Importance Of Capital Structure Ratios

A firm s capital structure is typically expressed as a debt to equity finance cfi s finance articles are designed as self study guides to learn important finance concepts online at your own pace.

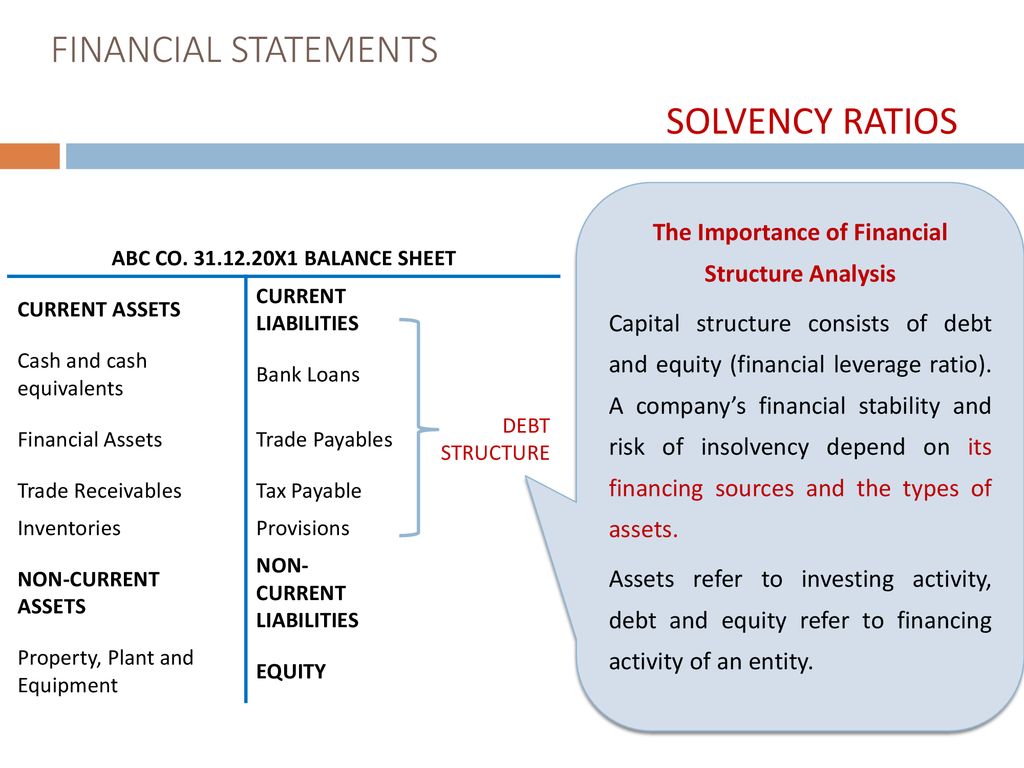

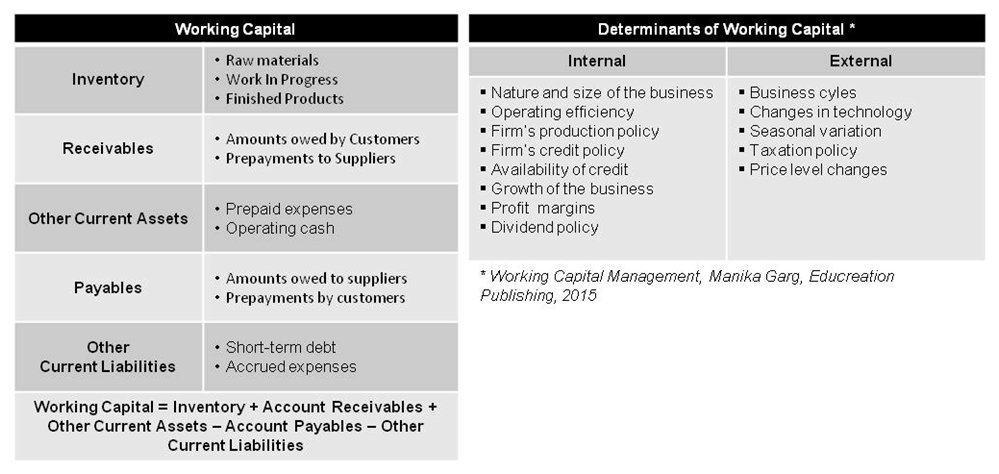

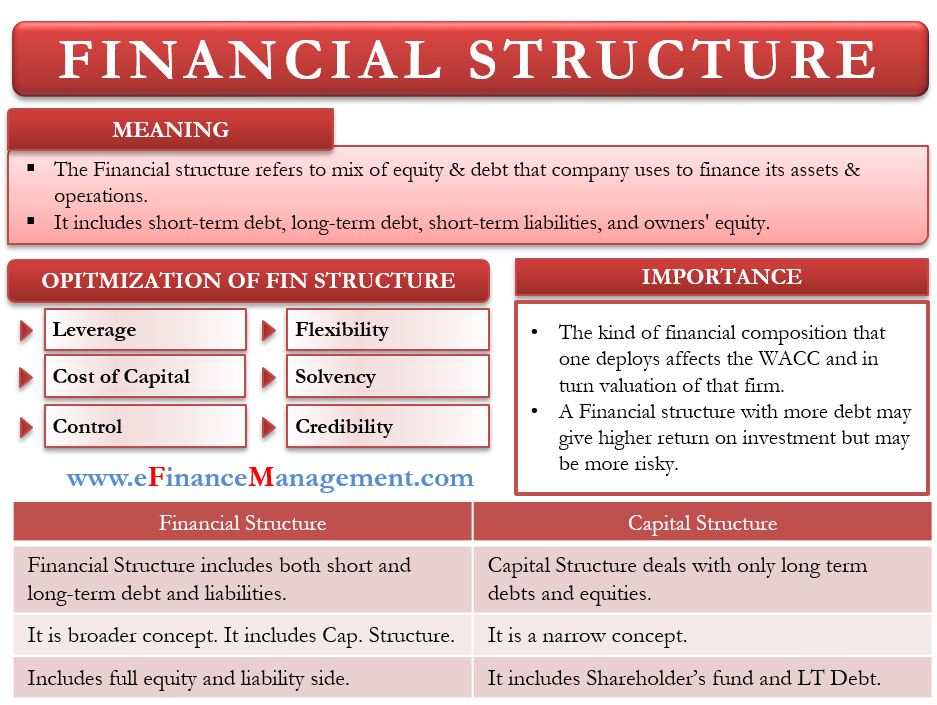

Importance of capital structure ratios. These ratios indicate the mix of funds provided by the owners and lenders and assure the lenders of the long term fund with respect to. Meaning and concept of capital structure. The capital is considered to have a multi tiered structure. Ratings that credit agencies provide on companies help assess the.

