Non Resident Tax Malaysia

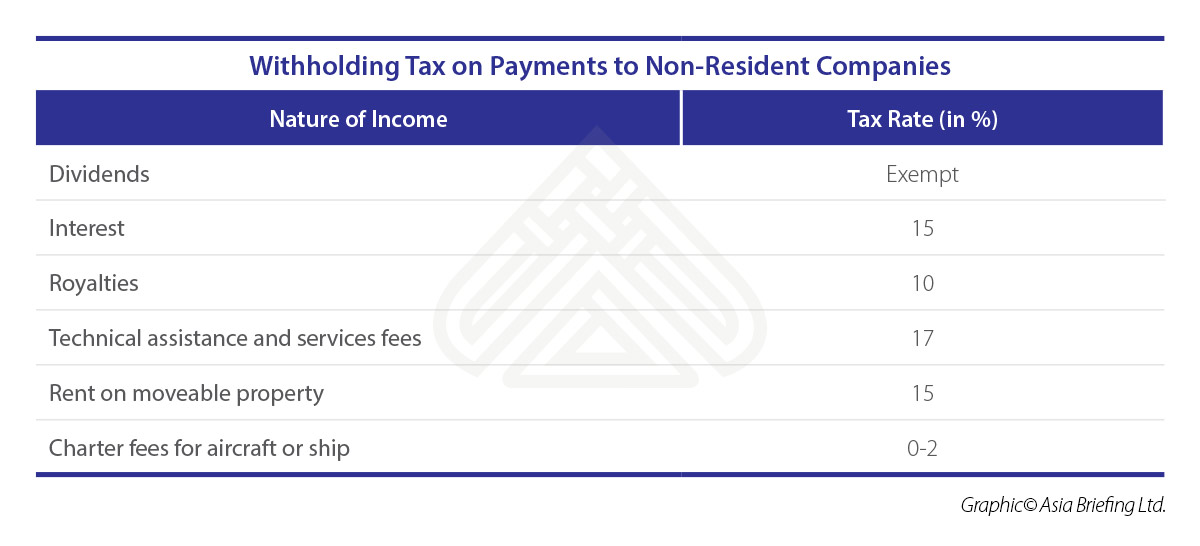

Non resident companies are liable to malaysian tax when it carries on a business through a permanent establishment in malaysia.

Non resident tax malaysia. The tax rates are limited to maximum 25. Under malaysian tax law both residents and non resident are subject to income tax on malaysian source income. You are non resident under malaysian tax law if you stay less than 182 days in malaysia in a year regardless of your citizenship or nationality. Citizens and permanent residents of malaysia do not fall into this category.

You ll still need to pay taxes for income earned in malaysia and will be taxed at a different rate from residents. An individual will be. Resident status is determined by reference to the number of days an individual is present in malaysia. Income tax for non resident.

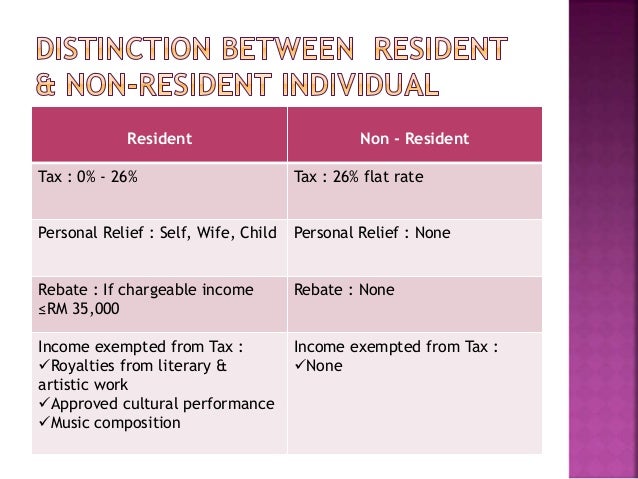

Royalty income received by non resident franchisors under franchised education scheme programmes by the ministry of education is exempted from tax. The status of individuals as residents or non residents determines whether or not they can claim personal allowances generally referred to as personal reliefs and tax rebates and enjoy the benefit of graduated tax rates. Residents and non resident status will give a different tax regime on income earned received from malaysia. Non resident individual is not liable to tax if employment is exercised in malaysia for less than 60 days in a year age 55 years old and above and receiving pension from malaysia employment receiving interest from banks receiving tax exempt dividends year of assessment 2014 please note use e filing e m e mt for easy declaration of.

You are regarded as a non resident under malaysian tax law if you stay in malaysia for less than 182 days in a year regardless whether you are malaysian or not. Income taxes in malaysia for non residents. Non resident company tax rate. Non resident individual is taxed at a different tax rate on income earned received from malaysia.

With effect from 2016 income tax for non resident is a flat rate of 28. Non resident individual is taxed at a different tax rate on income earned received from malaysia. So it is very important to identify whether you are residents or non resident in regard to malaysia tax law. Interest paid to a non resident by a commercial or merchant bank operating in malaysia is also exempt from tax.

Non resident companies are liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing in or derived from malaysia. You are non resident under malaysian tax law if you stay less than 182 days in malaysia in a year regardless of your citizenship or nationality.