Islamic Financial Services Act 2013 Slide

Islamic financial services act ifsa 2013 and the sharīʿah compliance requirement of the islamic finance industry in malaysia june 2018 isra international journal of islamic finance 10 1 94 101.

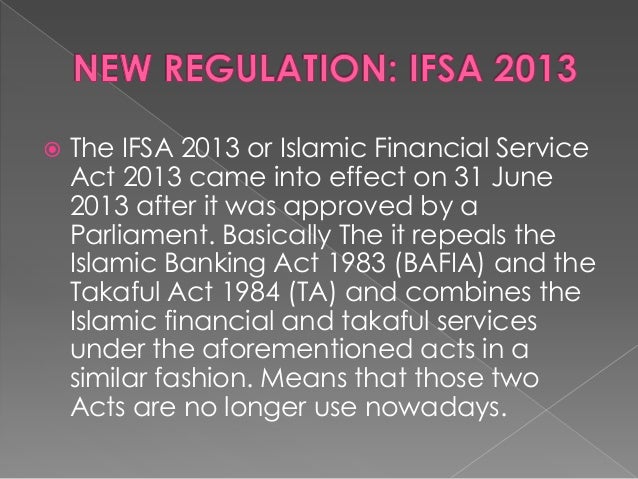

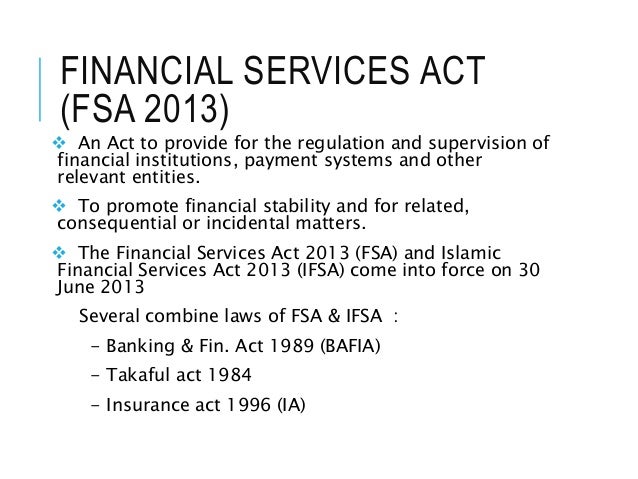

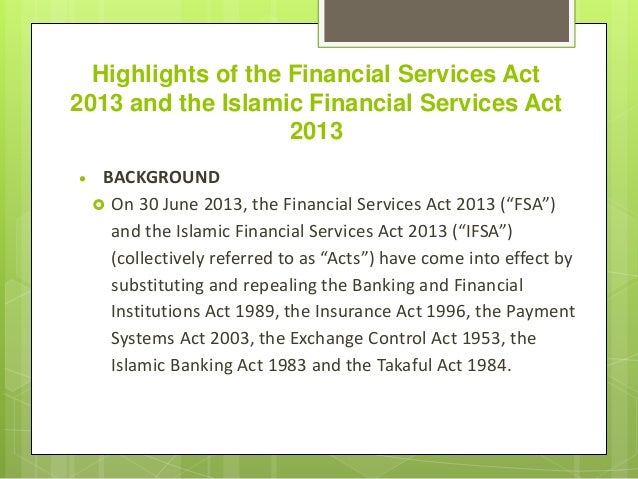

Islamic financial services act 2013 slide. Basically the it repeals the islamic banking act 1983 bafia and the takaful act 1984 ta and combines the islamic financial and takaful services under the aforementioned acts in a similar fashion. Shariah advisor is now criminally responsible for fraud criminal breach of trust criminal negligence as well as in civil suits if their fatwas that comes in form of resolution is done to defraud innocent ignorance muslims public at large. The islamic financial services act 2013. The financial services act fsa and the islamic financial services act ifsa came into force on 30 june 2013 replacing the repealed payment system act 2003 psa.

