in contact with all types of banking products conventional and islamic on a daily basis but may not be aware of how they operate and more importantly advantages or disadvantages posed towards their finances. No risk of underlying assets 2. Islamic banking is a banking system that is.