Importance Of Capital Structure Decision

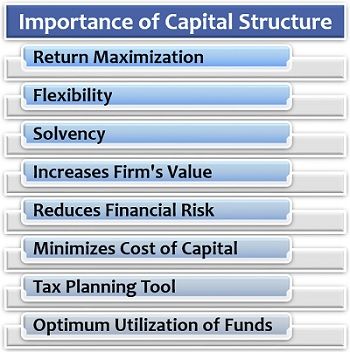

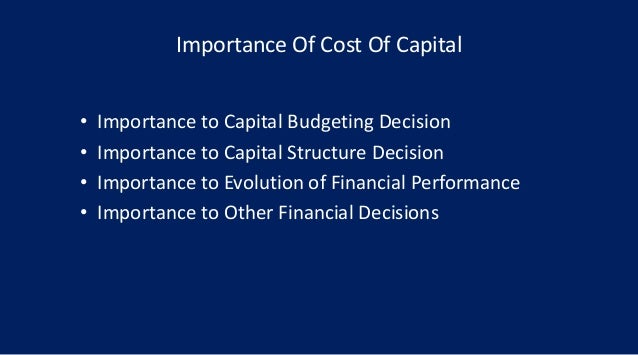

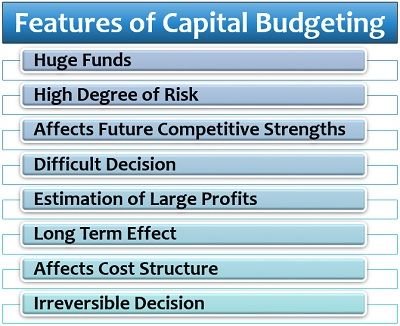

Capital structure planning which aims at the maximisation of profits and the wealth of the shareholders ensures the maximum value of a firm or the minimum cost of capital.

