Importance Of Capital Structure Theory

You see this with the dichotomy people keep drawing between the financial markets and the real economy a distinction that is useful for some purposes but which in this context often reinforces the.

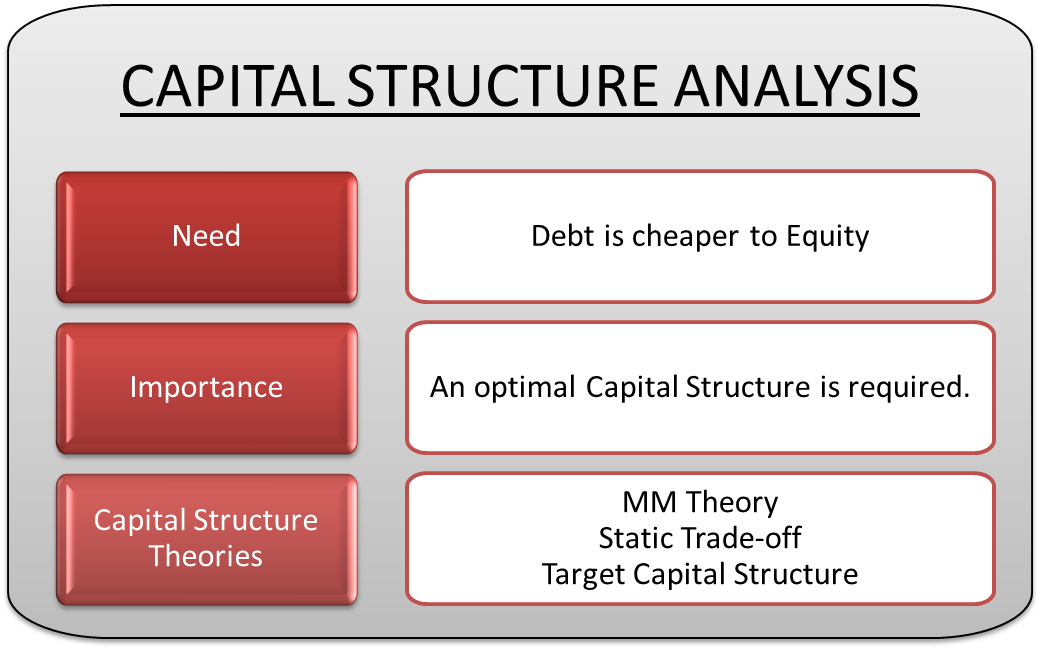

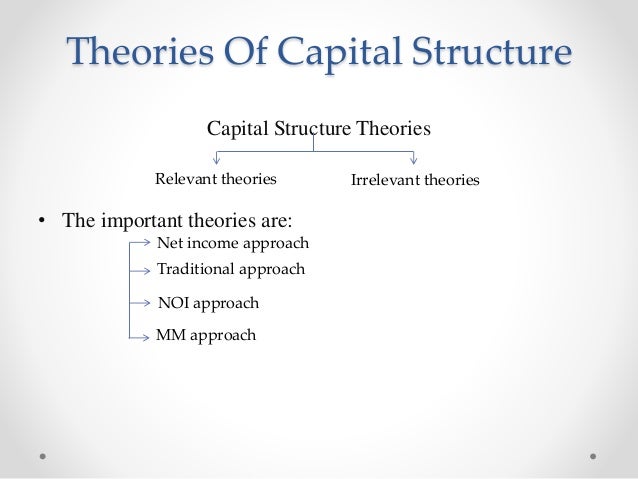

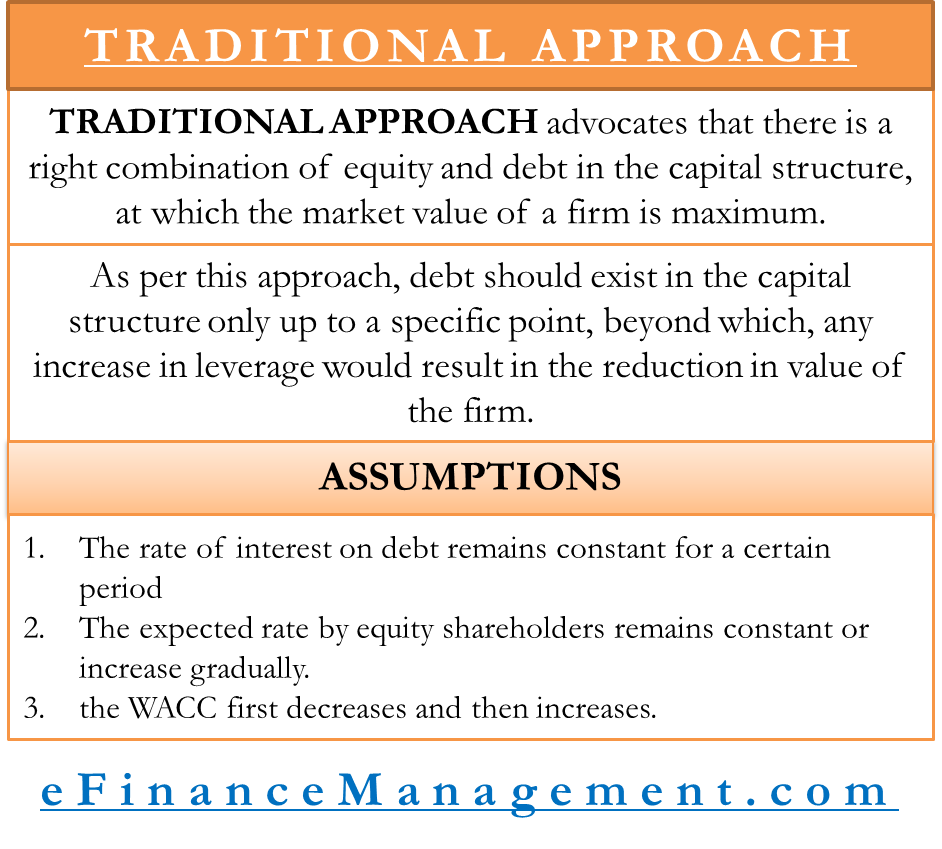