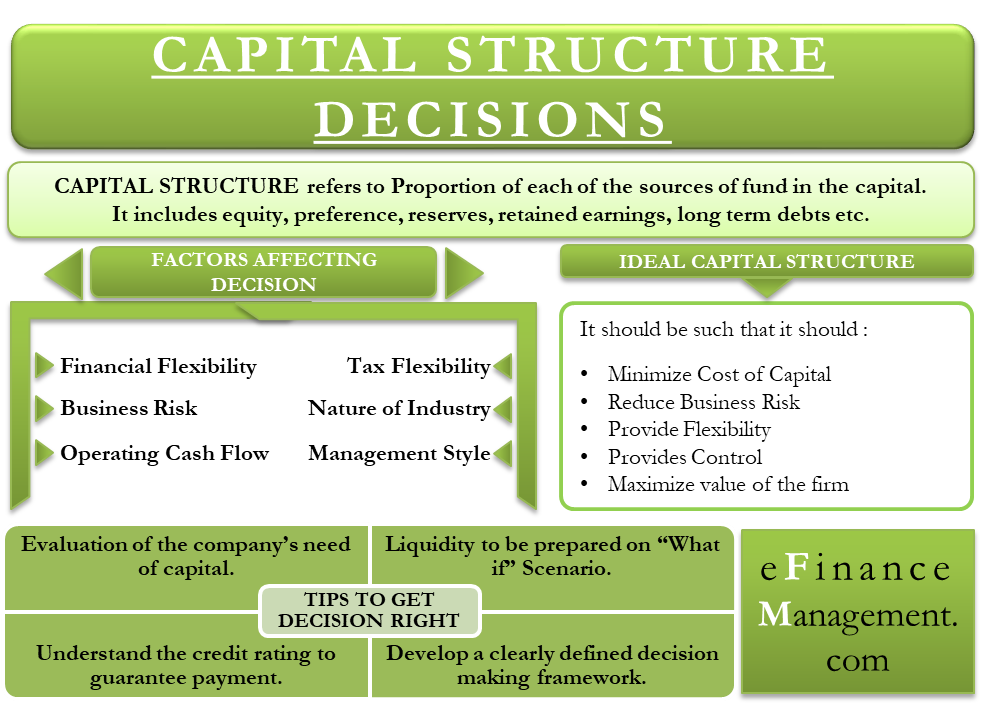

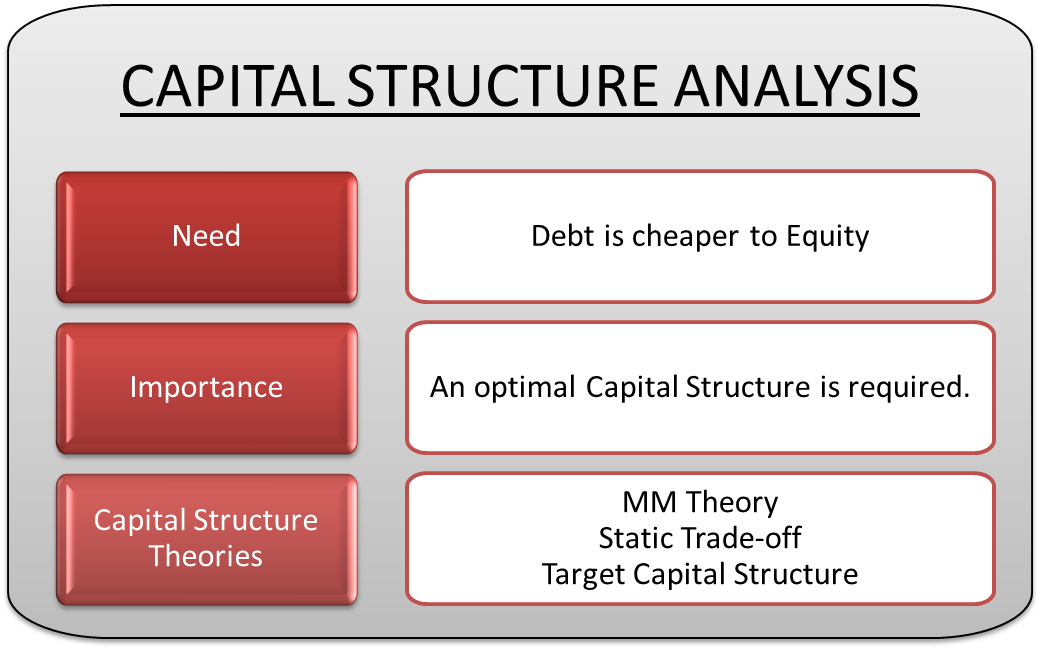

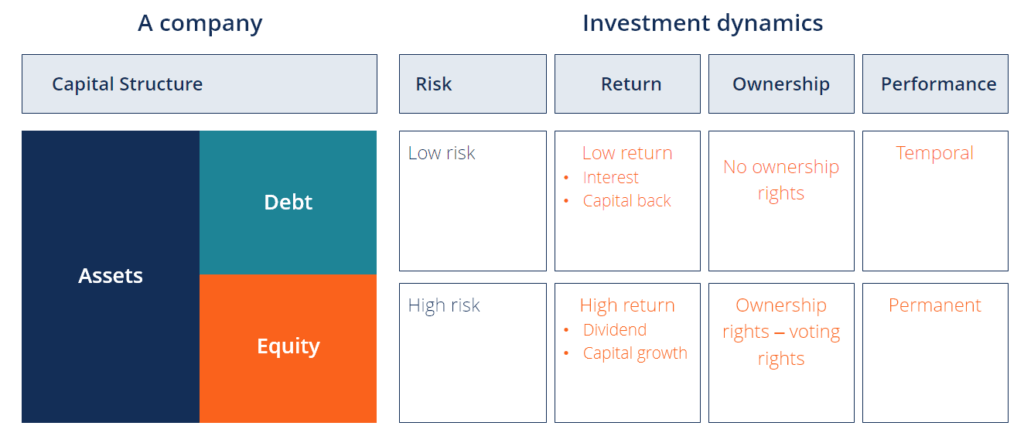

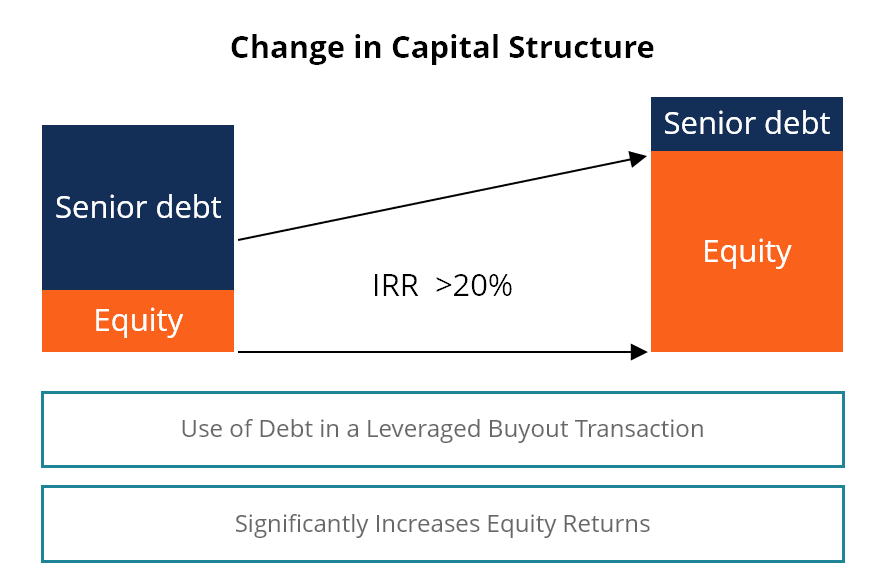

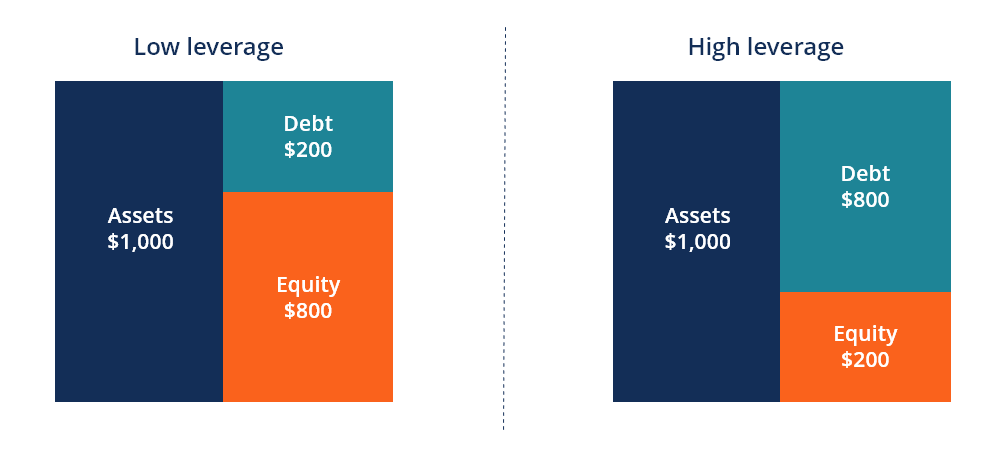

The term structure means the arrangement of the various parts. Some capital structure theories modigliani miller proposition. Therefore some part of the capital is considered to be more at risk than other parts. Investors understand that the way a business is funded can have a lot of impact on the returns it provides.

