Importance Of Capital Structure Decision In Financial Management

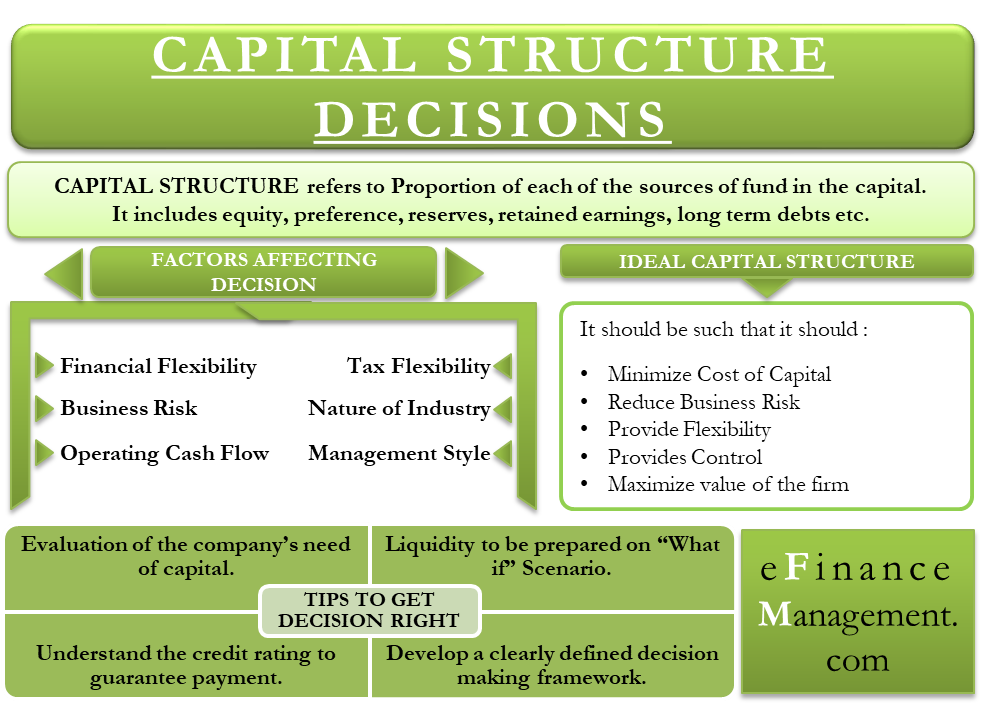

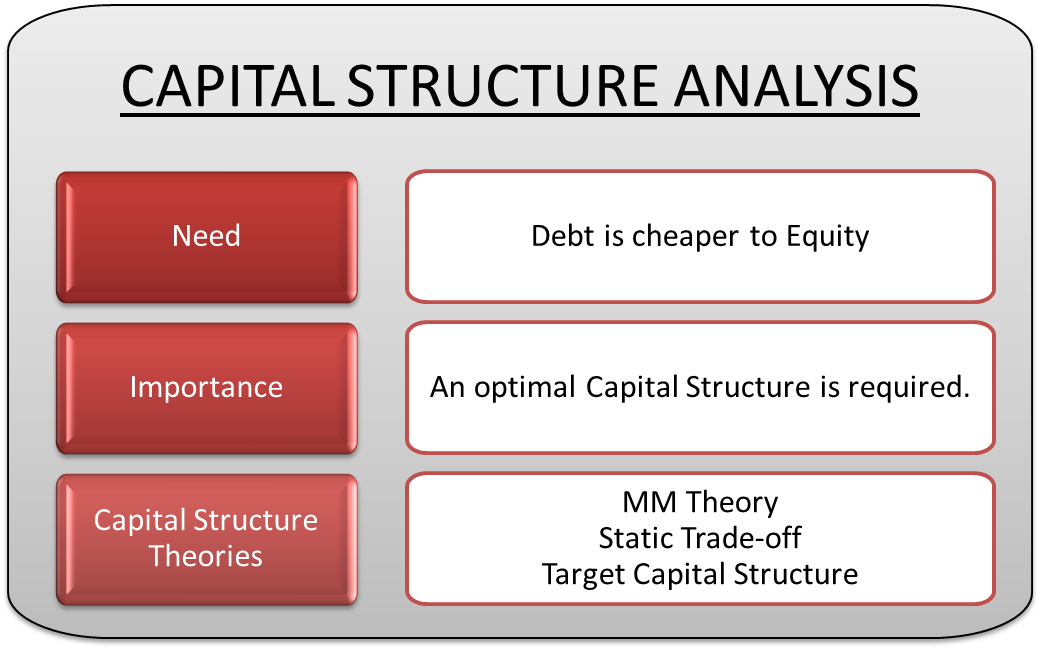

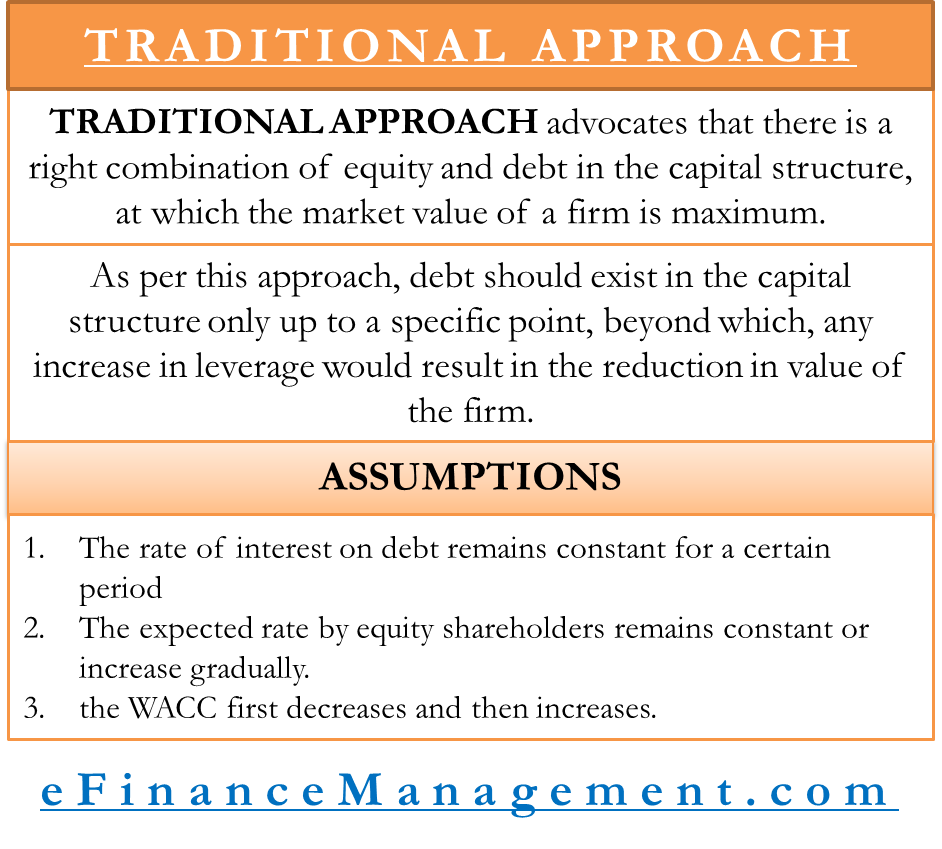

Decisions relating to financing the assets of a firm are very crucial in every business and the finance manager is often caught in the dilemma of what the optimum proportion of debt and equity should be.

