Demand And Supply Of Housing In Malaysia

This housing watch microsite aims to provide timely information on the key factors that influence the demand and supply of housing in malaysia for a more informed decision making and public discourse on this issue.

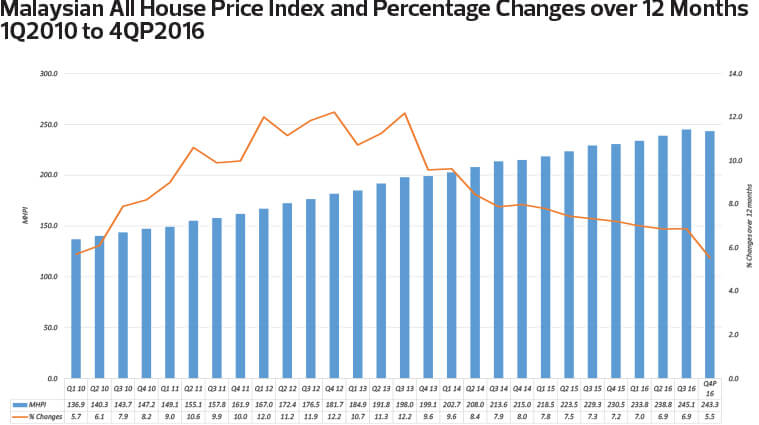

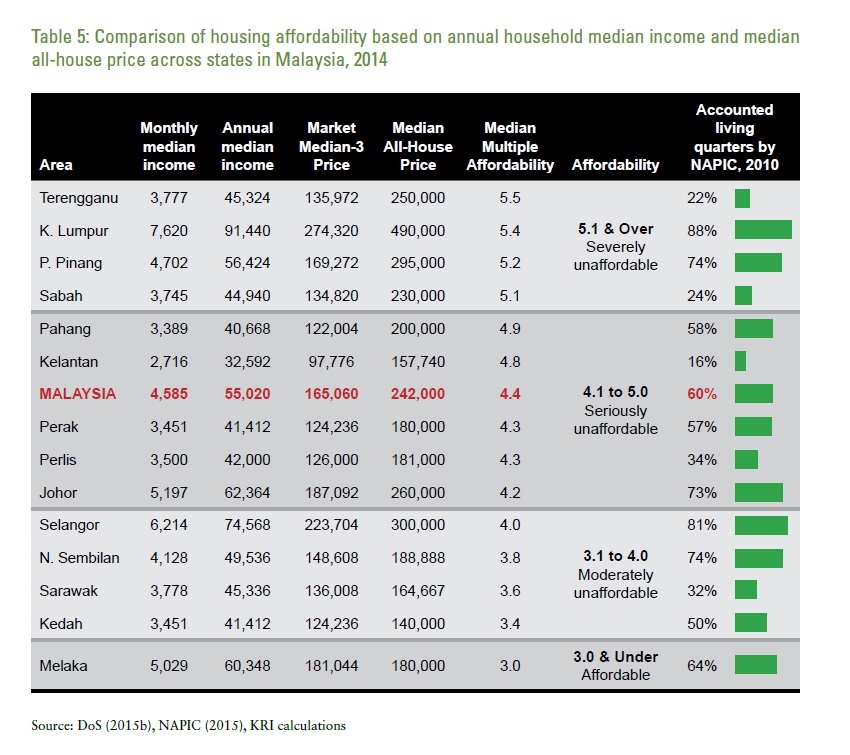

Demand and supply of housing in malaysia. Yet we continue to hear read of people wanting to buy a. The straits times reported that only a quarter of homes launched nationwide between 2016 to march 2018 cost under rm250 000 and for the first time in a decade the overall house price index fell on a quarterly basis last year. The government targets to provide 606 000 new affordable houses during the course of the 11th malaysia plan spanning from 2016 to 2020 introduce an integrated database to match supply and demand. Which means demand does exist but the issue is affordability.

