Non Resident Tax Rate Malaysia

Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar.

Non resident tax rate malaysia. If the individual is resident in regard to malaysian tax law the individual. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. You ll still need to pay taxes for income earned in malaysia and will be taxed at a different rate from residents. You are regarded as a non resident under malaysian tax law if you stay in malaysia for less than 182 days in a year regardless of nationality.

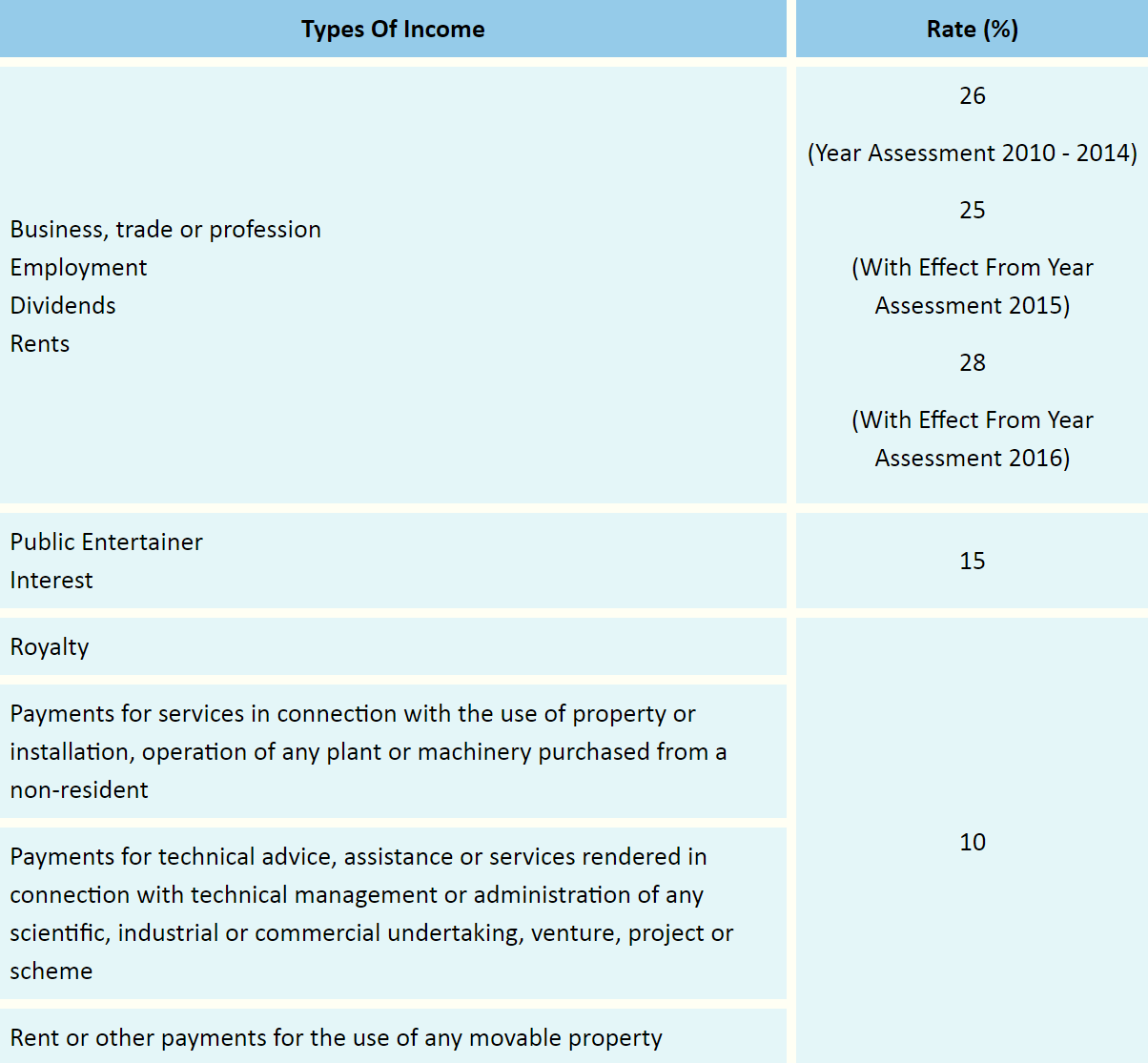

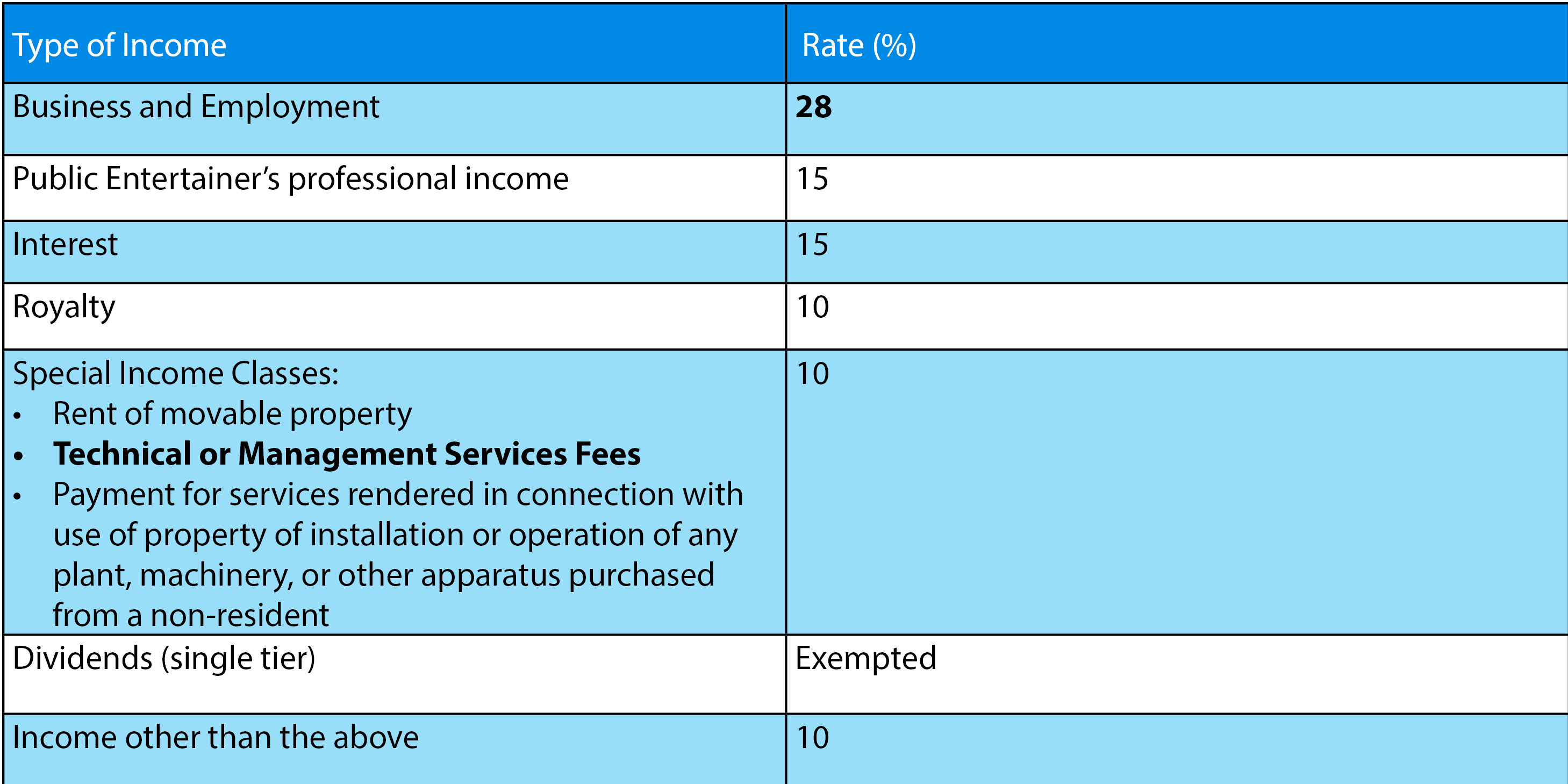

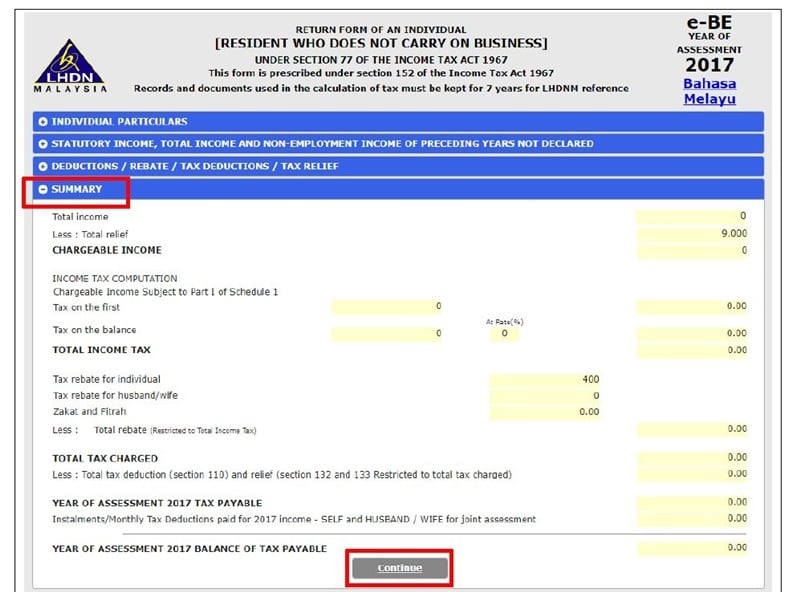

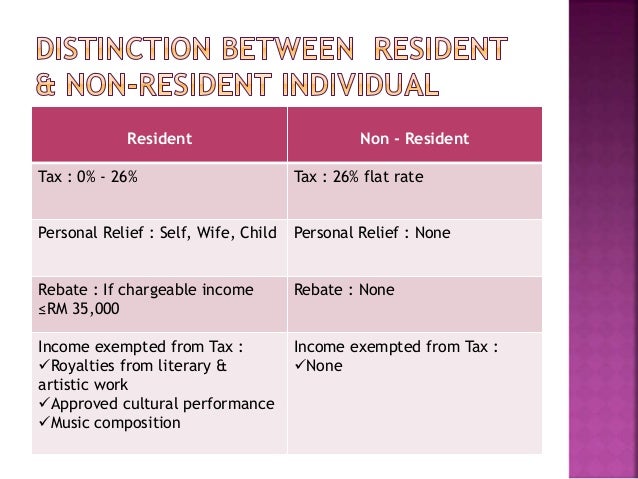

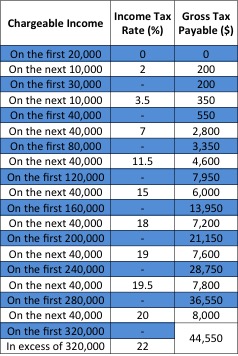

The status of individuals as residents or non residents determines whether or not they can claim personal allowances generally referred to as personal reliefs and tax rebates and enjoy the benefit of graduated tax rates. Non resident individual is taxed at a different tax rate on income earned received from malaysia. Malaysia personal income tax rate. Resident status is determined by reference to the number of days an individual is present in malaysia.

A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. You are regarded as a non resident under malaysian tax law if you stay in malaysia for less than 182 days in a year regardless whether you are malaysian or not. Income taxes in malaysia for non residents. Non resident individual is taxed at a different tax rate on income earned received from malaysia.

Green technology educational services. An individual will be considered non resident for income tax purpose if the individual is physically present in malaysia for less than 182 days during the calendar year regardless of the citizenship or nationality. You are non resident under malaysian tax law if you stay less than 182 days in malaysia in a year regardless of your citizenship or nationality. The tax rates are limited to maximum 25.

Non resident companies are liable to malaysian tax when it carries on a business through a permanent establishment in malaysia. You are non resident under malaysian tax law if you stay less than 182 days in malaysia in a year regardless of your citizenship or nationality. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. You ll still need to pay taxes for income earned in malaysia and will be taxed at a different rate from residents.