Definition Of Islamic Banking And Finance

The islamic finance industry has expanded rapidly over the past decade growing at 10 12 annually.

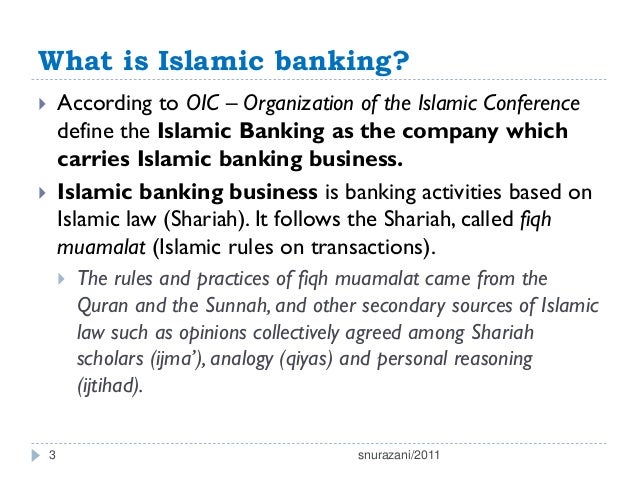

Definition of islamic banking and finance. Islamic banking or islamic finance arabic. Islamic banking a system of banking that only offers products that conform to the sharia or islamic law. What is islamic finance. Just like conventional financial systems islamic finance features banks capital markets fund managers investment firms and insurance companies.

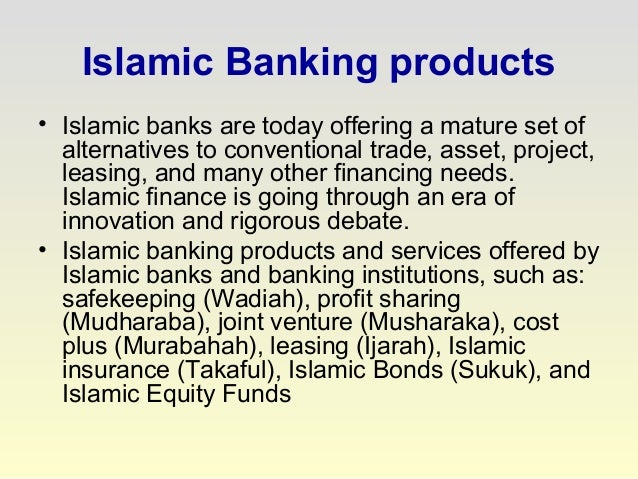

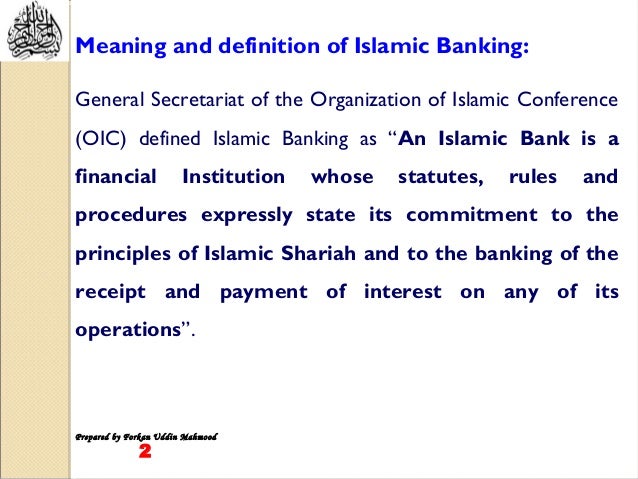

The main concept of the islamic banking is the prohibition on collection of interest and its utilization for the business purposes. However these entities are governed both by islamic law and the finance industry rules and regulations that. Qatar the main difference between conventional finance and islamic finance is that some of the practices and principles that are used in conventional finance are strictly prohibited under sharia laws. مصرفية إسلامية or sharia compliant finance is banking or financing activity that complies with sharia islamic law and its practical application through the development of islamic economics some of the modes of islamic banking finance include mudarabah profit sharing and loss bearing wadiah safekeeping musharaka joint.

