How To Invest In Unit Trust In Singapore

There is a little risk when investing in this unit fund because of the portfolio they invest in.

How to invest in unit trust in singapore. Unlike simpler forms of investment like buying singapore savings bonds or shares in your favourite telco company it s a little harder to make a decision when it comes to unit trusts. The difference between these and unit trusts is that ilps combine life insurance coverage and investment components. Choose from one of the categories below to view the wide range of unit trusts we offer either by geographical region or asset class. For a start there are a gazillion of them out there and they all have incomprehensible names like ab sicav i low volatility eq a sgd h acc.

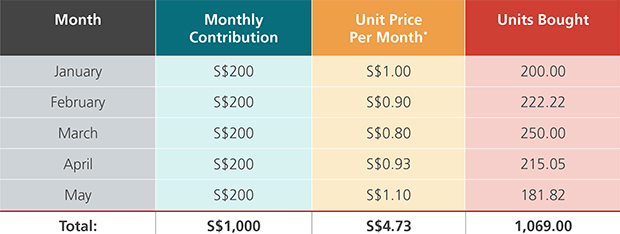

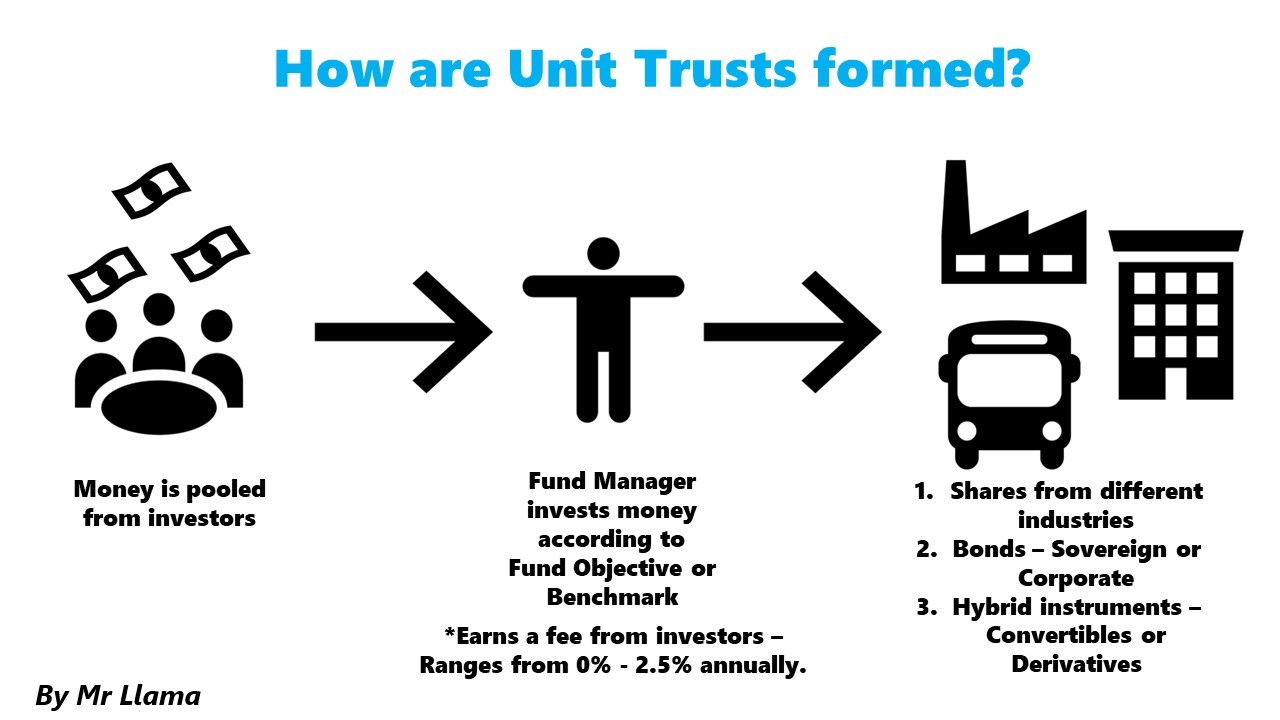

