Epf Withdrawal For Housing Loan Form 31

Withdrawal from employee provident fund in covid 19 times.

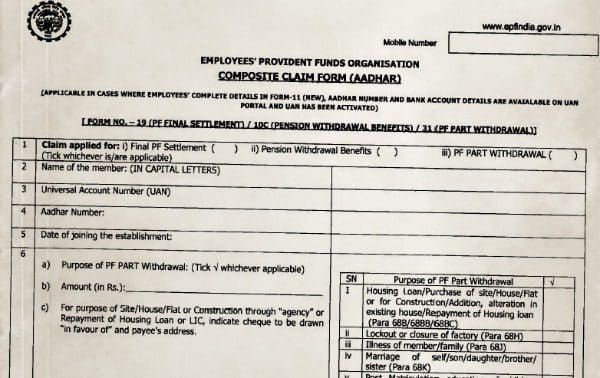

Epf withdrawal for housing loan form 31. How to withdraw from provident fund account for home loan repayment. Form 31 this particular form is meant for those who are applying for loan on pf account or opting for advance pf withdrawal. In march 2020 the government of india announced that individuals can withdraw a specific sum of money from their employees provident fund epf account if they are undergoing any financial challenges due to the covid 19 pandemic. Please apply for an advance withdrawal through composite claim form aadhar 1mb instructions 692 7kb composite claim form non aadhar 955kb instructions 769 5kb annexures to be attached with the claim form for withdrawal under para 68 bd of epf scheme 1952.

