Islamic Financial Services Act 2013 Penalty

The islamic financial services act 2013 malay.

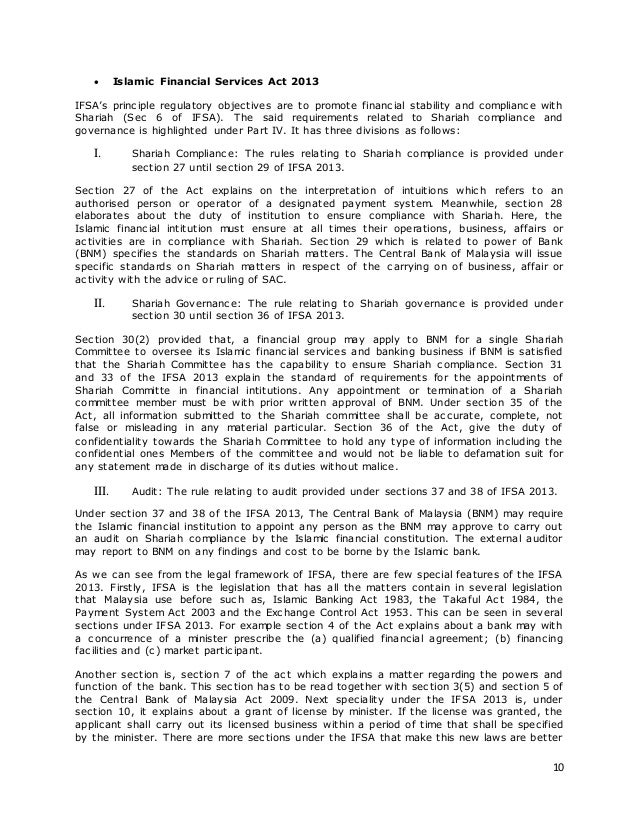

Islamic financial services act 2013 penalty. 6 any reference in this act to this act the islamic financial services act 2013 or the central bank of malaysia act 2009 shall unless otherwise expressly stated be deemed to include a reference to any rule regulation order notification or other subsidiary legislation made under this act the islamic financial services act 2013 or the central bank of malaysia act 2009. The fsa 2013 and ifsa 2013 will place malaysia s financial sector encompassing the banking system the insurance takaful sector the financial market and payment systems and other financial intermediaries on a platform for advancing forward as sound financial system. Section 28 3 of ifsa 2013 also regulates that where an institution becomes aware that it is carrying on any of its business. Ifsa 2013 has the effect of repealing the islamic banking act 1983 iba the takaful act 1984 the payment system act 2003 and the exchange control act 1953.

