Islamic Banking Vs Conventional Banking Malaysia

As part of the malaysian government s efforts to promote islamic financing in general.

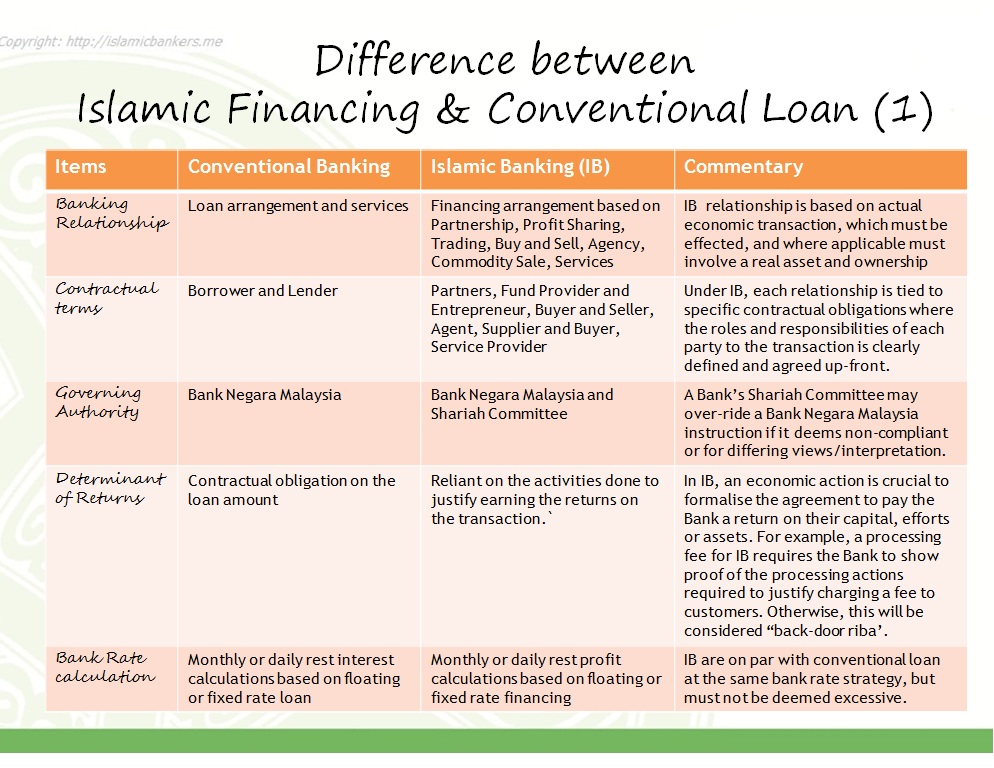

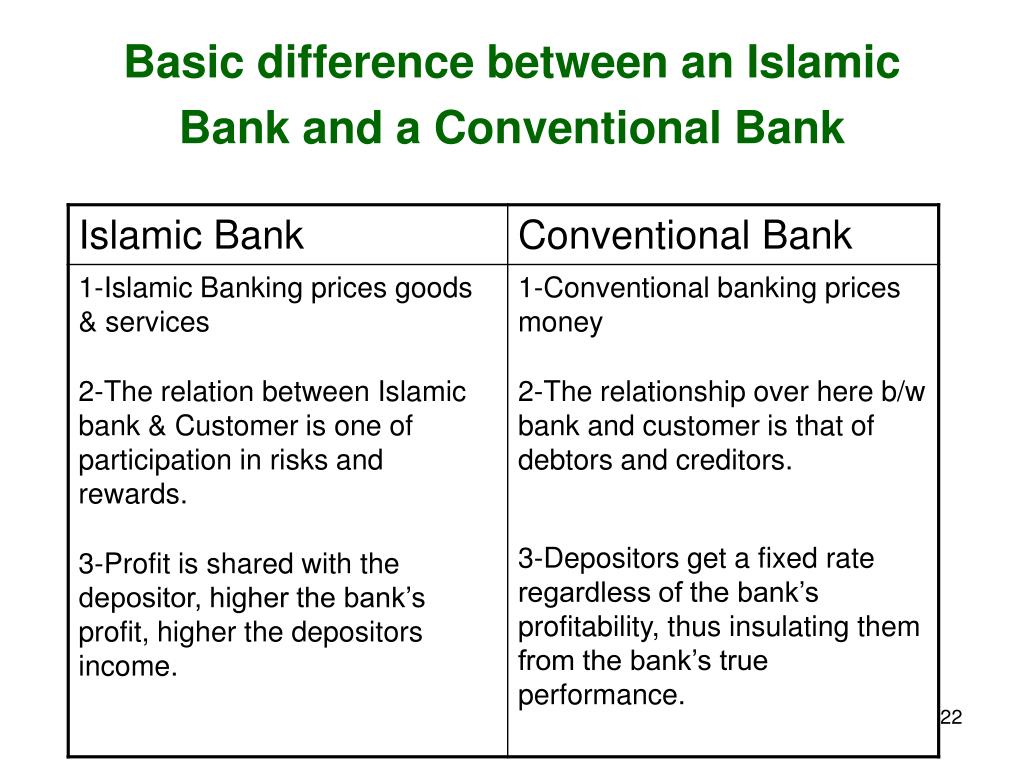

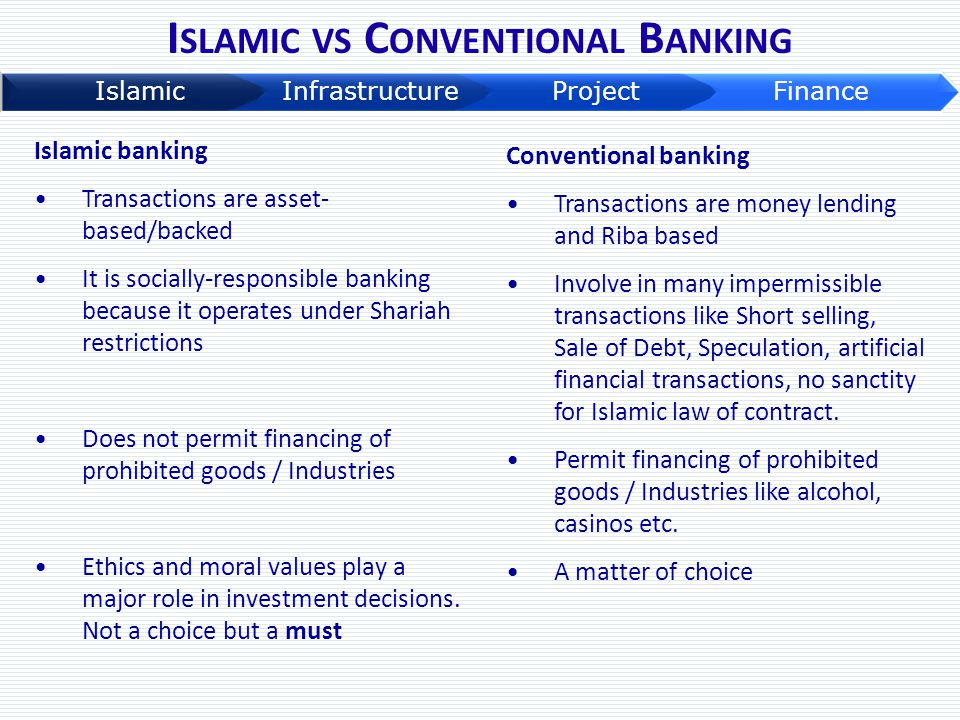

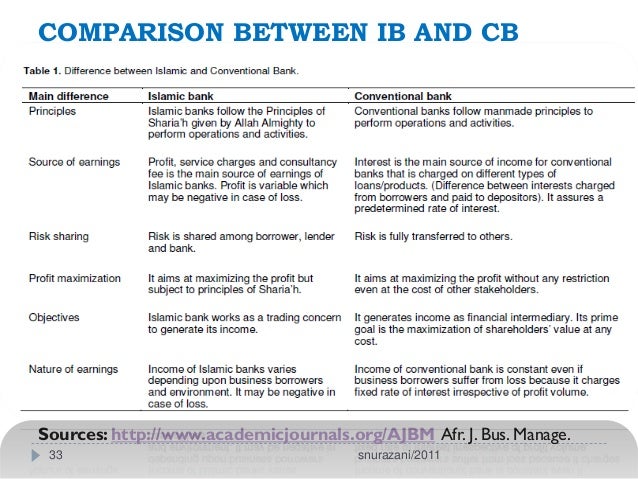

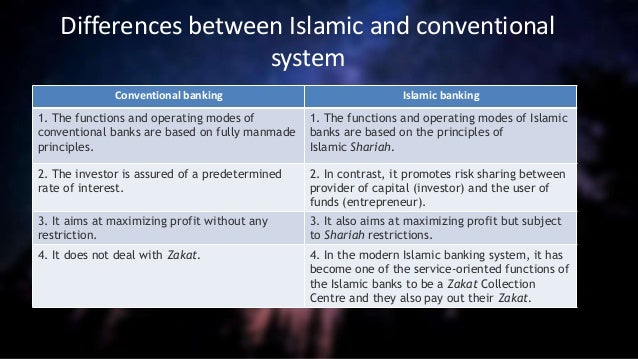

Islamic banking vs conventional banking malaysia. Benefits of islamic financing over conventional financing. This study compares the stability across bank specialisations i e. Islamic banks in malaysia operate according to a certain course of action as governed by the shariah advisory council of bank negara malaysia sac. Many have come in contact with all types of banking products conventional and islamic on a daily basis but may not be aware of how they operate and more importantly advantages or disadvantages posed towards their finances.