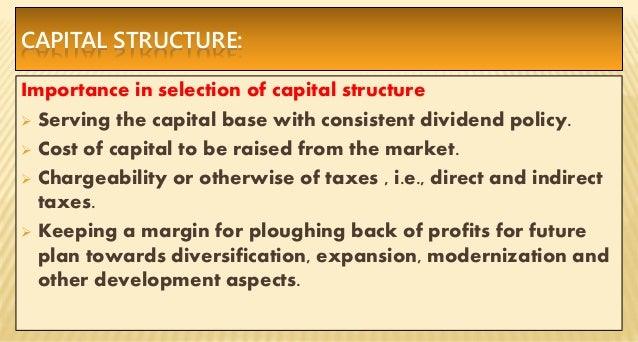

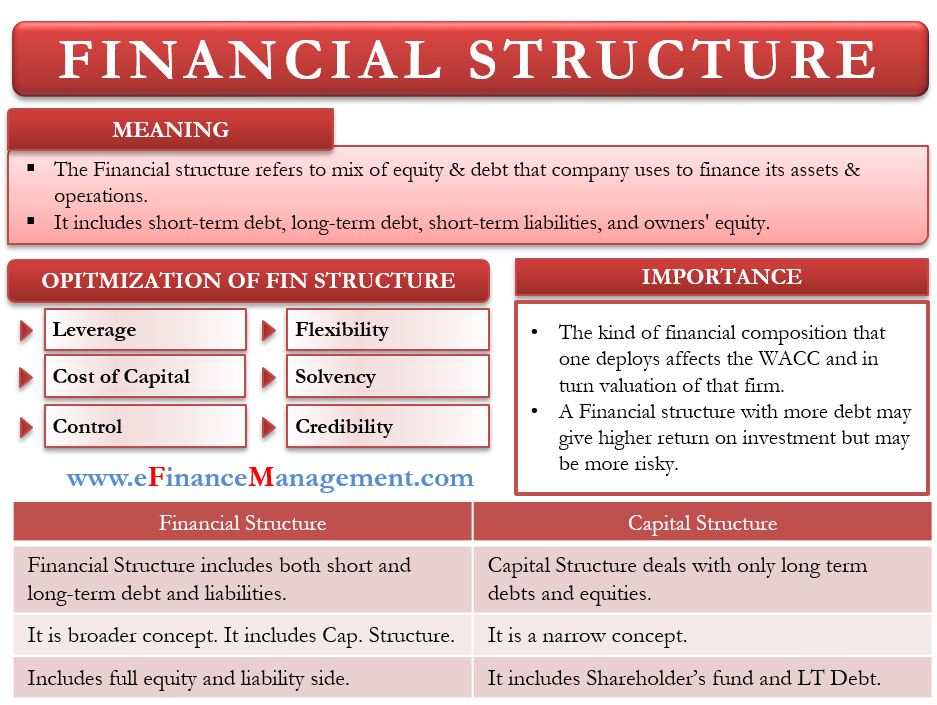

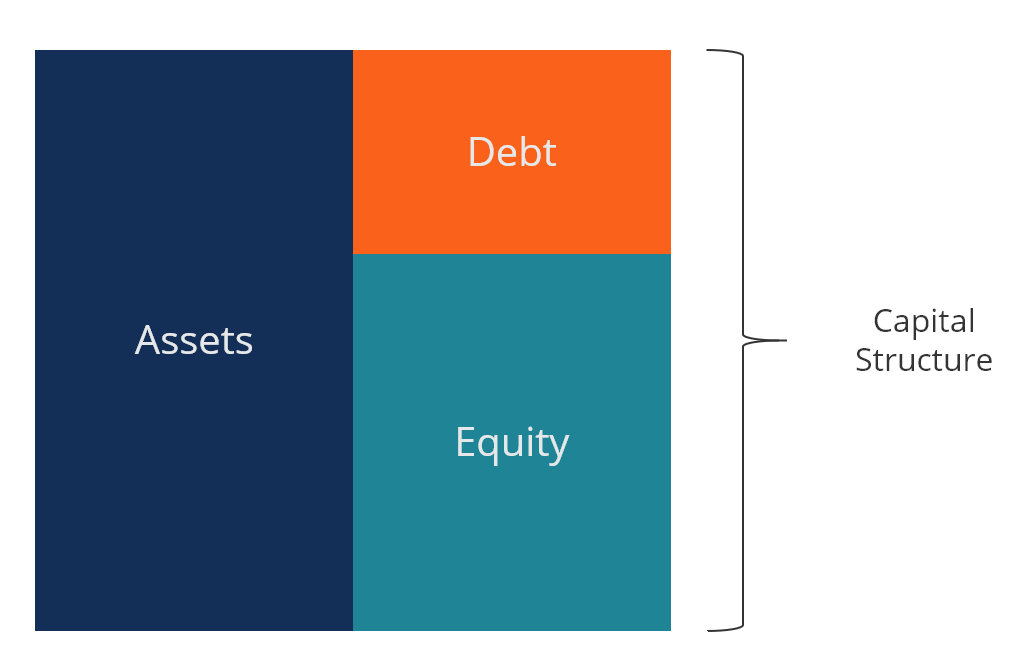

Importance of capital structure decision in financial management. Capital structure is how a company funds its overall operations and growth. Financial buys the. So capital structure means the arrangement of capital from different sources so that the long term funds needed for the business are raised. Let us make an in depth study of the meaning concept importance and factors of capital structure.