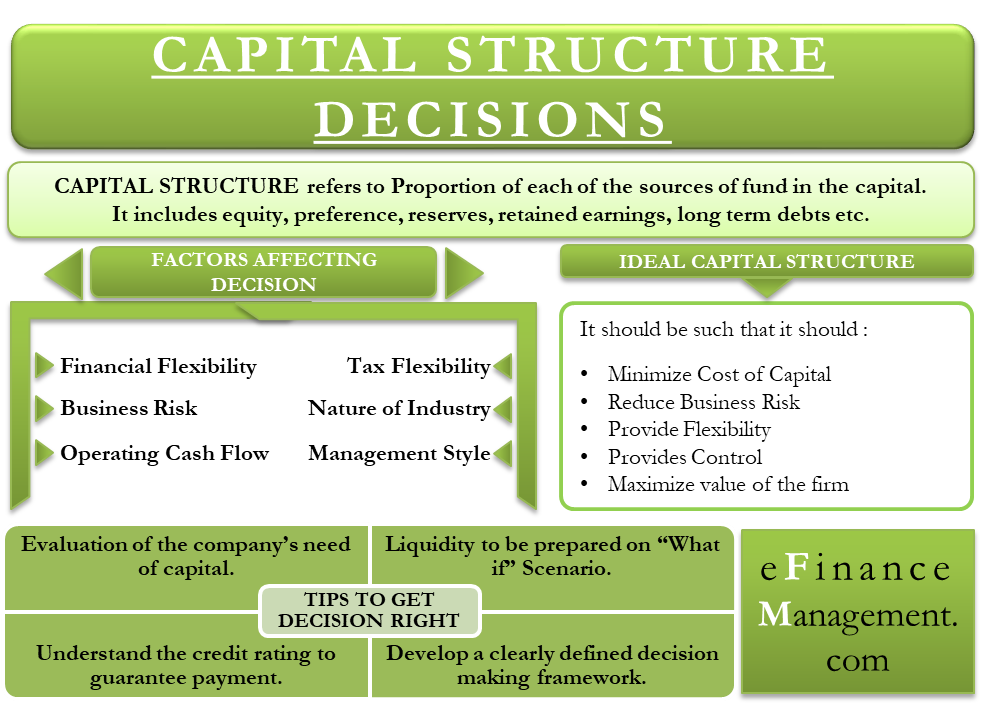

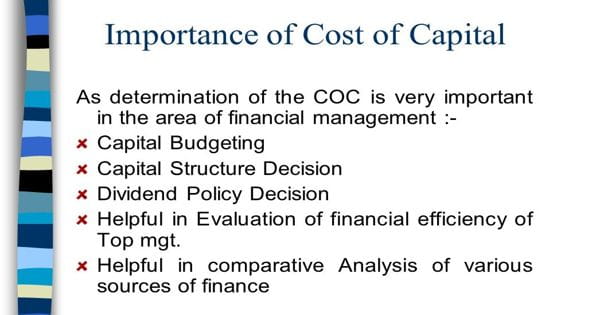

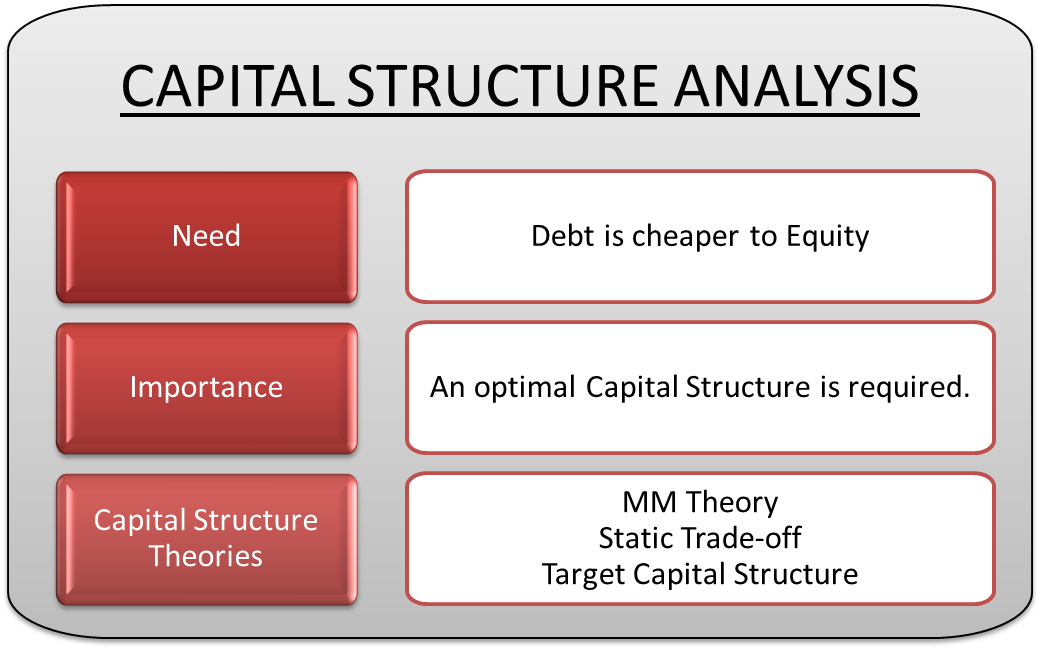

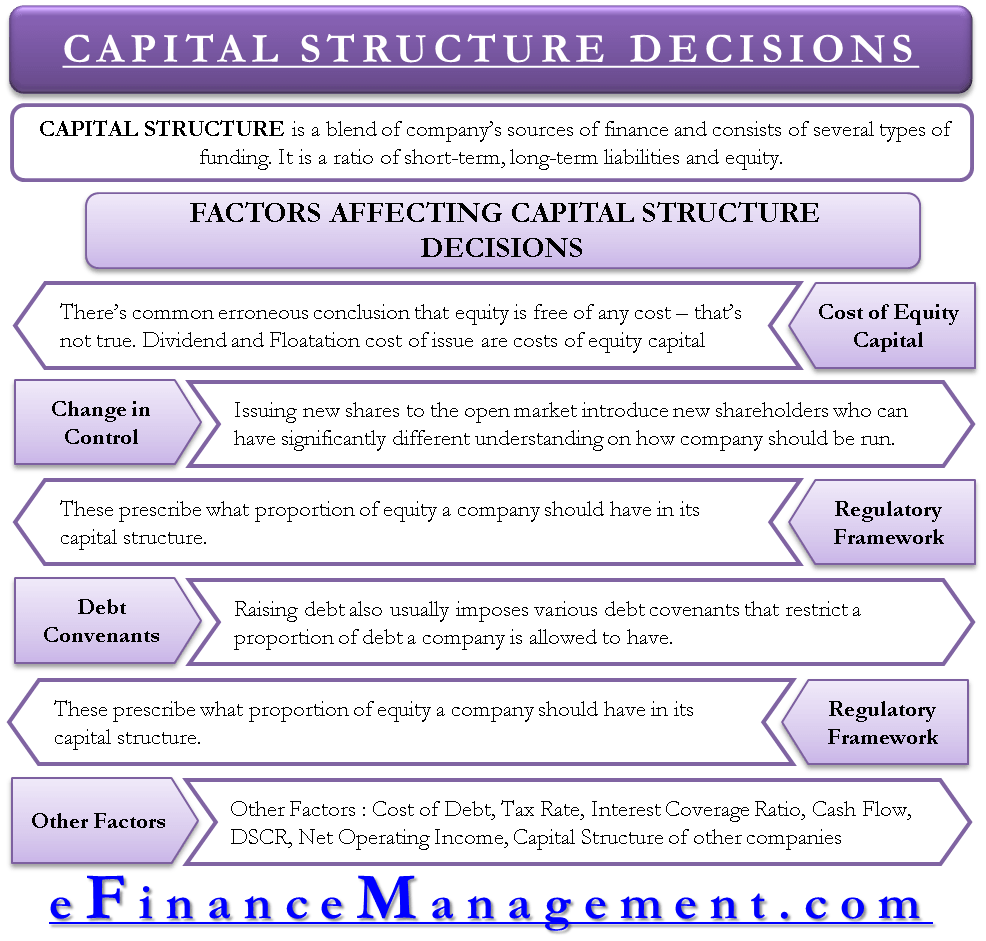

Importance of capital structure decision. The capital structure decision taken by the firm has an influence on the firm s cost of capital risk position and value of the firm. Decisions relating to financing the assets of a firm are very crucial in every business and the finance manager is often caught in the dilemma of what the optimum proportion of debt and equity should be. It is very important for the financial manager to determine the proper mix of debt and equity for his firm. Financial buys the.

