Unabsorbed Business Loss Carried Forward Malaysia 2018

Kuala lumpur nov 2 business entities are allowed to carry forward unabsorbed losses and unutilised capital allowances in a year of assessment for a maximum period of seven years of assessment said minister of finance lim guan eng.

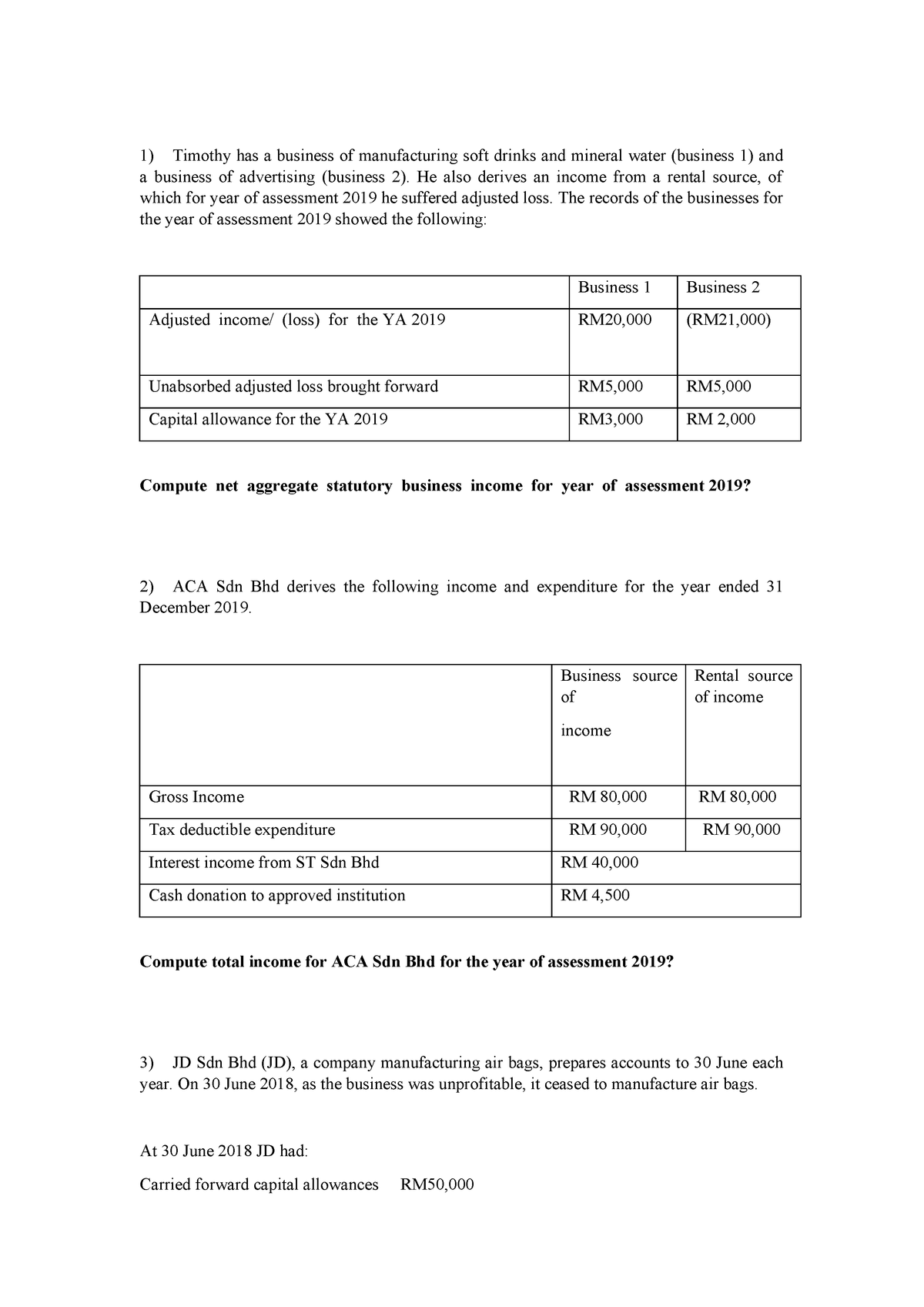

Unabsorbed business loss carried forward malaysia 2018. Any accumulated losses and allowances brought forward from year of assessment 2018 can be carried forward for another 7 years consecutive years of assessment i e. 2018 can be carried forward up to ya 2025. Utilisation of carried forward losses is restricted to income from business sources only. Unutilised losses in a year of assessment can only be carried forward for a maximum period of seven consecutive years of assessment while unabsorbed capital allowance can be carried forward indefinitely.

The unabsorbed tax losses of the target company brought forward from previous years will be available to offset against future business income of the target company. Any unutilised losses can be carried forward indefinitely to be utilised against income from any business source. Utilisation of capital allowance is also restricted to income from the same underlying business source. From year of assessments 2019 to 2025.

Losses allowances proposal 1. Effective from the year of assessment ya 2019 time limit is to be imposed on the carry forward of the following losses and allowances. The basis period for a company co operative or trust body is normally the financial year fy ending in that particular ya. As a concession companies except dormant companies are allowed to carry forward unabsorbed tax losses even when there is a substantial change more than 50 in the shareholders.

Business losses can be set off against income from all sources in the current year. For companies in a loss making non tax paying position. A person is also deemed to have a place of business in malaysia if that person a. All income of persons other than a company.

Unutilised business losses to be carried forward for a maximum of 7 consecutive years of assessment. The above proposal is effective from ya 2019. Unabsorbed business losses and unutilised capital allowances from a year of assessment. The restriction on carry forward of unutilised capital allowances and investment tax allowance has been removed from the amended finance bill 2018.

Any unabsorbed tax. The ya 2018 is the year ending 31 december 2018. For example the basis period for the ya 2018 for a company which closes its accounts on 30 june 2018 is the fy ending 30 june 2018.

.jpg)