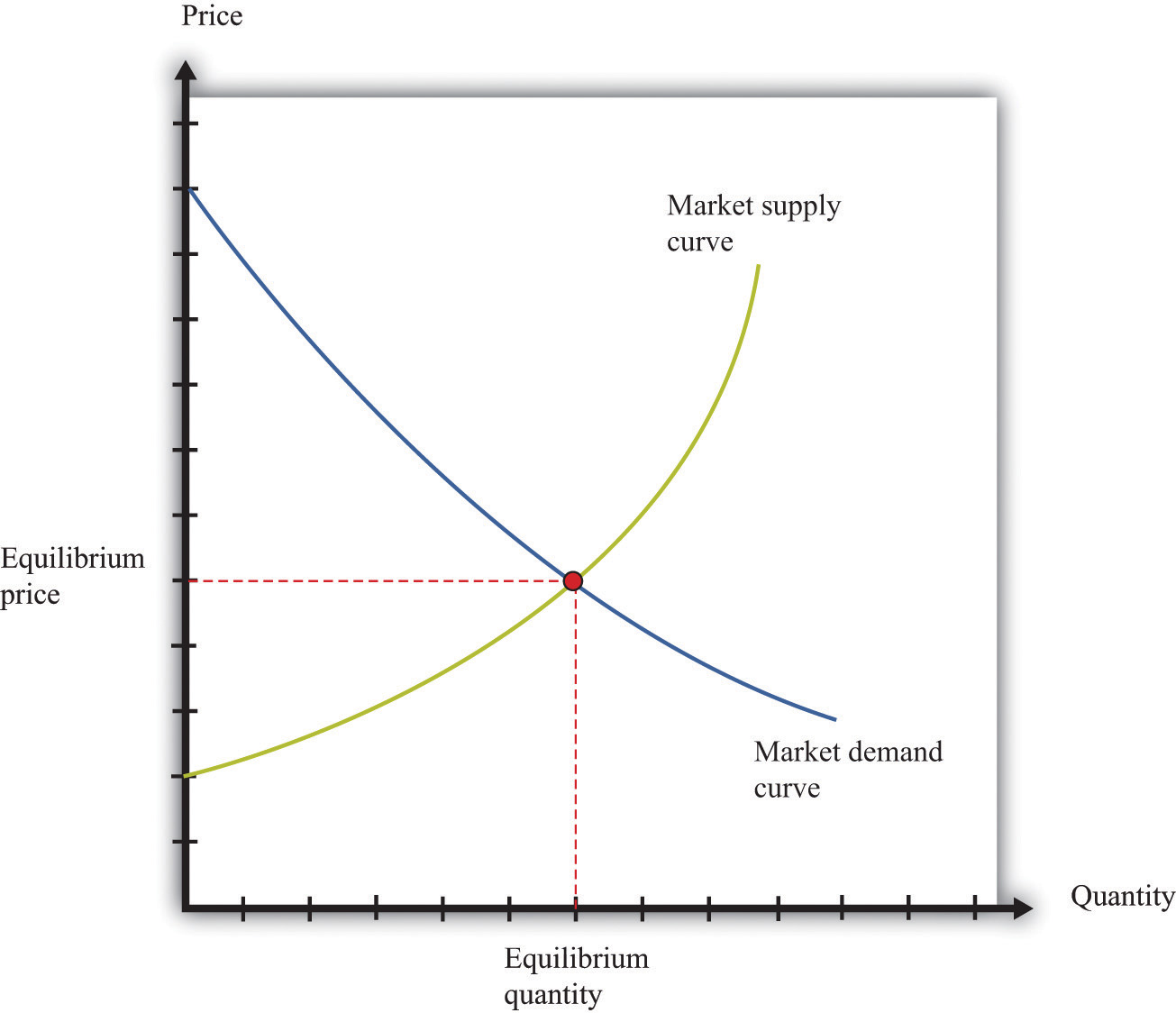

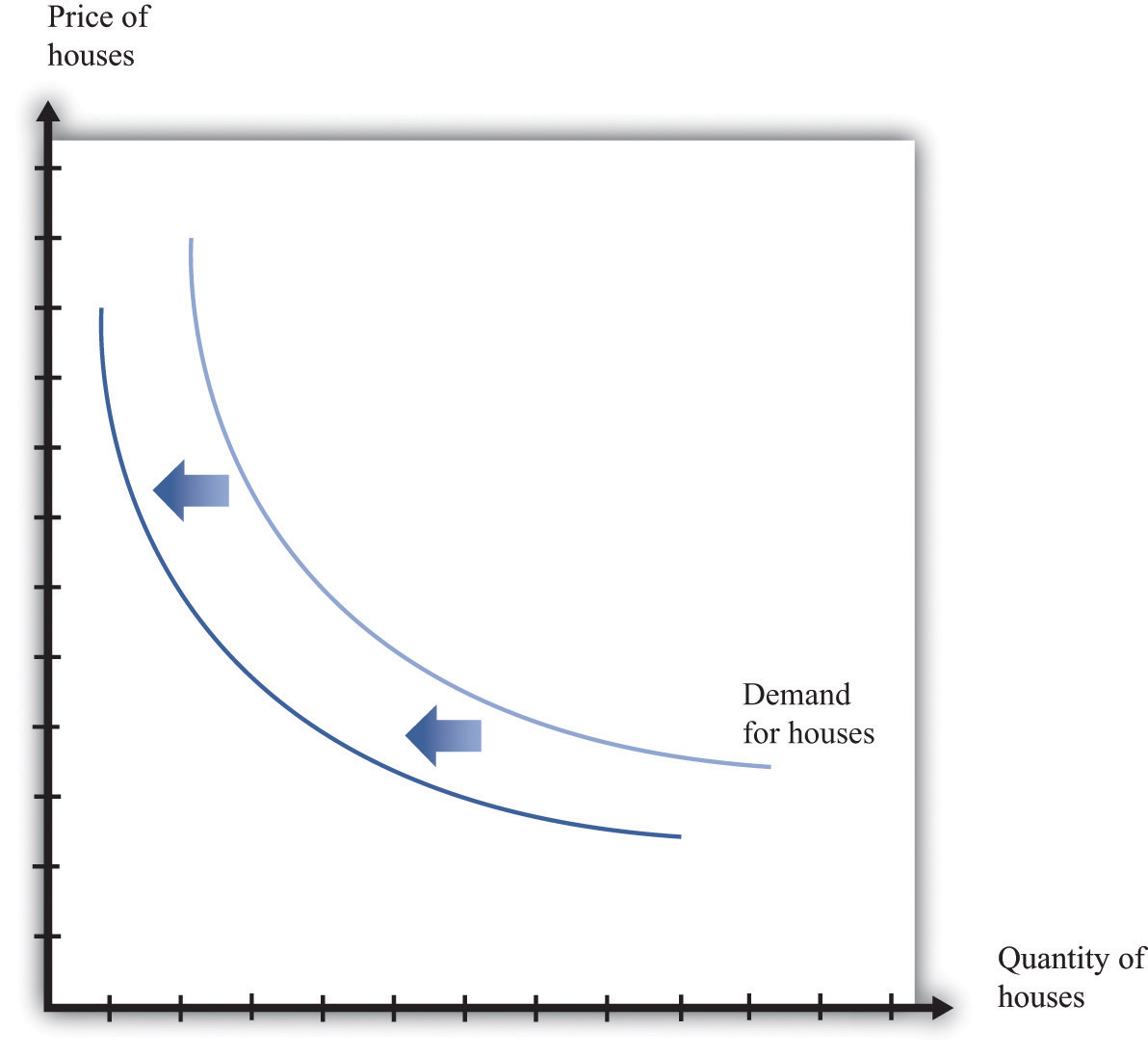

Kuala lumpur march 9 malaysian property developers face the conundrum of more expensive houses remaining unsold even as demand exceeds the supply of affordable housing. The malaysian reserve tmr looks at the housing supply and population of each state in the country. Affordable housing or otherwise the demand isn t there while the unsold supply languishes unwanted. One reason why i don t think there s a housing bubble in malaysia is that there s a fundamental divergence between supply and demand.