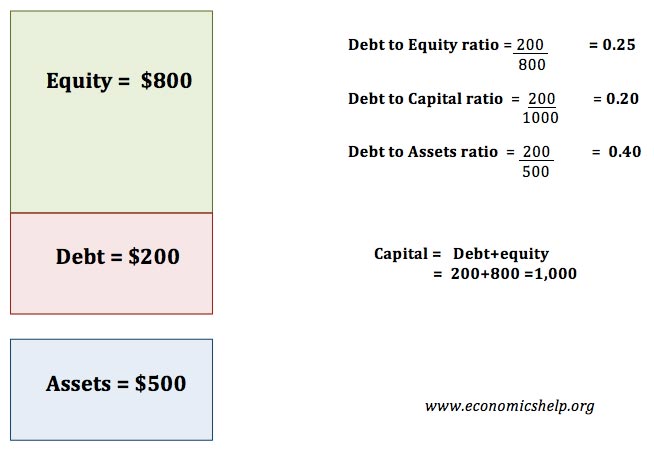

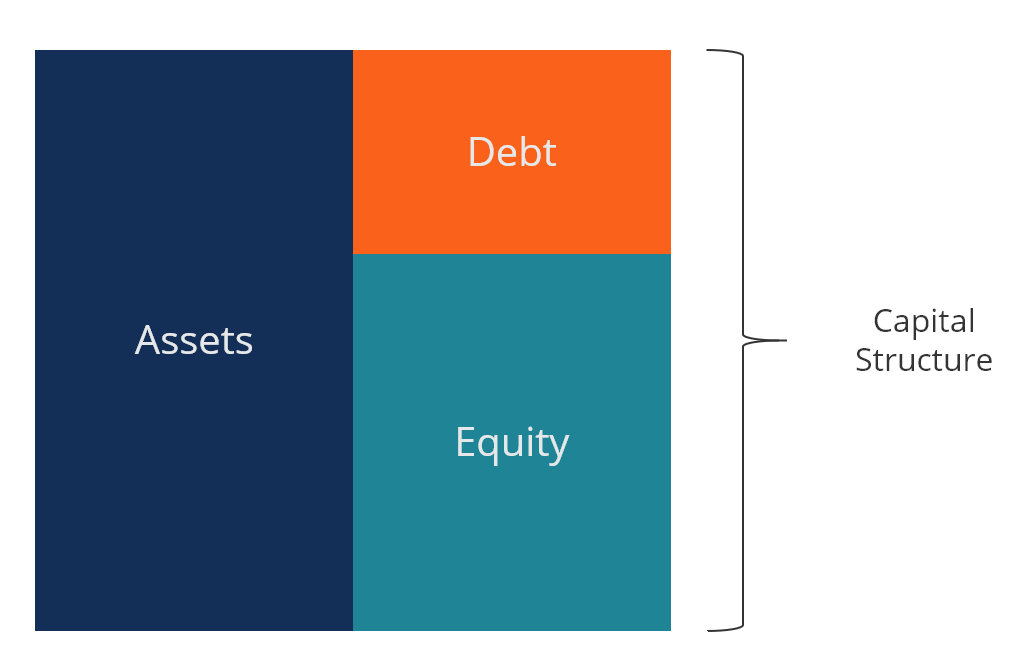

In one company debt capital may be nil while in another such capital may even be greater than the owned capital. The proportion between the two usually expressed in terms of a ratio denotes the capital structure of a company. The term capital structure refers to the relationship between the various long term forms of financing such as debenture preference share capital and equity share capital. So capital structure means the arrangement of capital from different sources so that the long term funds needed for the business are raised.

