How To Invest In Unit Trust

The minimum investment in a unit trust is usually a lump sum of 250 500 or 1 000 or regular monthly savings of 50.

How to invest in unit trust. Some funds pay dividends. You do not have personal control over the individual components of the investment portfolio. Unit trusts have long been considered low relative risk low return investments. Unit trusts are usually issued for purchase into retirement accounts ira accounts and for investors seeking income through either corporate bonds or municipal bonds and occasionally preferred stock.

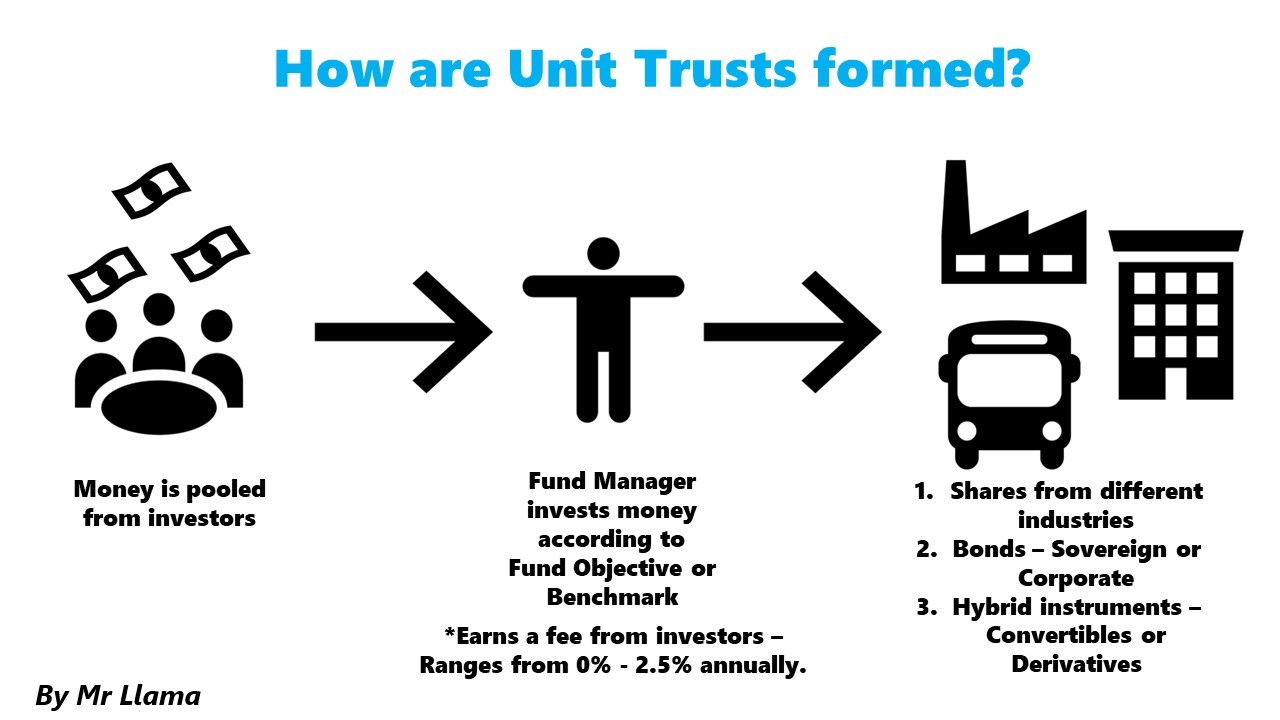

A unit trust is a collective investment not an individual one. A unit trust is a portfolio of different assets which include a mix of shares bonds and real estate among other investments. By pooling your money with that of other investors you ll be able to invest in a wide range of assets. You can buy and sell whenever you like without penalty.

They are typically purchased by low risk investors. Completely flexible you choose which fund s to invest in and whether to invest monthly with occasional lump sums or both. Invest in unit trusts which are professionally managed funds to help you grow your wealth. A unit trust invests a pool of money collected from a number of investors in a range of assets.

The best way to invest in unit trusts is directly through a low cost unit trust provider. Ways to invest in unit trusts. If you would like to enjoy the benefit of diversification with unit trusts investment you can invest a lump sum amount or set up a monthly investment plan. To be clear unit trust is just an investment structure it is not an investment strategy itself.

Unit trust lump sum and regular savings investing outside a nisa this is a simple effective and low cost way to invest in our funds. There is a capital gain when the price of the units rises above the price you paid for the fund. The price of each unit is based on the fund s net asset value nav divided by the number of units outstanding. However if you are new the best way to dip your toe in investment is by investing in unit trusts.

Unit trusts enable investors to diversify their investments into different markets and investment instruments such as equities bonds securities currencies and warrants derivatives. Charges erode returns so the less you pay to access an investment the more cash will be left to grow for you. A charge of 1 or more may not sound like much but these tiny percentages add up to a huge amount in time. Returns from unit trusts you invest in a fund by buying units in the fund.

Unit trust etf or reits are all under the trust structure.