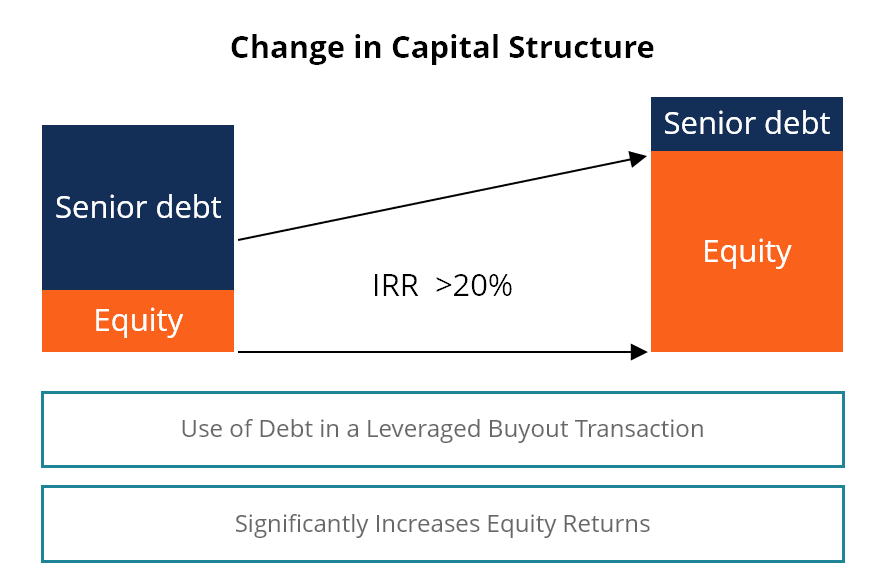

Importance of capital structure theory. The following graph shows the clear picture. 2 1 1 goal of this chapter. Important theories or approaches to financial leverage or capital structure or financing mix are as follows. The existence of an optimum capital structure is not accepted by all.

