Unabsorbed Business Loss Carried Forward Malaysia

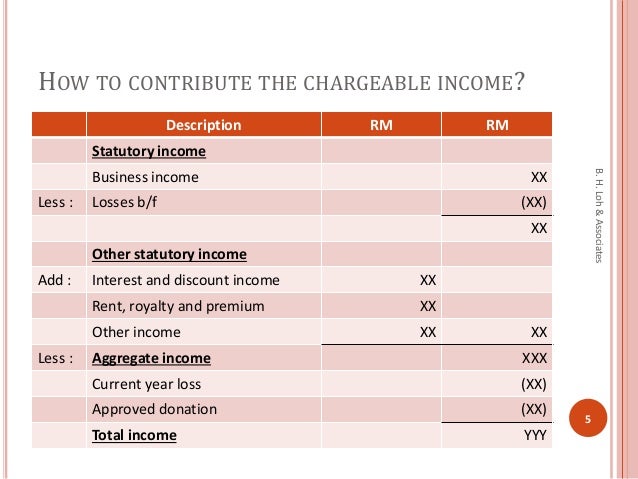

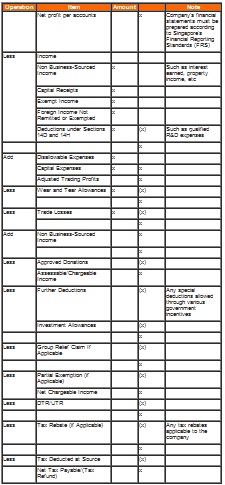

Utilisation of carried forward losses is restricted to income from business sources only.

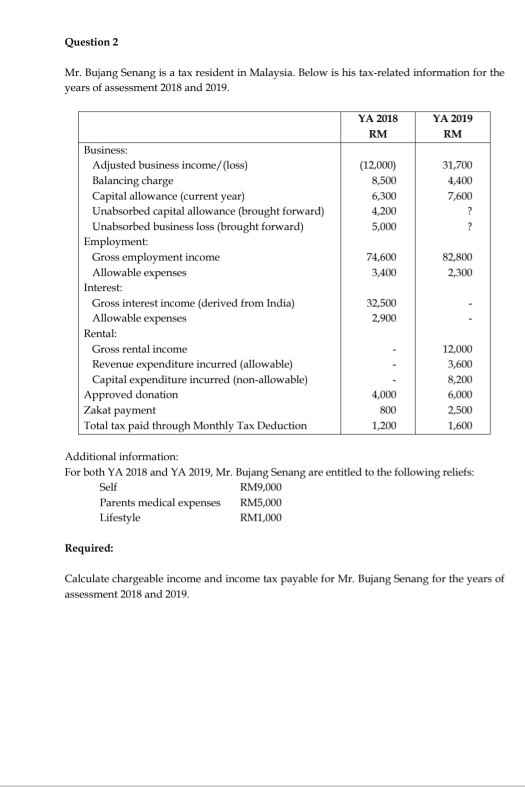

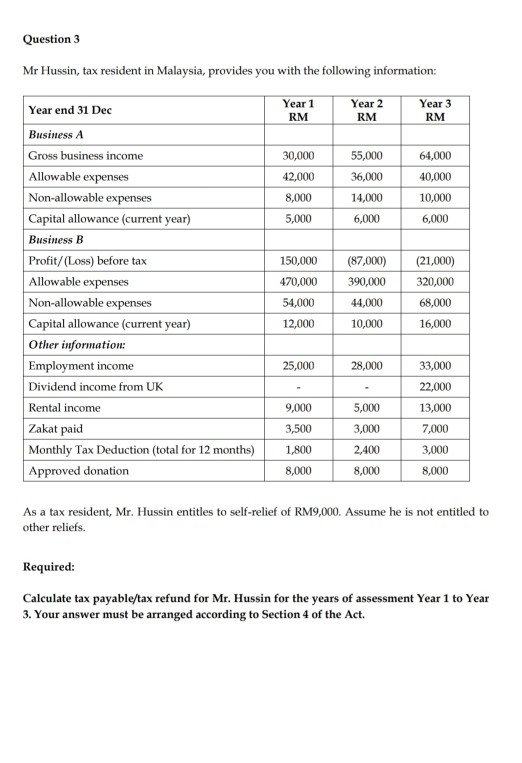

Unabsorbed business loss carried forward malaysia. The unabsorbed tax losses of the target company brought forward from previous years will be available to offset against future business income of the target company. Kuala lumpur nov 2 business entities are allowed to carry forward unabsorbed losses and unutilised capital allowances in a year of assessment for a maximum period of seven years of assessment said minister of finance lim guan eng. Malaysia 60 3 2032 2799 mui lee leow. For companies in a loss making non tax paying position.

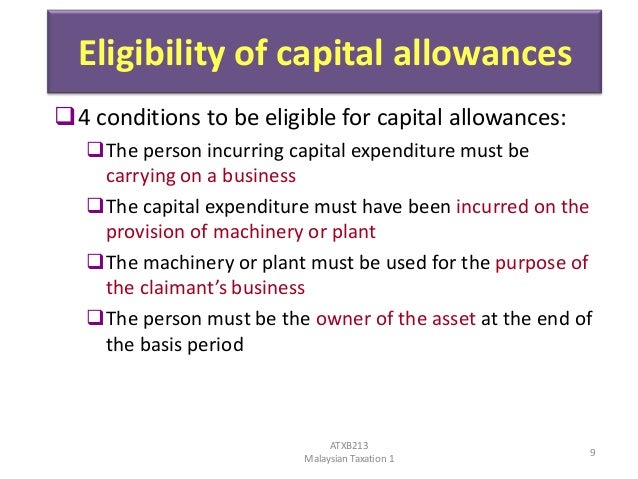

Review of restriction on carry forward of losses and allowances. Any unutilised losses can be carried forward indefinitely to be utilised against income from any business source. Unutilised losses in a year of assessment can only be carried forward for a maximum period of seven consecutive years of assessment while unabsorbed capital allowance can be carried forward indefinitely. Utilisation of capital allowance is also restricted to income from the same underlying business source.

2019 time limit is to be imposed on the carry forward of the following losses and allowances. O unabsorbed business losses 7 consecutive yas following the relevant ya. Business losses can be set off against income from all sources in the current year. Finance minister lim guan eng tables budget 2019 at parliament in kuala lumpur november 2 2018 picture by shafwan zaidon.