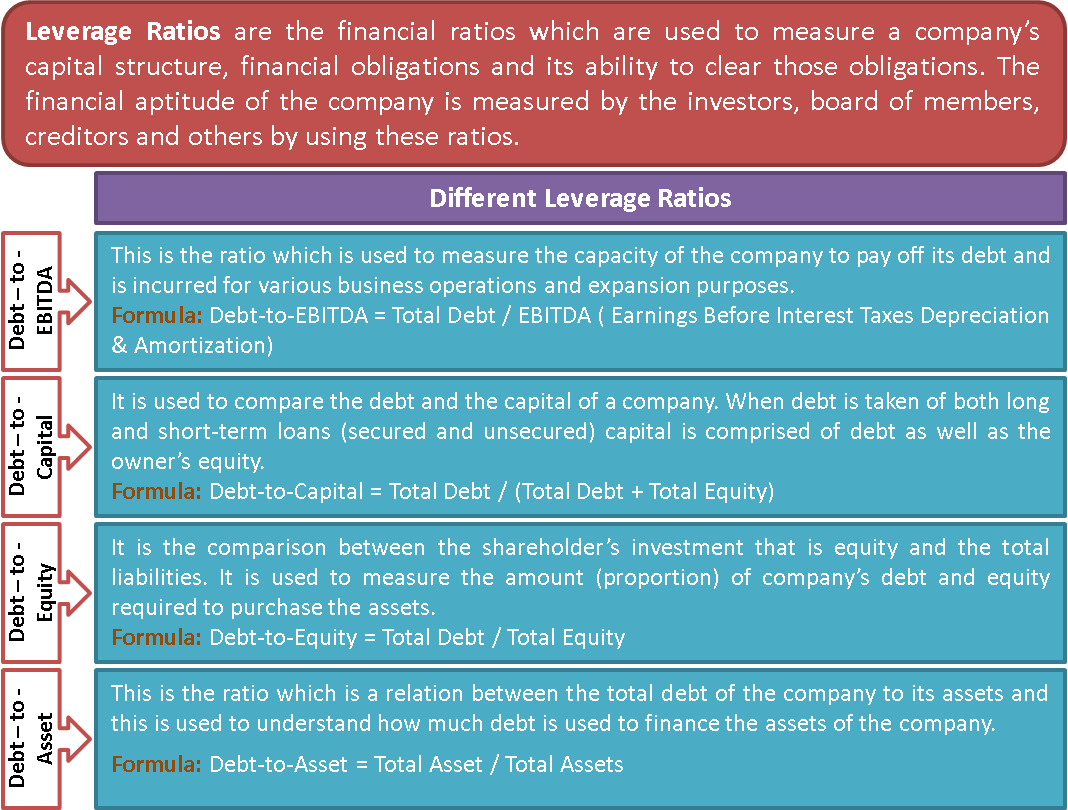

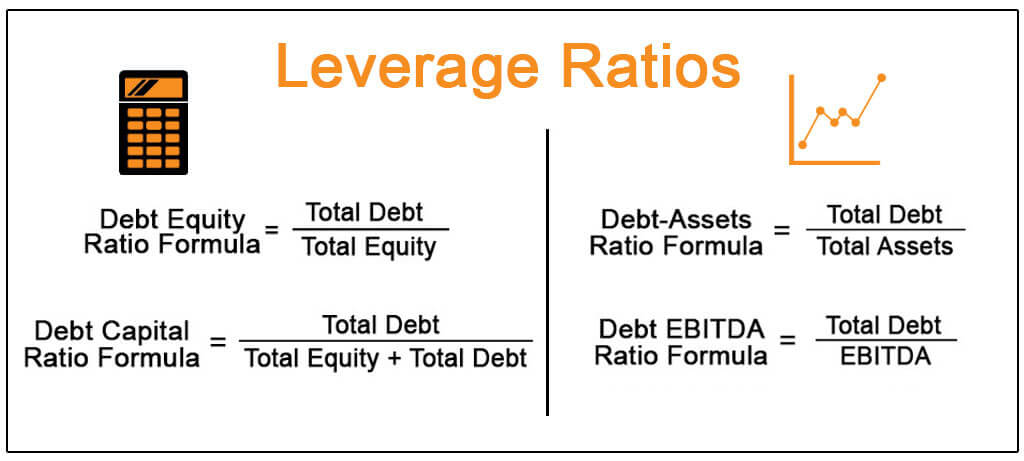

Definition of capital structure. Important ratios to analyze capital structure include the debt ratio the debt to equity ratio and the capitalization ratio. Capital structure is the mix of the long term sources of funds used by a firm. Browse hundreds of articles.

Capital structure ratios may be defined as those financial ratios which measure the long term stability and structure of the firm. For the purpose of calculating the capital adequacy ratio not all the bank s capital is considered to be at an equal footing. Capital structure ratios are also known as leverage ratios. While this theory has been replaced by several modern theories the study of capital structure analysis cannot be complete without understanding the mm approach it explains the fundamental relationship between the capital structure and cost of equity introducing the impact of taxes and financial distress.

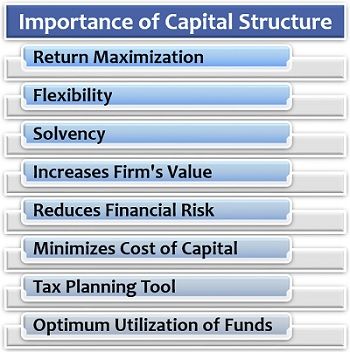

Same business can yield different returns. Capital structure ratios are very important to analyze the financial statements of any company for the following reasons.

/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)