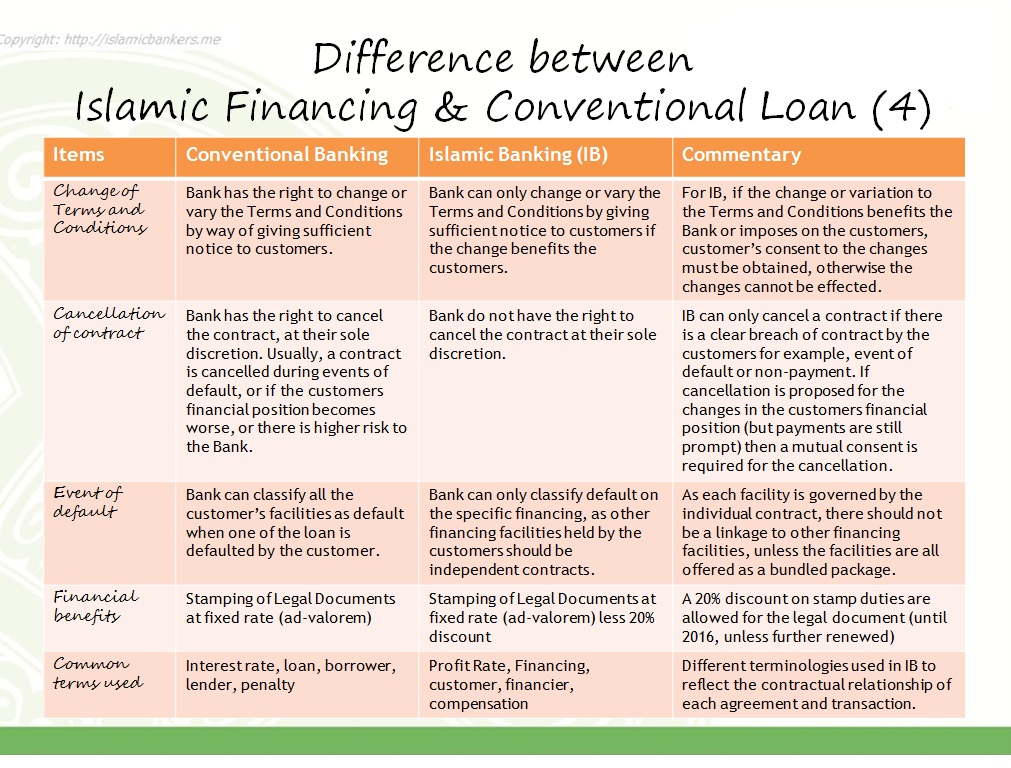

Islamic banks bank ownership local vs. In conventional loans the bank lends borrowers money with an interest. Ability of the islamic banking in malaysia to be an alternative or substitute for the commercial bank during the financial crisis. For an indefinite amount of time there will be a 20 stamp duty discount for islamic loan agreement documents.