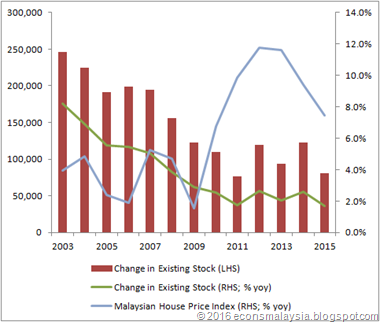

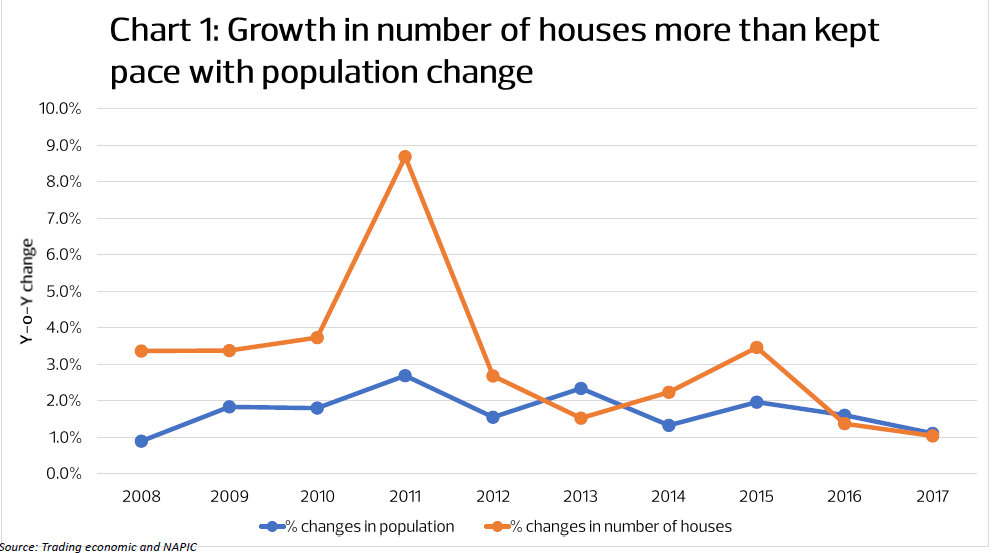

Yet talk of people wanting to buy houses but not being able to do so abounds. There is more than ample supply. Shortage of supply in the affordable housing market since 2005 malaysia s housing stock has increased by 35. In malaysia housing offi ce and retail with a focus on the key states1 kuala lumpur selangor johor and pulau pinang and seeks to highlight lessons from the experiences of other countries.

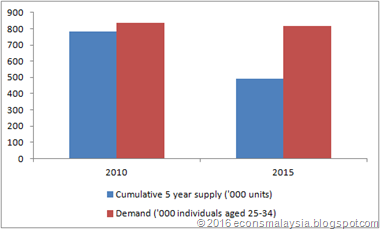

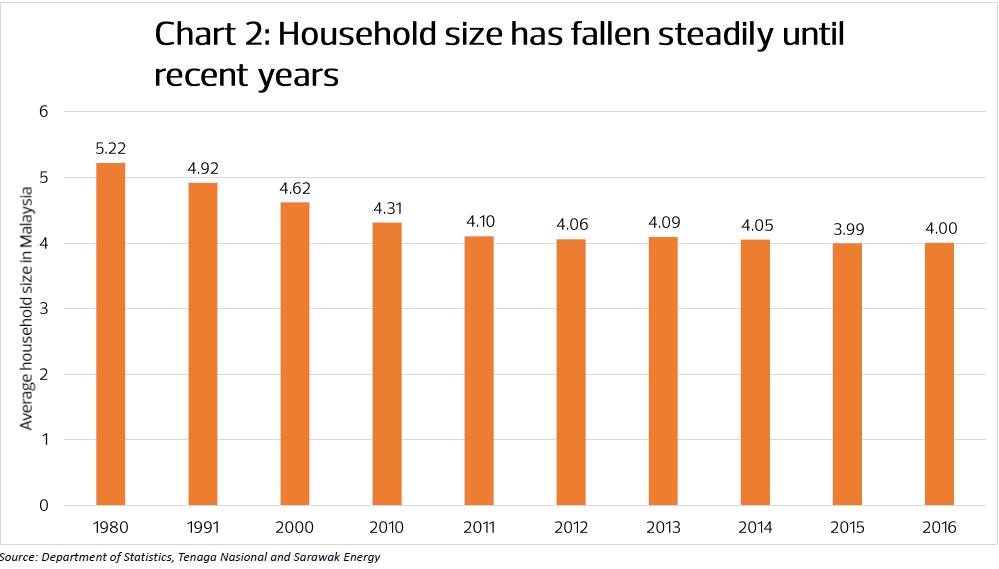

Clearly malaysia does not need to build more houses in the near to medium term. The obvious conclusion is that malaysia does not need to build significantly more houses in the near to medium term affordable housing or otherwise to meet demand. About 24 709 units were completed in the first half of 2011 a lower number compared to 50 611 units completed in the first half of 2010. The potential demand from first time home buyers here defined as individuals aged 25 34 will peak in the next five years the 5 year compound annual growth rate of this segment of the population rose from 2 1 in 2005 to 3 75 in 2010 and 3 1.

Unsold houses are available in every state and major urban centers across the nation.