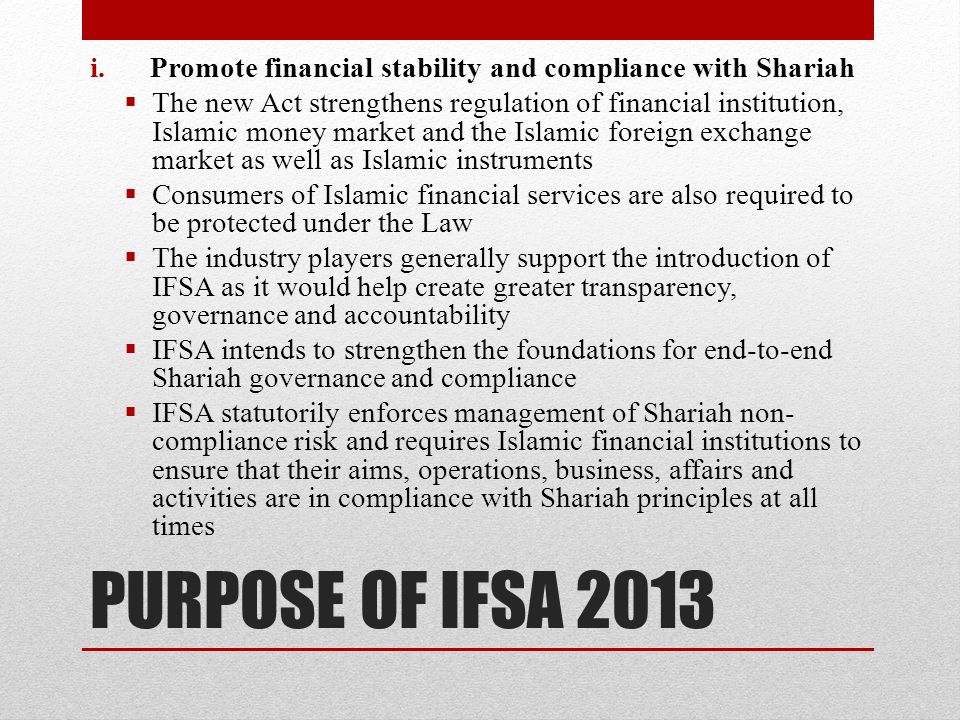

Hence separate from any decision on criminal proceedings the central bank is authorised under the financial services act 2013 and islamic financial services act 2013 to pursue administrative actions. Akta perkhidmatan kewangan islam 2013 is a malaysian laws which enacted to provide for the regulation and supervision of islamic financial institutions payment systems and other relevant entities and the oversight of the islamic money market and islamic foreign exchange market to promote financial stability and compliance with shariah and for. The islamic financial services act 2013. The new laws enacted repealed a number of separate laws as measure to promote more robust regulatory framework for the market.

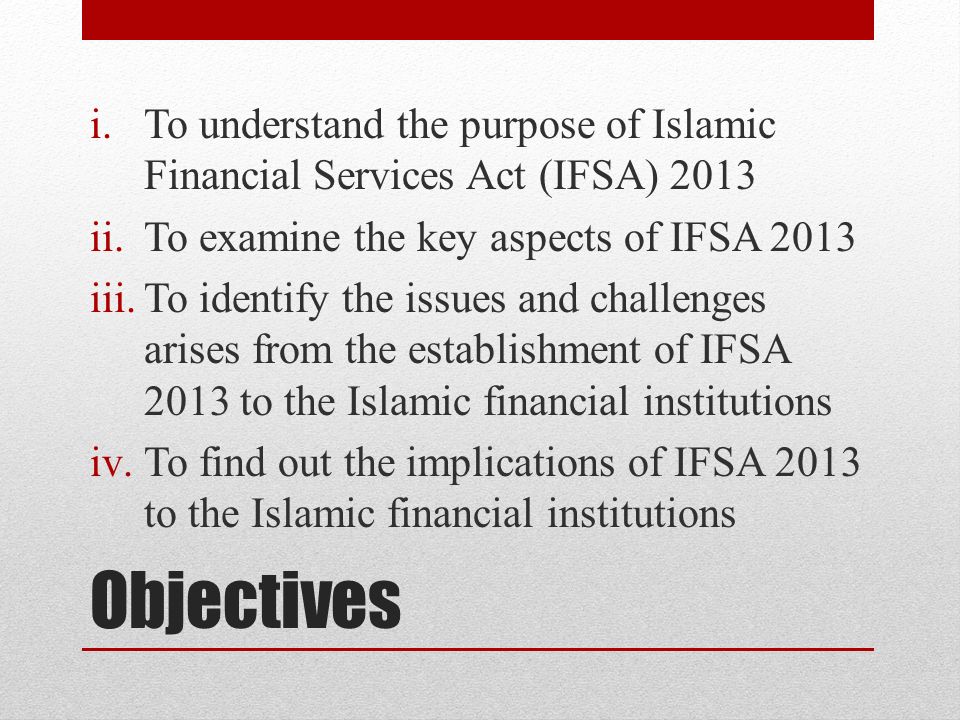

Under the repealed islamic banking act 1983 iba all monies accepted from customers were classifi ed as islamic deposits which comprise of both deposit and investment products. Persons approved under financial services act 2013 to carry on islamic financial business division 2 restriction on dealings of authorized persons 15. The islamic financial services act ifsa 2013 is a malaysian banking law which was enacted to regulate and supervise the banking practices of islamic finance institutions. Islamic financial services act ifsa 2013 and the sharīʿah compliance requirement of the islamic finance industry in malaysia june 2018 isra international journal of islamic finance 10 1 94 101.

The next level of sharīʿah compliance commitment. Licensed takaful operator to carry on family takaful or general takaful business division 3 representative office 17. Authorized person to carry on authorized business only 16.