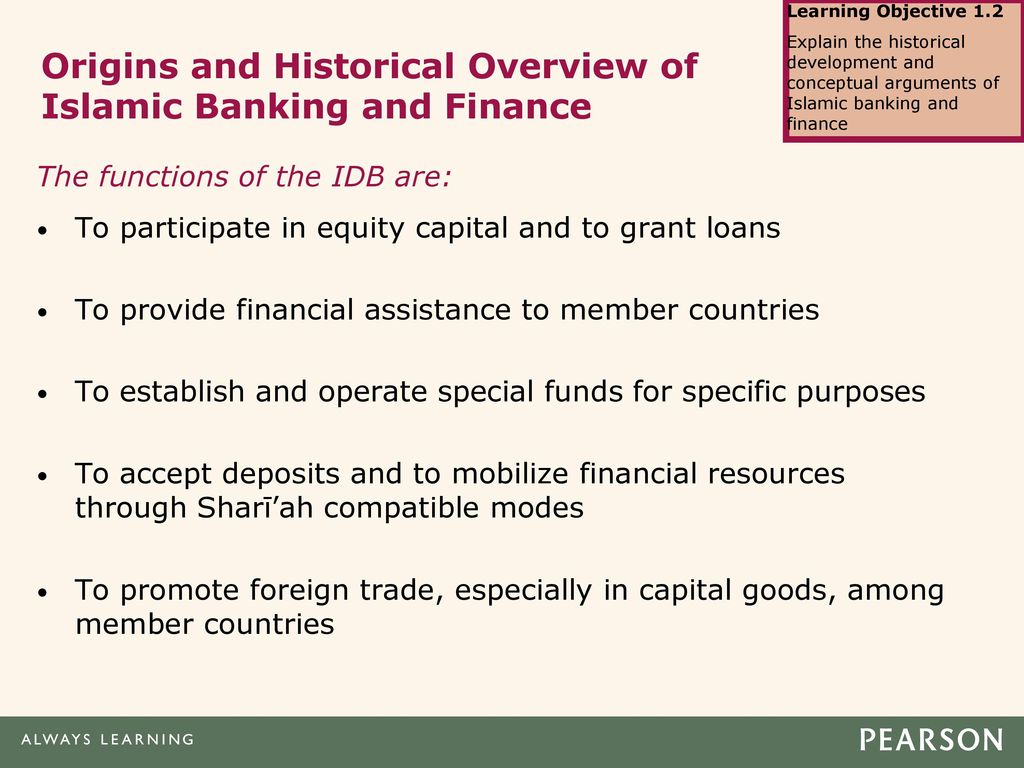

There is no single definition of islamic finance but it is widely used today to refer to financial and commercial activities that respect the principles of islamic law and jurisprudence more commonly referred to as shari a. Today sharia compliant financial assets are estimated at roughly us 2 trillion covering bank and non bank financial institutions capital markets money markets and insurance takaful. Respect for such principles allows investing and making profits in accordance with the rules of muslim law. The term islamic banking refers to a system of banking or banking activity that is consistent with islamic law sharia principles and guided by islamic economics.

For example in islamic banking checking and savings deposits do not accrue interest. Because this involves higher risk than conventional banking services various highly technical products. Islamic banking is a finance management system that is based on the islamic rules of sharia. Islamic finance is governed by the sharia islamic law sourced from the quran and the sunnah.

Introduction to islamic banking. Islamic finance is seen as an alternative approach to lending that is based strongly around morals and religious belief islamic trade finance is simply trade finance performed in a way that complies with the laws from the islamic holy book the qu ran the idea of a set of rules for islamic finance was introduced around 1950 70 as a solution and a response to the. Nowadays the islamic finance sector grows at 15 25 per year while islamic financial institutions oversee over 2 trillion.

:max_bytes(150000):strip_icc()/PROJECT-DEVELOPER-9bddde300c994be3871dd9790d15f7bb.jpg)