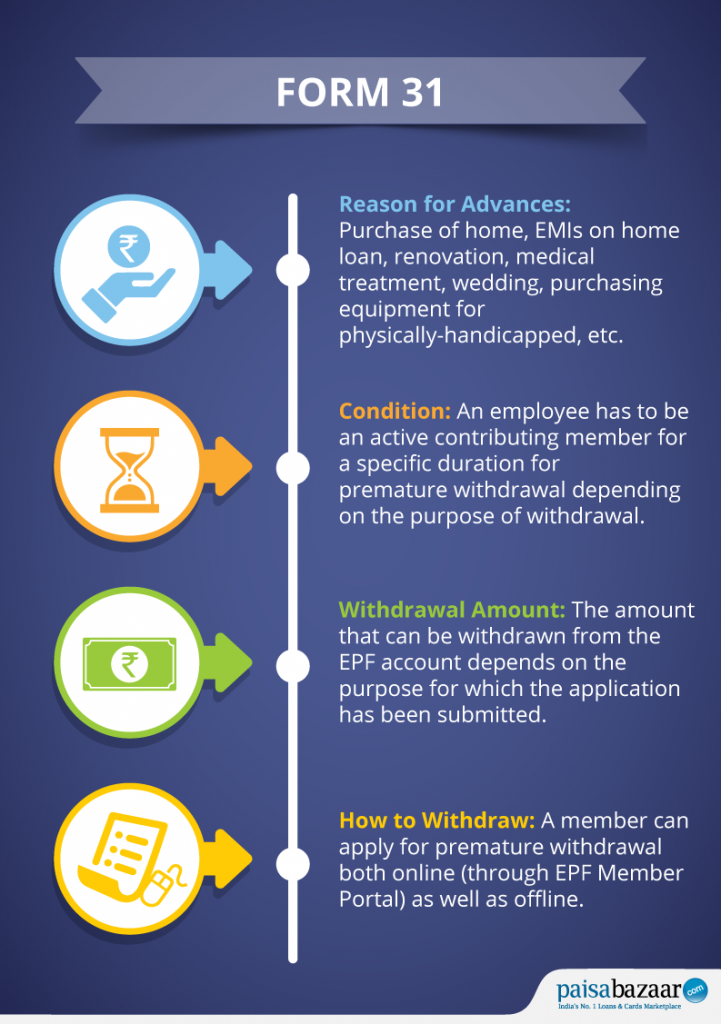

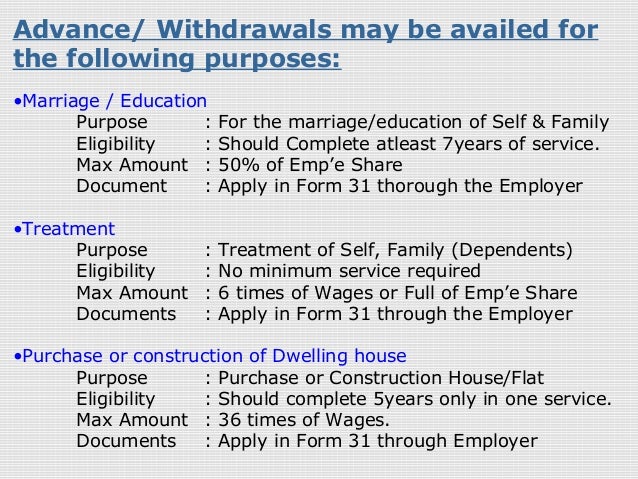

Epf form 31 is utilised to file a claim for partial withdrawal of funds from epf or employees provident fund. Also it is mandatory to provide latest and factual information in the form. This form is also known as epf advance form. For instance it can be withdrawn in advanced for medical treatments marriage or home loan.

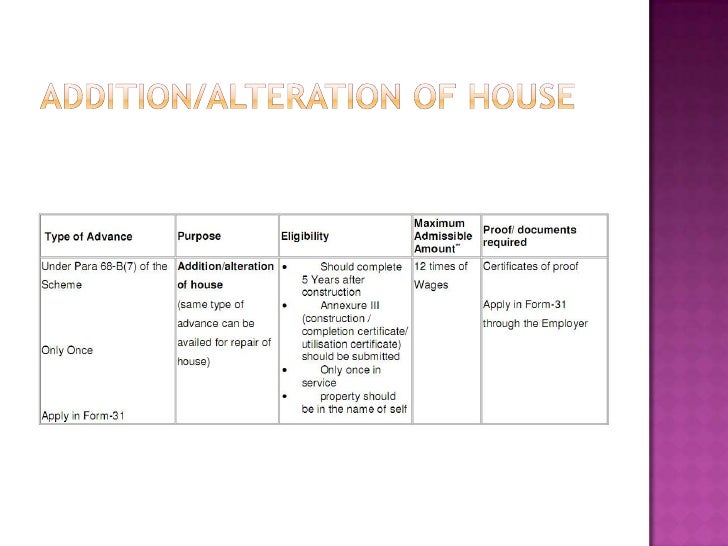

A trust a local body or a housing finance corporation. The following are the contents to fill in the form by each of them. Epf form 31 is used to make declaration for partial withdrawal of your epf corpus that has been otherwise reserved for the purpose of retirement. 1952 allows pf withdrawal for repayment of loans in special cases.