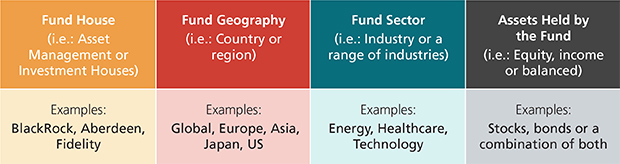

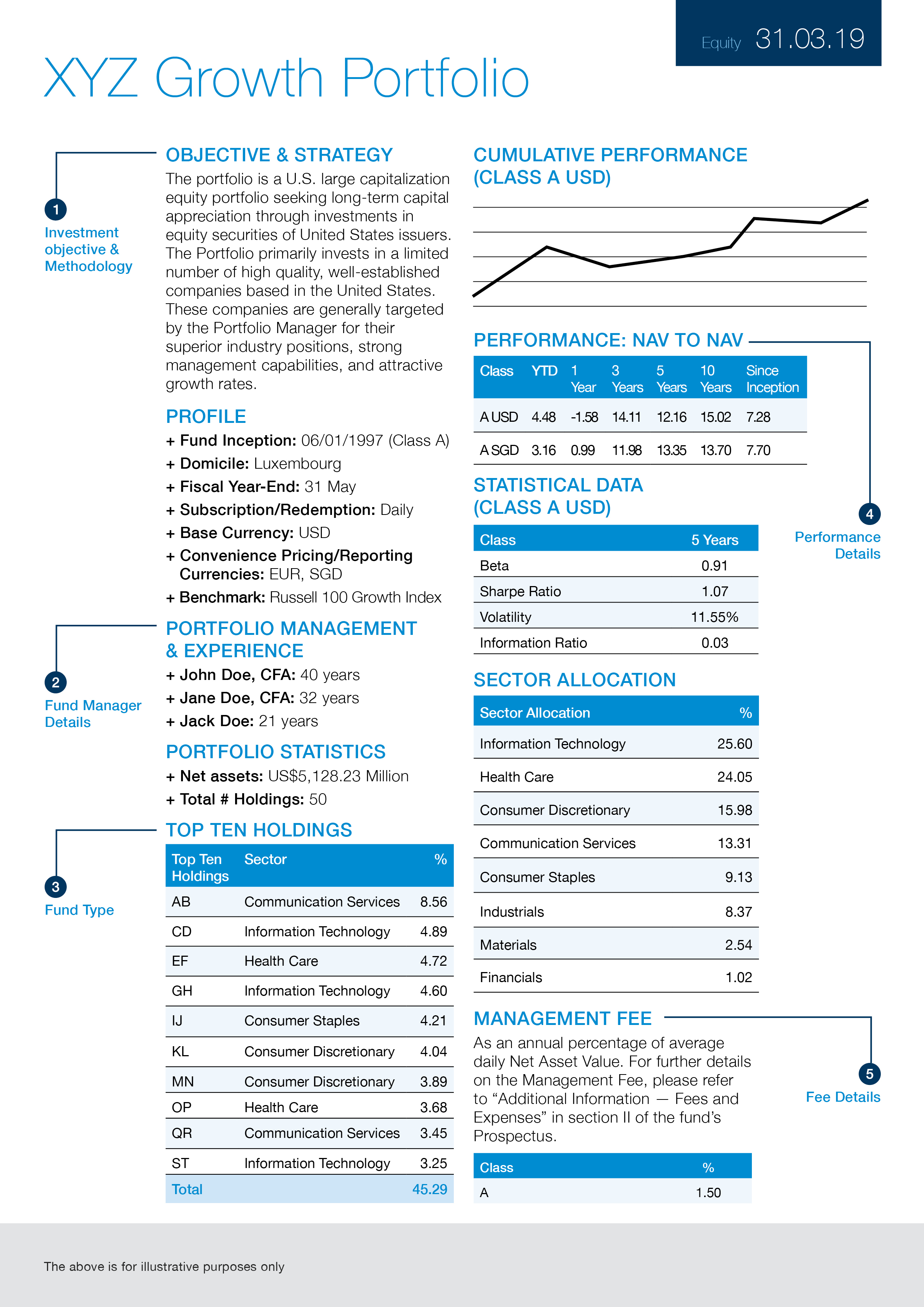

The nav is the market value of the fund s net assets investments cash and other assets minus expenses payables and other liabilities. A fund house s fund name would reflect these. Most funds in singapore allow daily buying and selling of units. Your premiums are used to pay for units in sub funds of your choice and some of the units are then sold to pay for insurance and other charges.

On the other hand there are inherent risks when investing in a unit trust. Also unit trusts and mutual funds are quite liquid meaning you can sell or buy your shares easily without needing to wait a long period of time. Investment linked insurance policies ilps are another way to invest in funds. Unit trusts are typically classified by geography sector and type of assets held.