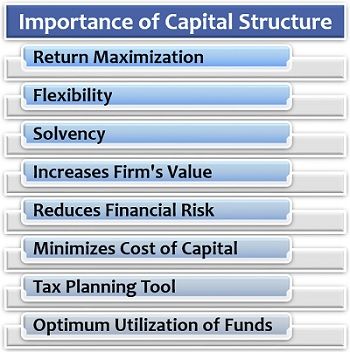

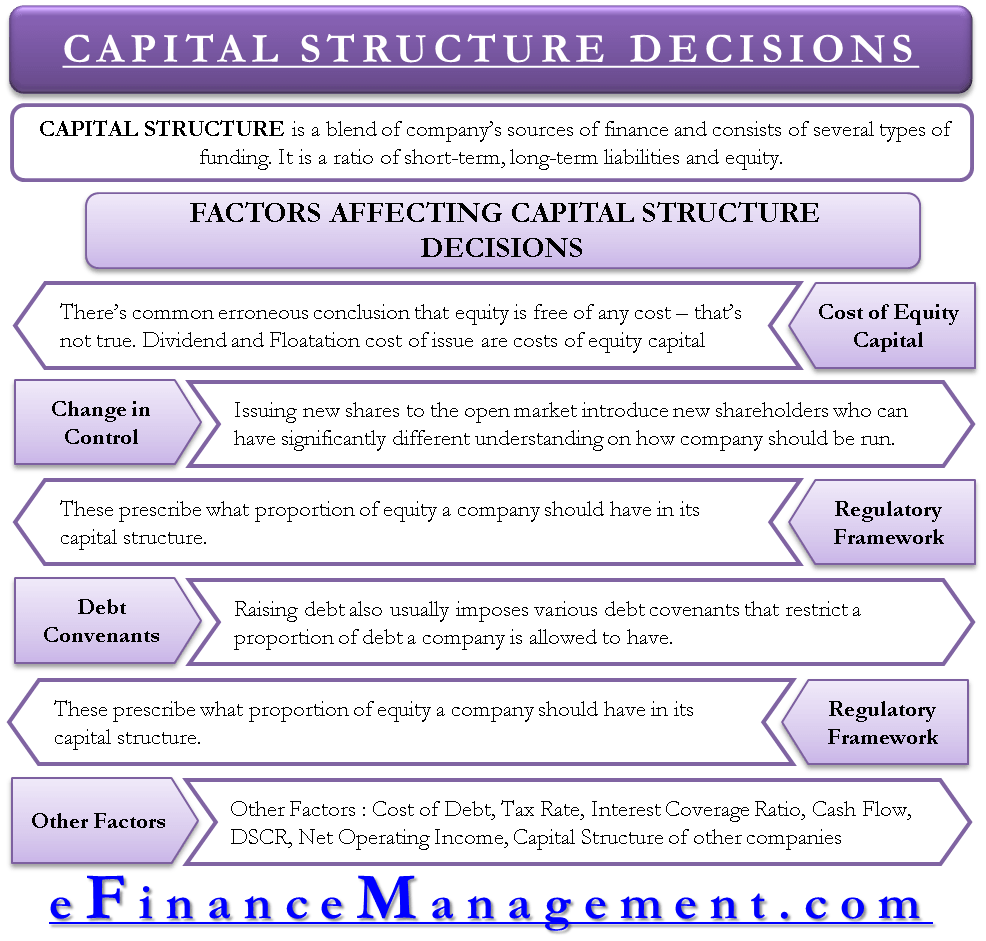

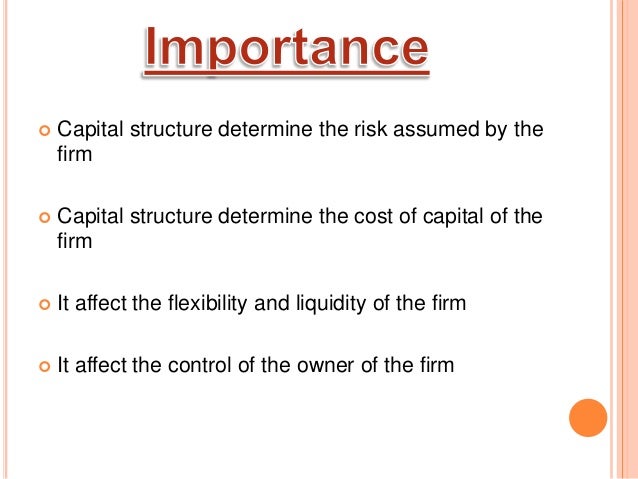

Thus capital structure is extremely important and capital structure decisions or practices have a significant role to play in corporate financial management. Importance of capital structure. In financial management it is a significant term and it is a very important decision in business in the capital structure of a company broadly there are mainly two types of capital i e. Meaning and concept of capital structure.