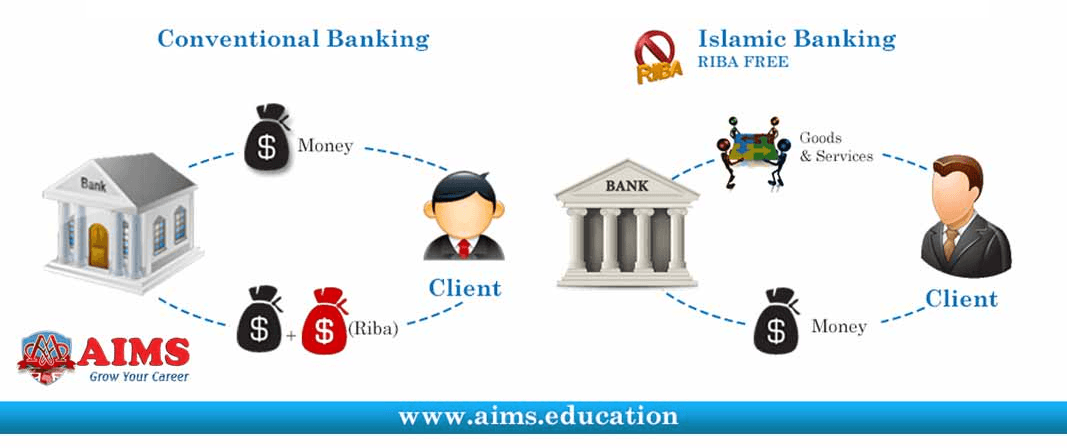

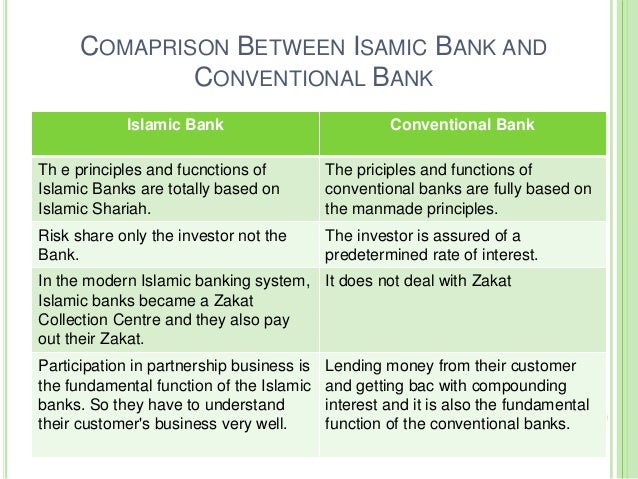

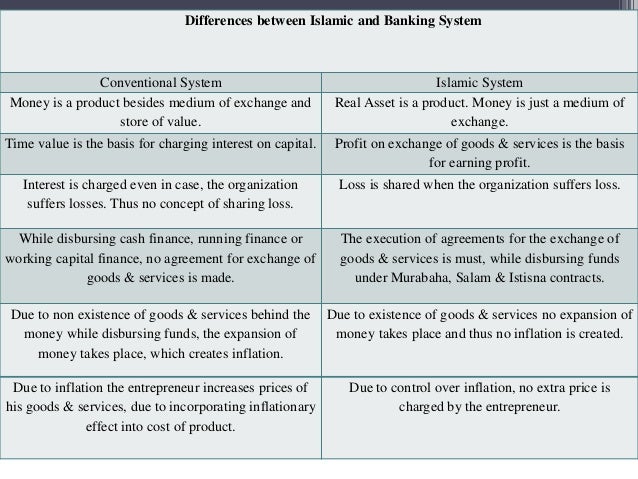

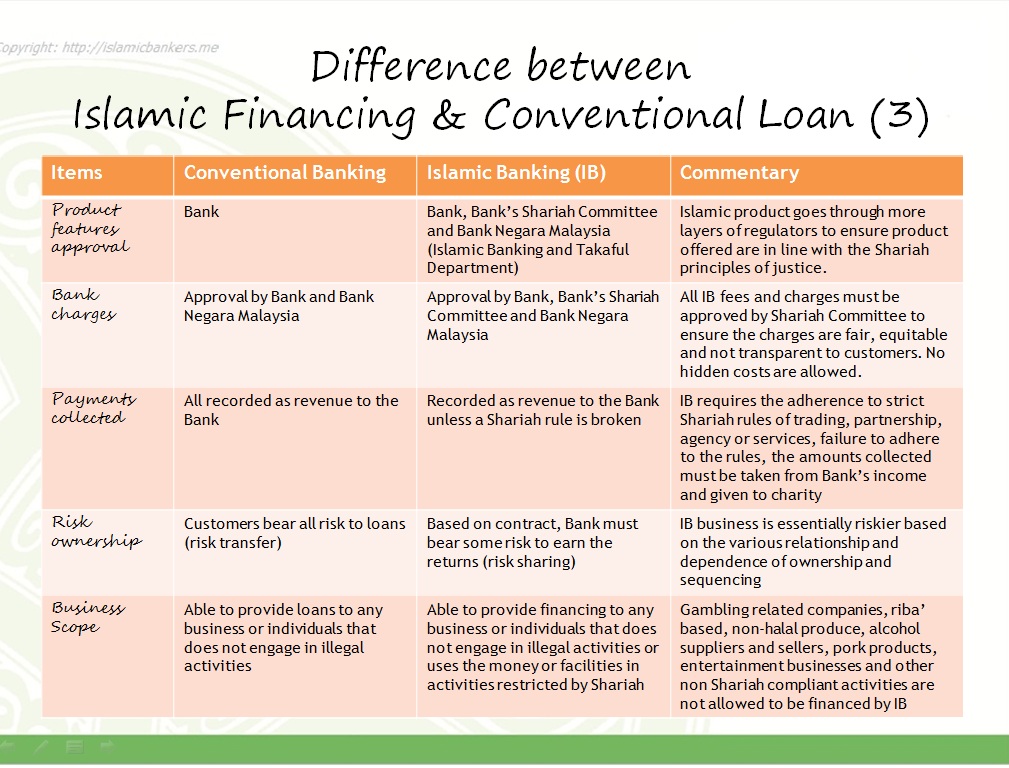

Fundamentally the difference between islamic banking and conventional banking is that the idea fairness to the clients is theoretically focused on the idea of islamic banking itself. In addition this paper also examine the stability of islamic. Conventional banks aim to maximize returns and minimize risk. The loan contract for bba islamic financing is known as a sale and buy back agreement.

The sac is the most powerful authority on islamic finance in malaysia. What is a conventional loan. A case study of malaysia. In addition this paper also examine the stability of islamic bank compared.

Foreign banks and bank size large vs.