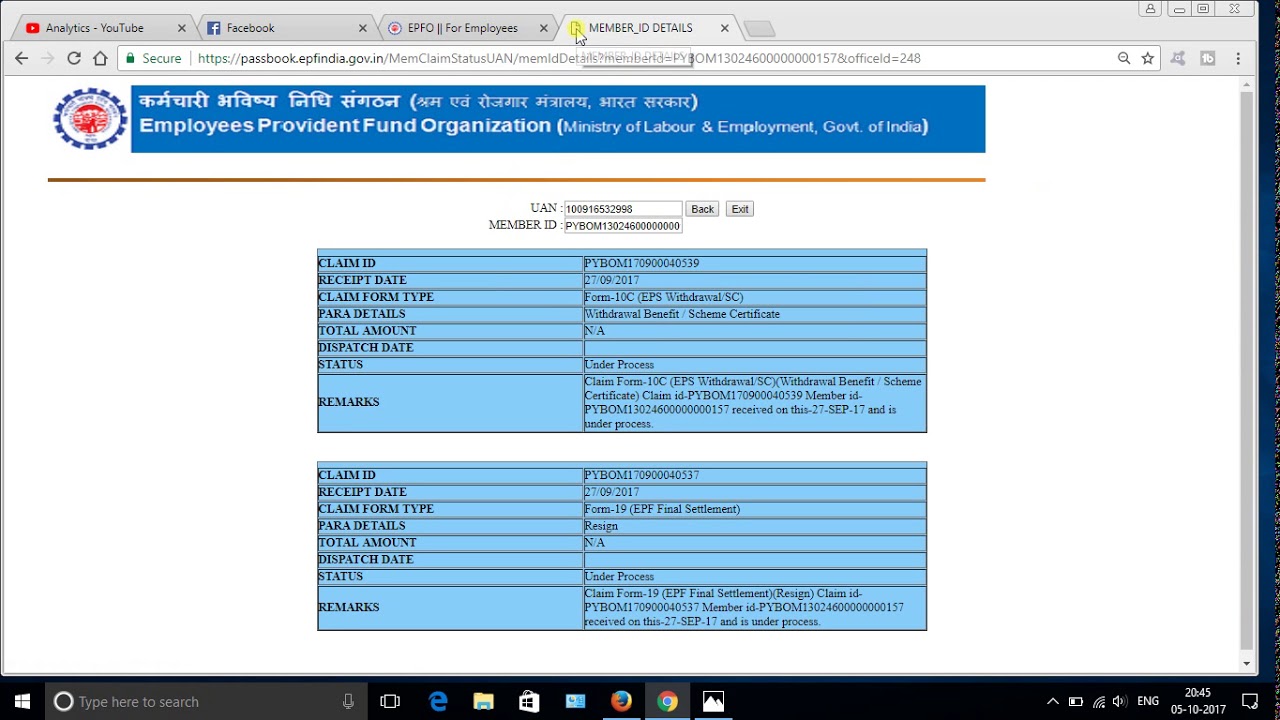

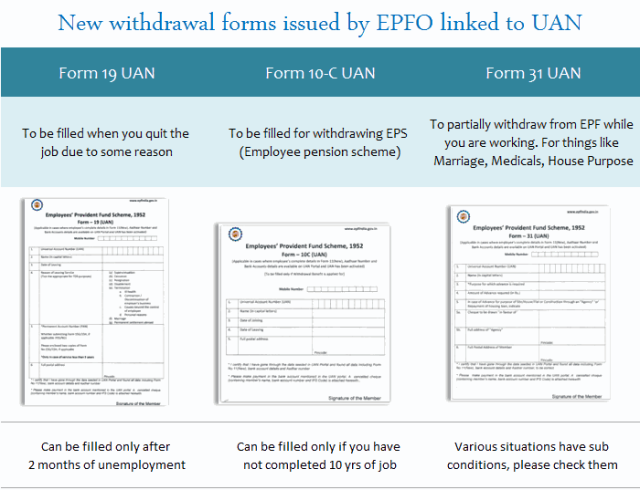

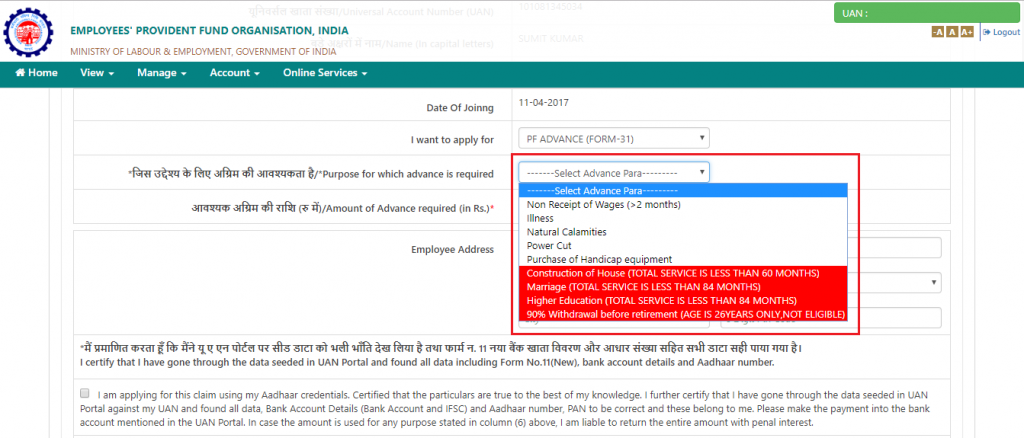

The employees provident fund organisation offers an online facility where employees can apply for epf advance. Epf or employees provident fund is a government backed savings option that can facilitate salaried individuals to build a significant corpus to cover their financial needs post retirement. Instructions and guidelines for the advances to be claimed through form 31 s no purpose of the withdrawal additional details relevant para of epf scheme 1952 membership period required. Form 31 19 and 10c.

Want an advance from my provident fund account. Withdrawal from the fund for repayment of loans in special cases. However to apply for epf advance online the employee must have his her bank details aadhaar card and pan card details updated on the portal. A for refund of outstanding.

The form required for claiming an epf advance is form 31. It must be noted that partial withdrawal from epf is allowed only certain specific conditions such as purchase construction of home repayment of home loan medical emergencies wedding of self sibling child or education of child sibling. An employee an employer and the epf commissioner must fill the form 31 of epf. News about pf withdrawal rules.

A member is allowed to avail loans on for different reasons. The following are the requisite details to be filled by the employee in a epf withdrawal form 31.