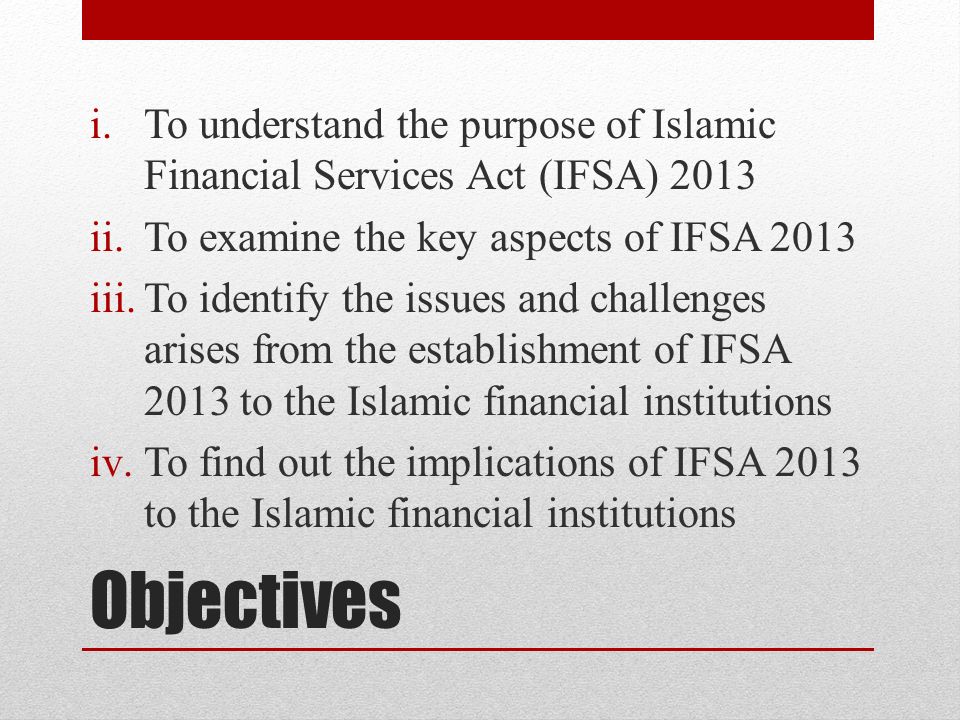

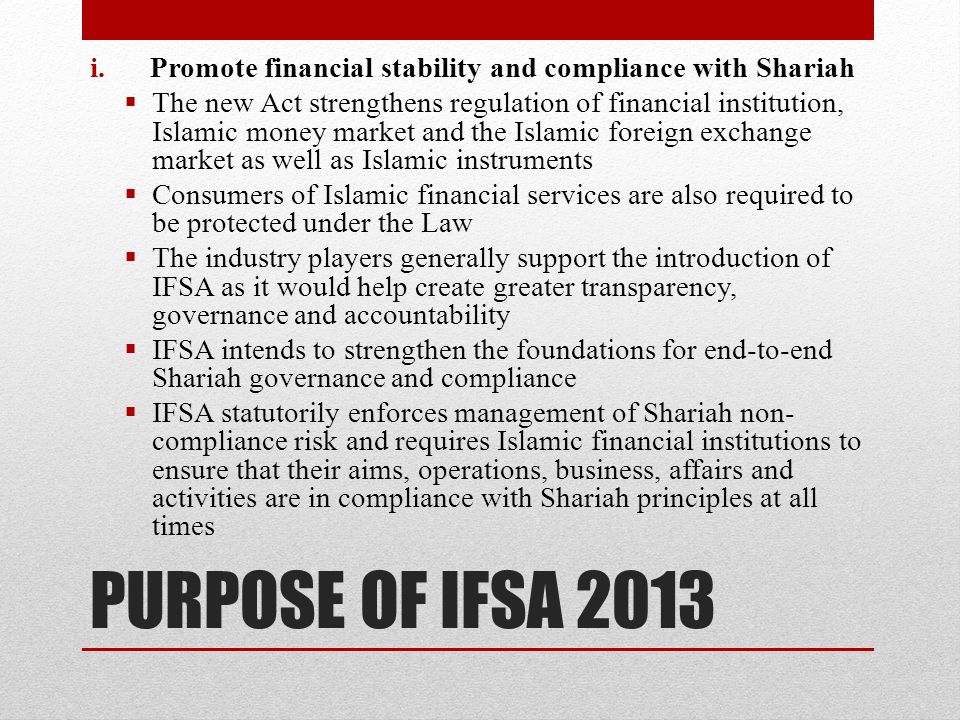

The act provides a legal platform for development of islamic finance in malaysia which is reflected upon a comprehensive regulatory framework on specificities of the various islamic financial contracts and supports on the effective application of shariah financial contracts in the offerring of islamic financial products and services. Persons approved under financial services act 2013 to carry on islamic financial business division 2 restriction on dealings of authorized persons 15. Pdf the new malaysian islamic financial services act 2013 act 759 ifsa 2013 came into force on the 30th june 2013. Authorized person to carry on authorized business only 16.

Licensed takaful operator to carry on family takaful or general takaful business division 3 representative office 17. Islamic financial services act 2013 under the new ifsa 2013 shariah advisor is now liable for criminal liabilities as well as civil liabilities. With the introduction of this act we obtained clarity on many matters but not all of it is in our favour. The islamic financial services act ifsa 2013 was introduced to streamline the islamic banking definitions and practices.

Shariah compliance nor surilawana binti hj sulaiman 3120147 4 every institution shall at all times a ensure that its internal policies and procedures are consistent with the standards specified by the bank under this. Find read and cite all the research. The ifsa 2013 or islamic financial service act 2013 came into effect on 31 june 2013 after it was approved by a parliament. Islamic financial services act 2013 ifsa 2013 cont.

From the act we see a significant re defining of the deposit product. The fsa ifsa incorporates strengthened provisions to regulate payment system operators and payment instrument issuers in order to promote safe efficient and reliable payment systems and instruments.