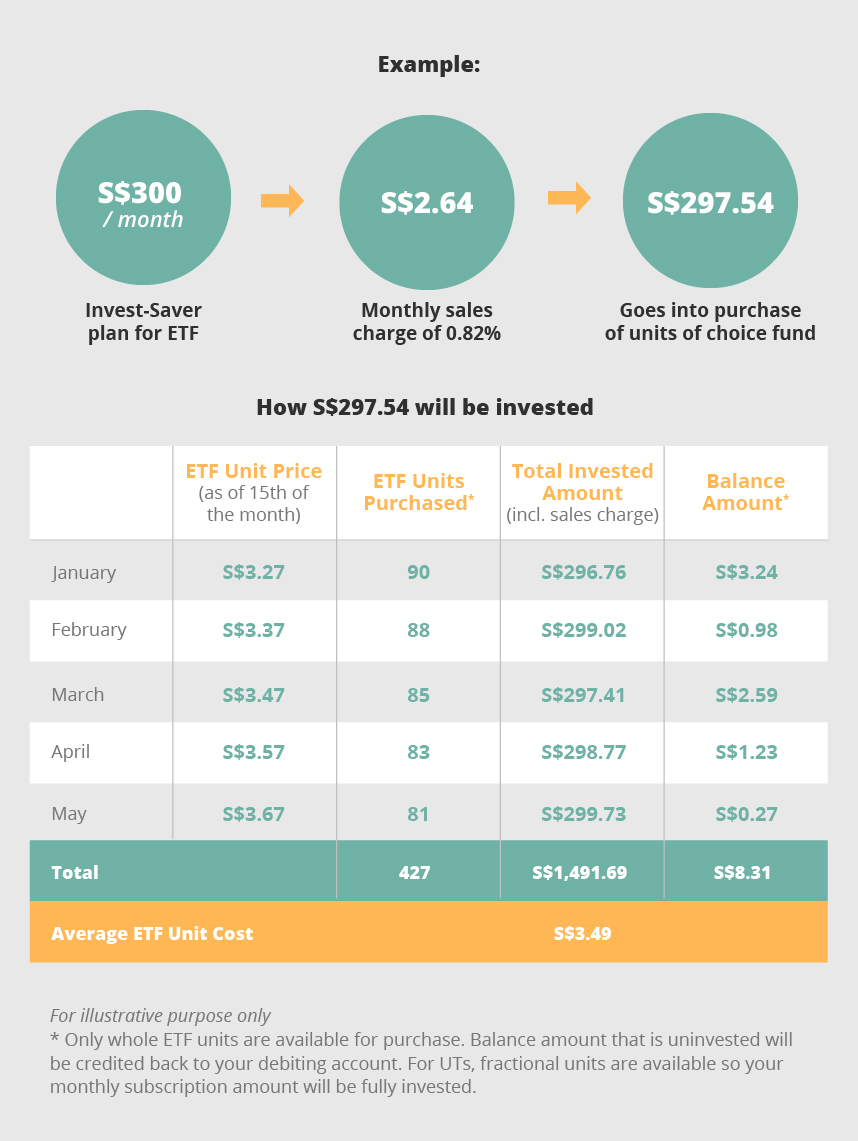

Investors cannot be blamed because there are more than 2 000 unit trusts and 100 etfs registered in singapore picking the right one to invest can just be mind boggling. The unit trust offers investors an opportunity to invest in singapore s best stocks and blue chip companies such as dbs ocbc and singtel in an affordable manner. Investing in a mutual fund is like purchasing a slice of a big cake. If you want to get exposure to the best listed companies in singapore then aberdeen singapore should be your unit trust.

I won t go to the technical part of unit trust but rather the practical aspects today. How the price is determined the price of each unit is based on the fund s net asset value nav divided by the number of units outstanding. For example if a fund name reads yellow pebble asia energy equity fund this means that the fund is managed by a fund house called yellow pebble which invests in equity stocks of companies in the energy sector that are listed in asia. First as with all investments you may lose money by buying a share of a unit trust.

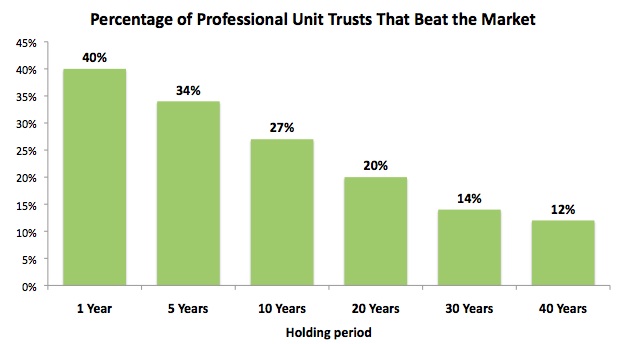

However let s take a look at the real numbers behind mutual funds and unit trusts. Check out our suite of unit trusts.