Epf Withdrawal For Housing Loan Down Payment

2 buying a home as an individual you may withdraw the difference between the price of the home and the loan amount plus 10 of the home purchase price or all the money in account 2 whichever is lower and not less than rm500.

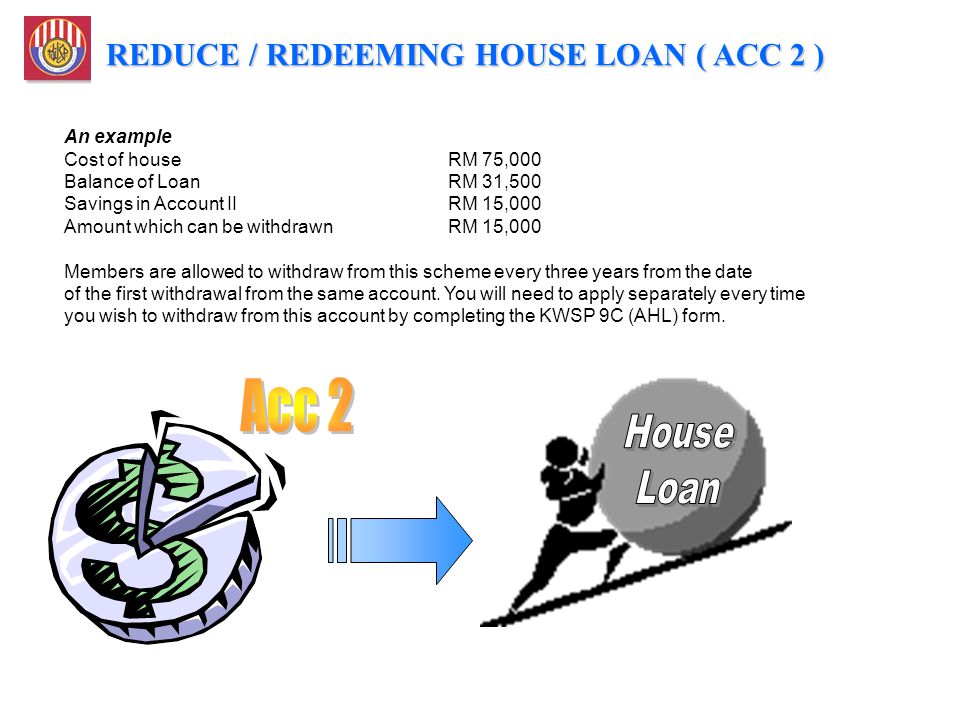

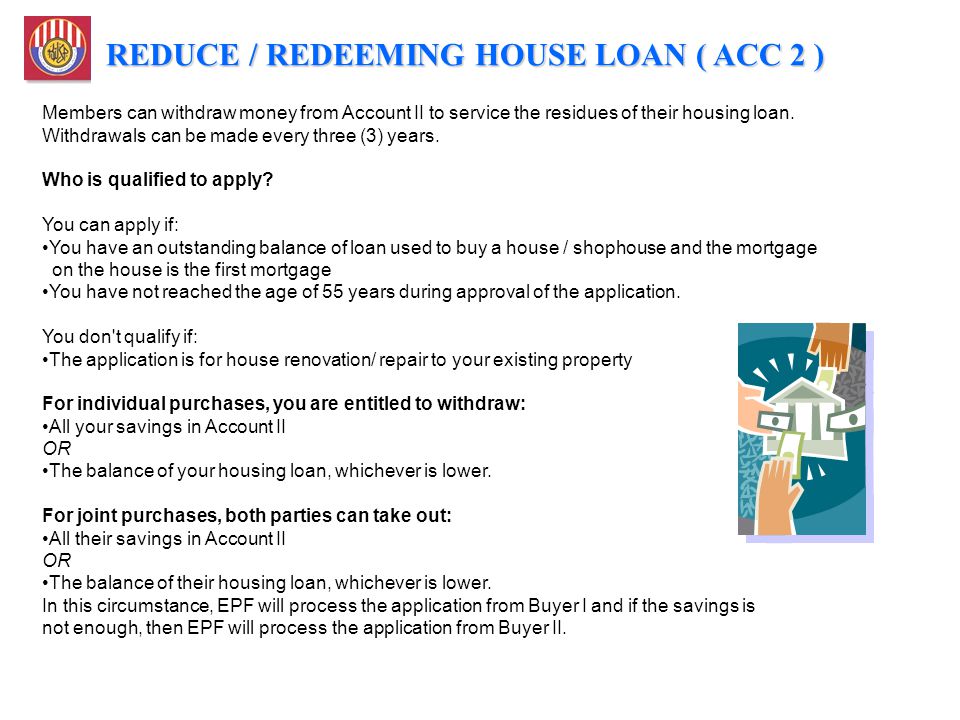

Epf withdrawal for housing loan down payment. Epf withdrawal for repay housing loan modifying existing house purchasing sponsored links. The government it seems is pulling out all the stops in making housing for all by 2022 a success. You may withdraw the difference between the price of the home and the loan amount plus 10 of the home purchase price or all the money in account 2 whichever is lower and not. After a subscriber takes a loan if his monthly emi is rs20 000 and his her monthly epf contribution is rs10 000 the epfo will pay rs10 000 to the bank or housing finance company after receiving.