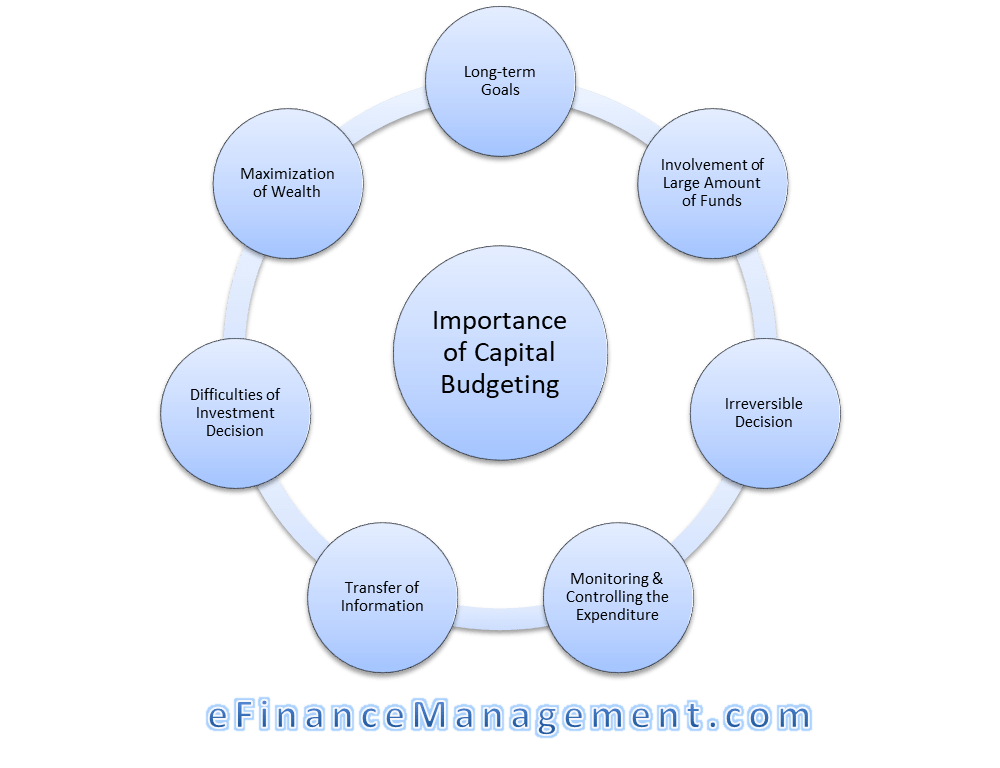

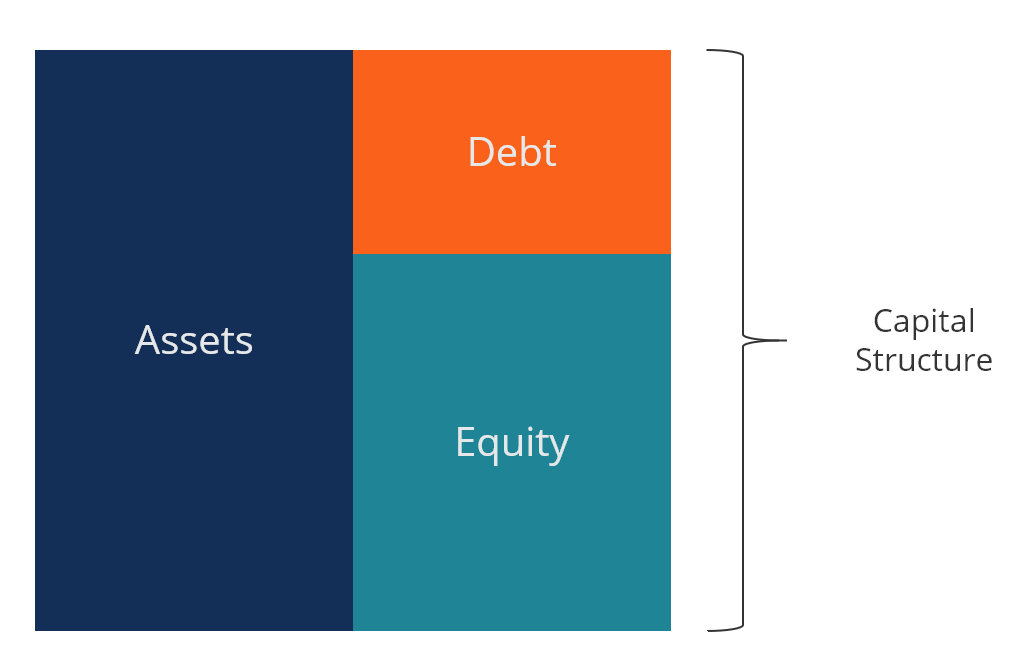

Debt consists of borrowed money that is due back to the lender commonly with interest expense. The consideration of retaining control of the business is an important factor in capital structure decisions. In this guide we ll outline the acquisition process from start to finish the various types of acquirers strategic vs. Owing to such importance.