A firm s major decision is its financial decisions which can be analyzed in the theory of corporate capital structure that is based on a model developed by dodd 1986 and is determined mainly by cost variables equity debt and bankruptcy risk and other potential variables such as growth are profitability and operating leverage. Financial leverage is the extent to which a business firm employs borrowed money or debts. Capital structure planning which aims at the maximisation of profits and the wealth of the shareholders ensures the maximum value of a firm or the minimum cost of capital. In this guide we ll outline the acquisition process from start to finish the various types of acquirers strategic vs.

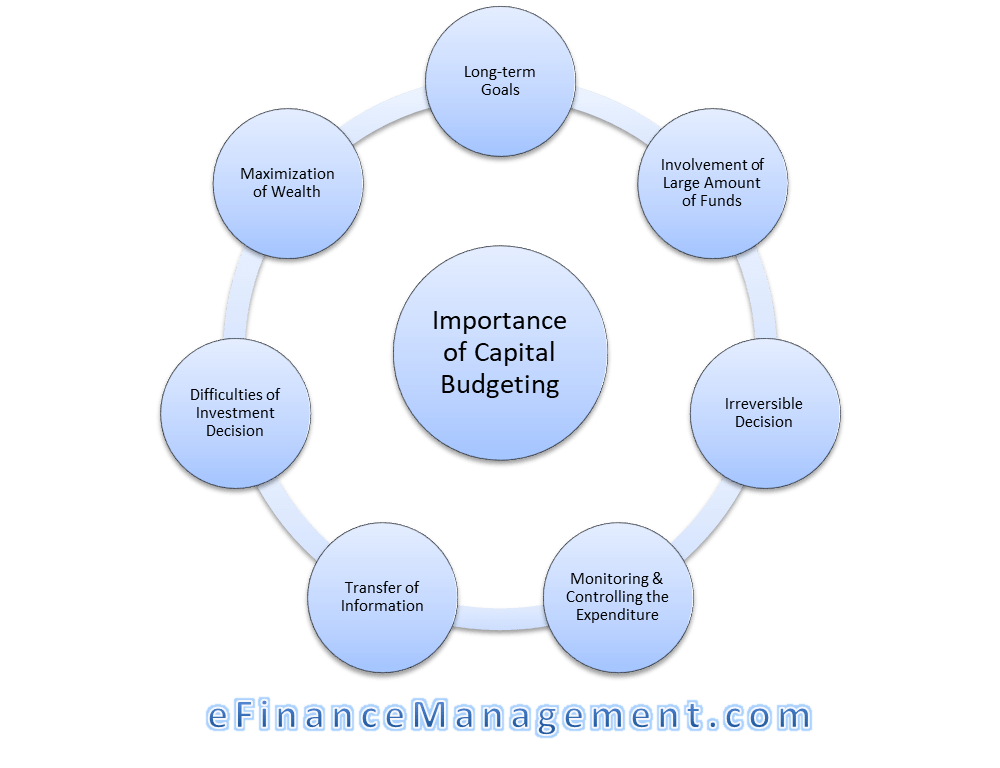