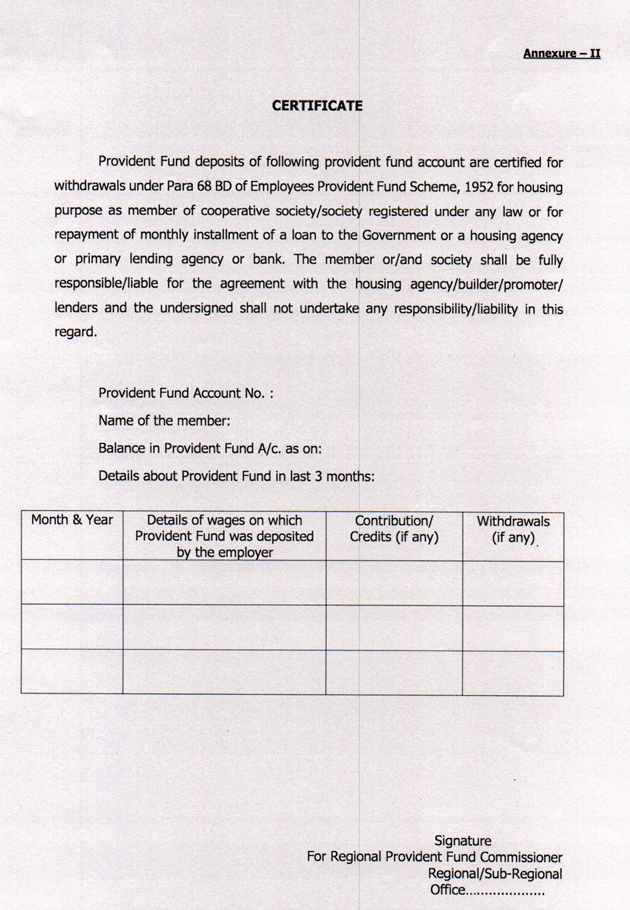

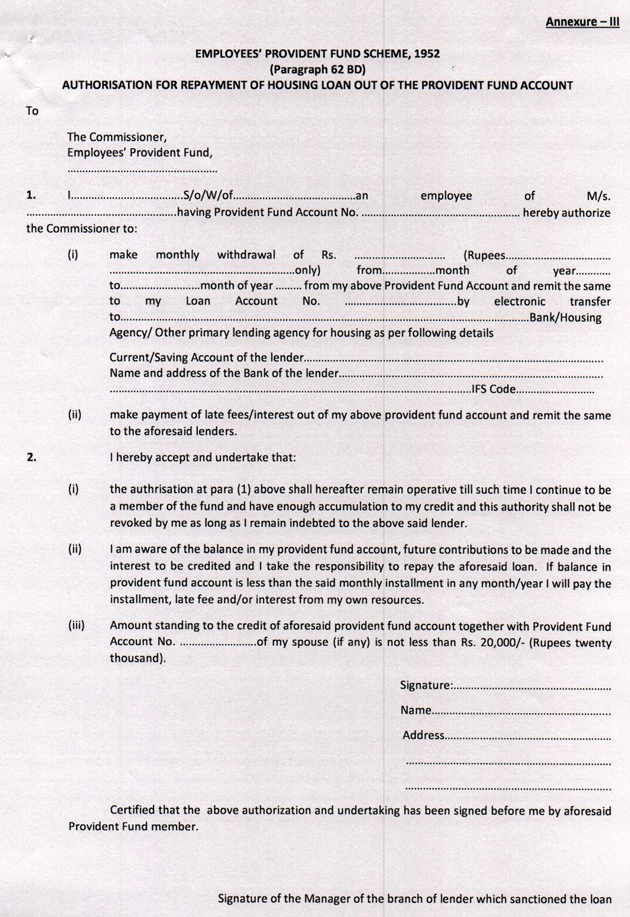

Members can withdraw the existing amount to be used in repaying an already prevailing house loan. As per the newly added para 68 bd in the epf scheme 1952 epf members can apply for a withdrawal of up to 90 of the accumulated corpus for either making the down payment of the house or for the payment of emis or for the construction of a new house. The contributory employees to dip into their retirement savings to own a home of their own. She he needs to.

Buying a home as an individual. The maximum you may withdraw under a zero down home loan is 10 of the home price to help pay for entry costs and other fees. This scheme is an addition to the above scheme withdrawal to reduce redeem housing loan and allows you to set up a standing instruction for money from account 2 to be directly paid to the bank or. Epfo has allowed members i e.

The contributory employees of the provident fund pf scheme to use 90 percent of epf accumulations to. The initiative gets a shot in the arm by allowing members of epfo i e. Withdrawal to pay down housing loan monthly installment. To facilitate epf members in preparing for a comfortable retirement the epf allows you to make a partial or full withdrawal from your savings to meet the specific retirement related needs that are in line with the epf s current policies.

However there certain procedures and criteria that one is required to carefully follow. The full list of t cs plus the necessary supporting documents can be found at kwsp 9c ahl d8 withdrawal form of kwsp s website. One can withdraw from pf epf account for loan repayment in two ways offline and online.