Islamic Financial Services Act 2013

The financial services act fsa and the islamic financial services act ifsa came into force on 30 june 2013 replacing the repealed payment system act 2003 psa.

Islamic financial services act 2013. From the act we see a significant re defining of the deposit product. This is to ensure the integrity of and confidence in the financial system the central bank said. This book provides detailed commentary on each section of. The new act provides a more uniform governance and regulatory framework for islamic banks in malaysia and caters for new developments in the financial market.

Pdf the new malaysian islamic financial services act 2013 act 759 ifsa 2013 came into force on the 30th june 2013. With the introduction of this act we obtained clarity on many matters but not all of it is in our favour. The islamic financial services act 2013 malay. The islamic financial services act ifsa 2013 is a malaysian banking law which was enacted to regulate and supervise the banking practices of islamic finance institutions.

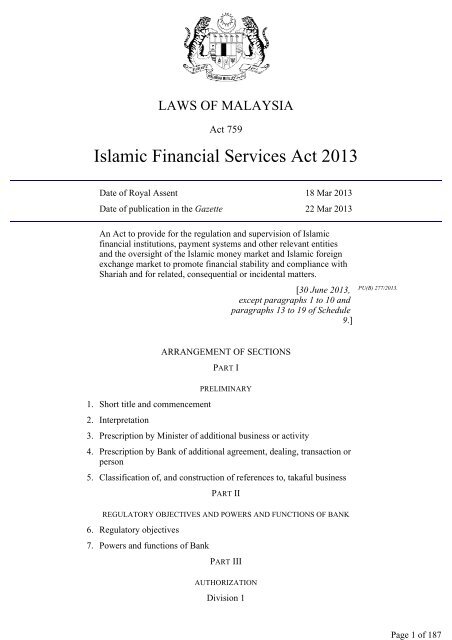

Ifsa 2013 has the effect of repealing the islamic banking act 1983 iba the takaful act 1984 the payment system act 2003 and the exchange control act 1953. On 30 june 2013 the financial services act 2013 and the islamic financial services act 2013 collectively referred to as acts have come into effect by substituting and repealing the banking and financial institutions act 1989 the insurance act 1996 the payment systems act 2003 the exchange control act 1953 the islamic banking act 1983 and the takaful act 1984. Read more human rights wrongs 1malaysia development berhad 1mdb attorney general s chambers agc bank negara malaysia financial services act 2013 islamic financial services act 2013. Akta perkhidmatan kewangan islam 2013 is a malaysian laws which enacted to provide for the regulation and supervision of islamic financial institutions payment systems and other relevant entities and the oversight of the islamic money market and islamic foreign exchange market to promote financial stability and compliance with shariah and for.

The islamic financial services act ifsa 2013 was introduced to streamline the islamic banking definitions and practices. The fsa ifsa incorporates strengthened provisions to regulate payment system operators and payment instrument issuers in order to promote safe efficient and reliable payment systems and instruments. Islamic financial services act ifsa and financial services act fsa the regulatory framework in malaysia has marked another milestone in the financial market with the introduction of ifsa and fsa in 2013 to cater to the growing market of the country s financial industry. Its main objectives are to.