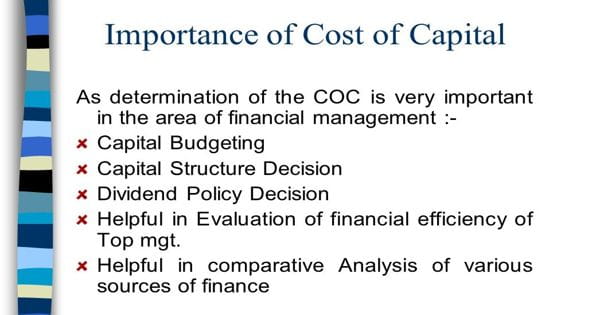

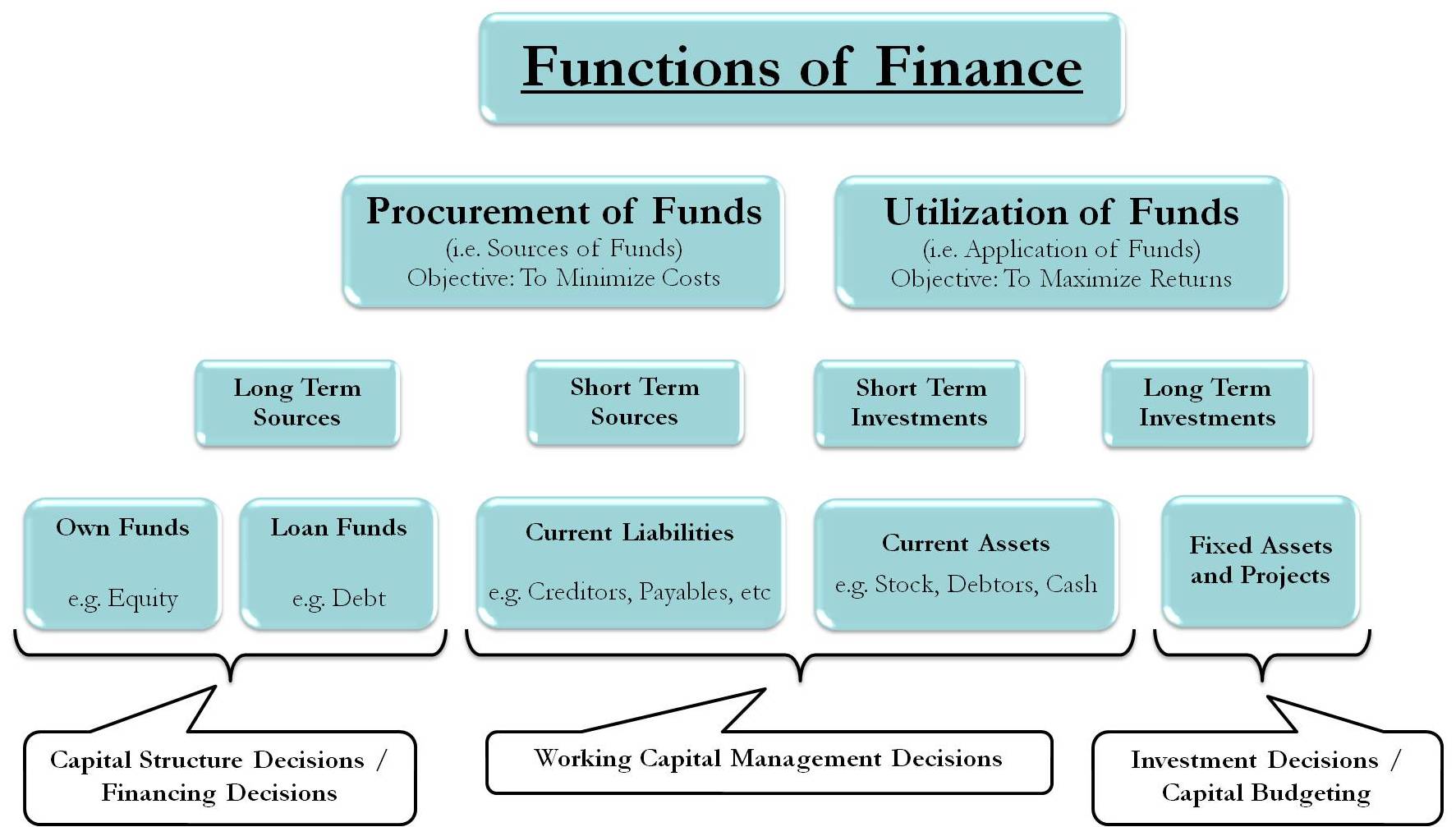

The term structure means the arrangement of the various parts. Capital structure in mergers and acquisitions m a when firms execute mergers and acquisitions mergers acquisitions m a process this guide takes you through all the steps in the m a process. There are four main financial decisions capital budgeting or long term investment decision application of funds capital structure or financing decision procurement of funds dividend decision distribution of funds and working capital management decision in order to accomplish goal of the firm viz to maximize shareholder s owner s wealth. Learn how mergers and acquisitions and deals are completed.