Public Mutual Prs Equity Fund Performance

Our products unit trust.

Public mutual prs equity fund performance. Performance charts for public mutual prs strategic equity fund pmprsef including intraday historical and comparison charts technical analysis and trend lines. Give us a call at 603 2022 5000. Performance charts for public mutual prs conservative fund pmprscv including intraday historical and comparison charts technical analysis and trend lines. Annual scheme trustee fee.

This means i would need to earn rm 107 in my first year from the equity fund to match my returns from the epf. 20 of the fund s nav can be invested in warrants while up to 40 of the fund s nav can be invested in existing public mutual unit trust funds. Public mutual prs growth fund is targeting those investors below age of 40 years old or have high risk profile. Public mutual prs conservative islamic conservative fund.

Markets may be volatile in the short term but saving for your retirement is a long term endeavour. The fund seeks to achieve long term capital growth. Public mutual prs growth moderate equity strategic equity fund. This fund will mainly invest in combination of index dividend growth stocks.

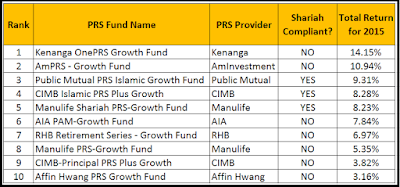

Prs eqf seeks to achieve its objective by investing 75 to 98 of its net asset value nav in equities and collective investment schemes which comprises a diversified portfolio of blue chip stocks index stocks and growth stocks. Public bank a complete one stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers. Fund performance quick view top 8 performers. 20 of the equity portion of the fund can be invested in asia.

This means the equity fund needs to generate more than 8 42 and 11 26 in returns to beat returns from fds and the epf respectively. The balance of the fund s nav will be invested in fixed income securities and liquid assets which include money. Public mutual prs islamic growth moderate strategic equity fund. Insure fund prices nav.

Give us a call at 603 2022 5000.