How To Calculate Capital Allowance In Taxation Malaysia

Capital allowance is only applicable to business activity and not for individual.

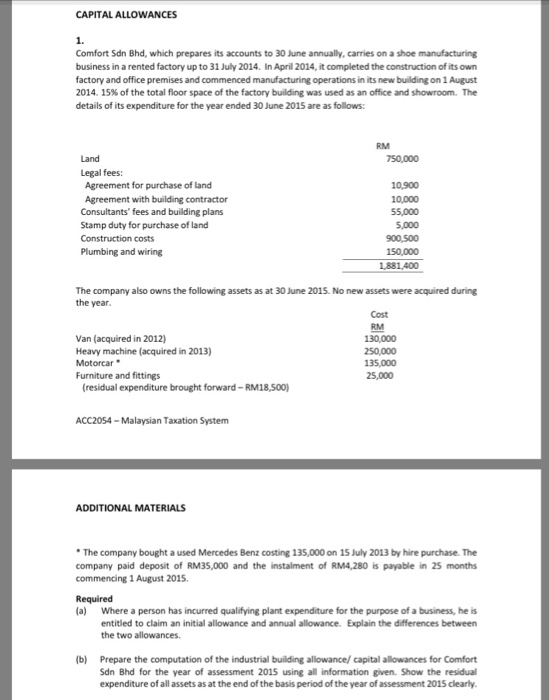

How to calculate capital allowance in taxation malaysia. 4 clawback of capital allowances claimed on assets owned less than 2 years the clawback of capital allowances claimed does not apply to disposals made with valid commercial reasons referred to as bona fide disposals such as. Partial from a set of corporate income tax computation itc or either an individual with business income who going to claim for their capital allowance capital allowance schedulers analysis would be a large portion for most of the itc with tangible assets here i going to standardize and analysis the procedures steps by steps to be apply on your capital allowance ca schedulers. Therefore it is onerous on a taxpayer to ensure that the calculation of tax is correctly computed and declared accordingly especially when it involves a substantial amount of capital expenditure. This ruling is effective.

Relevant provisions of the law 2 1 this pr takes into account laws which are in force as at the date this pr is published. Computation of capital allowances and balancing charge. Examples of assets used in a business are motor vehicles machines office equipment furniture and computers. Disposal of asset not suitable for use or which is no longer needed in the business.

Please refer to the royal customs excise department rced for indirect taxes. Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances. Other taxes include property gains tax stamp duty and indirect taxes such as sales tax import and export duties and service taxes. Manufacturing company may claim reinvestment allowance ra investment tax allowance ita and or normal capital allowance ca.

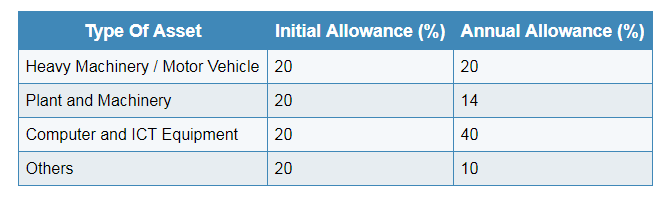

A tax treatment in relation to qualifying expenditure on plant and machinery for the purpose of claiming capital allowances. Computation of initial annual allowances in respect of plant machinery 1 0 tax law this ruling applies in respect of the computation of annual allowances for plant and machinery under paragraph 15 schedule 3 income tax act 1967 and the income tax qualifying plant annual allowances rules 2000 p u a 52 2000. And b computation of capital allowances for expenditure on plant and machinery. Business loss for the year of assessment 2016 capital allowances b f and current year capital allowances on other assets were rm160 000 rm30 000 and rm55 000 respectively.

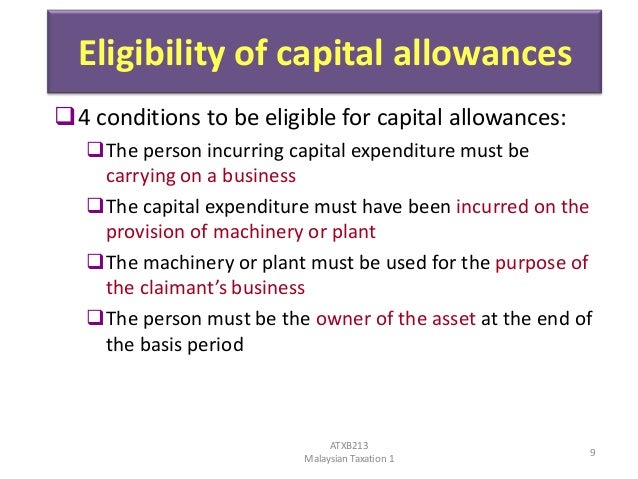

Disposal due to damage. In the current tax environment in malaysia the amount of tax declared by a taxpayer would constitute its own tax assessment. Conditions for claiming capital allowance are. The purpose of capital allowance is to give a relief for wear and tear of fixed assets for business.

Capital allowance is given as deduction from business income in place of depreciation expenses incurred in purchase of business assets. Some examples of assets that are normally used in business are motor vehicles machines office equipments and furniture.