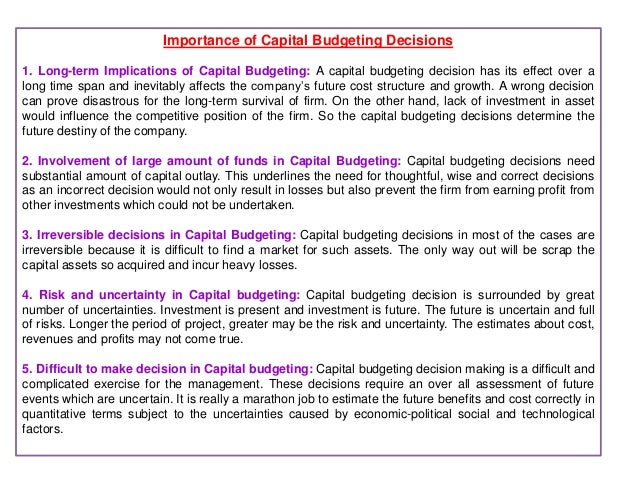

Capital structure is how a company funds its overall operations and growth. Learn how mergers and acquisitions and deals are completed. Importance of capital structure. Thus capital structure is extremely important and capital structure decisions or practices have a significant role to play in corporate financial management.

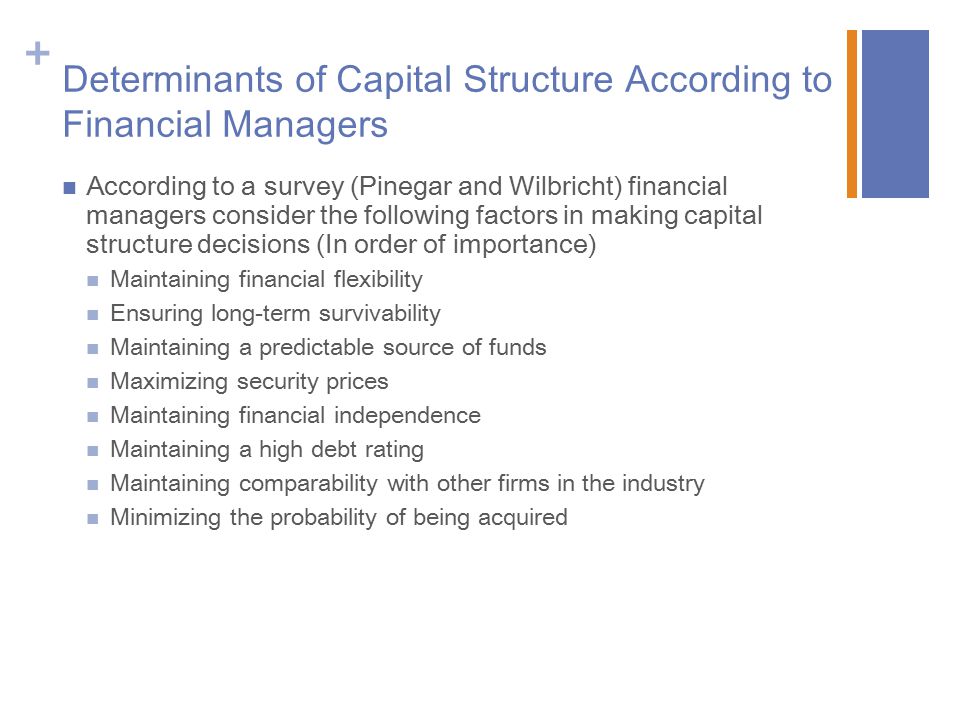

Since capital structure is the amount of debt or equity or both employed by a firm to fund its operations and finance its assets capital structure is typically expressed as a debt to equity ratio. C apital structure decision is considered as one of the most important decisions of the firm. Also capital structure decisions impact the risk and return of equity owners. Capital structure decisions entail decisions regarding the source and quantum of capital required in a business keeping in mind factors such as control existing shareholders to hold majority stake level of financial risk not beyond the tolerable limit and cost of capital to be minimum.