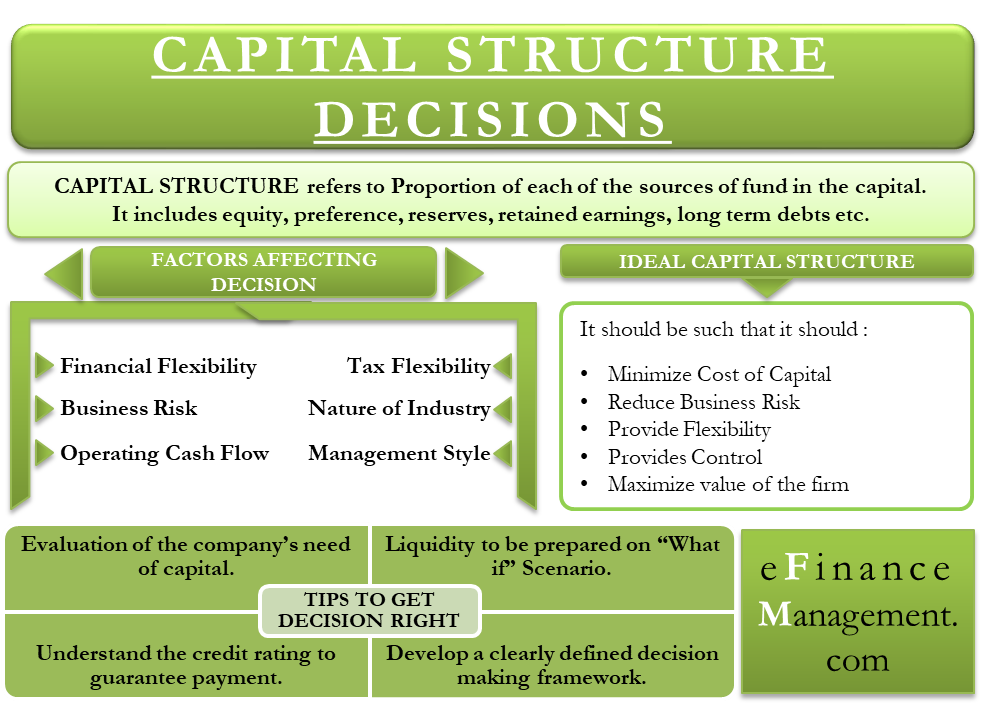

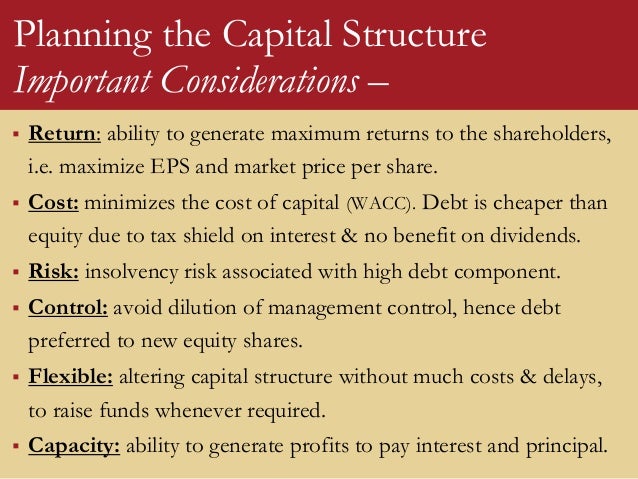

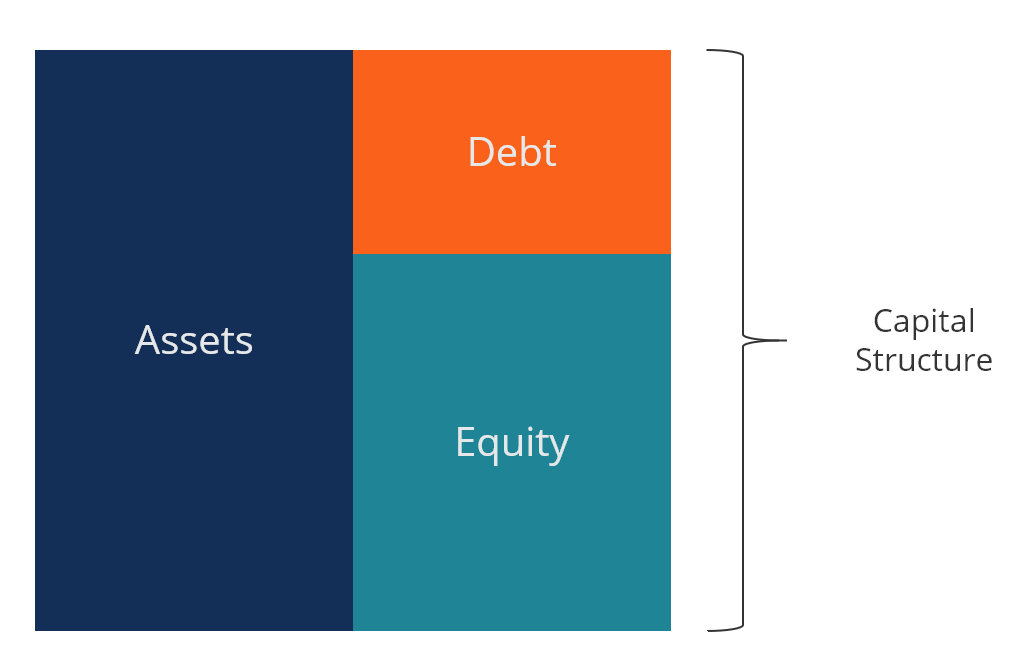

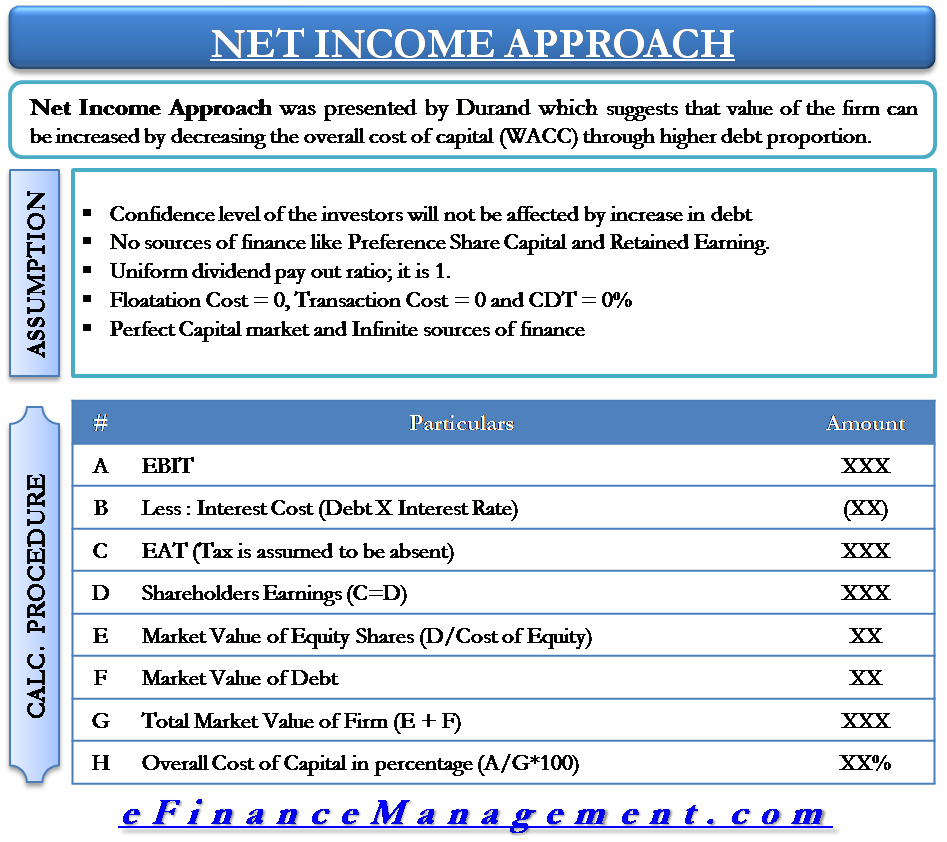

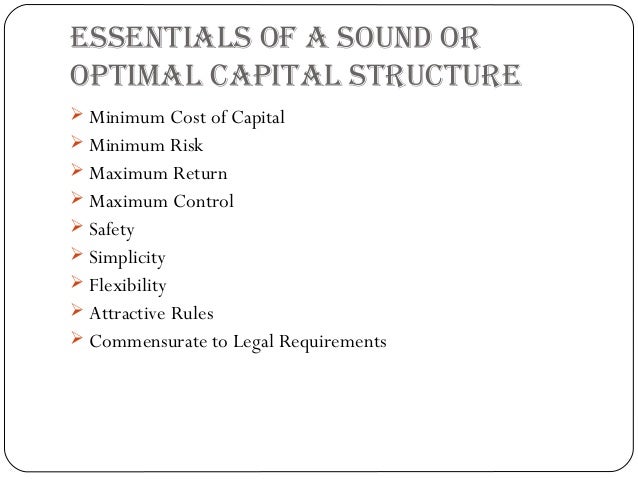

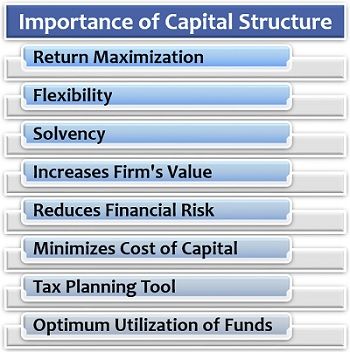

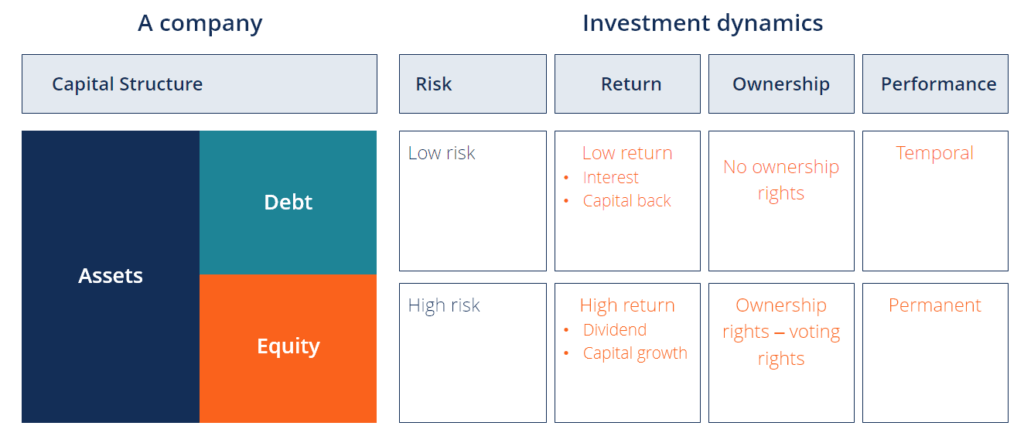

According to this approach a firm can minimize the weighted average cost of capital and increase the value of the firm as well as market price of equity shares by using debt financing to the maximum possible extent. Suppose a company has an unleveraged capital structure or its capital is purely composed of 100 equity. Discussion of financial leverage has an obvious objective of finding an optimum capital structure leading to maximization of the value of the firm. Financing the firm s assets is a very crucial problem in every business and as a general rule there should be a proper mix of debt and equity capital in financing the firm s assets.

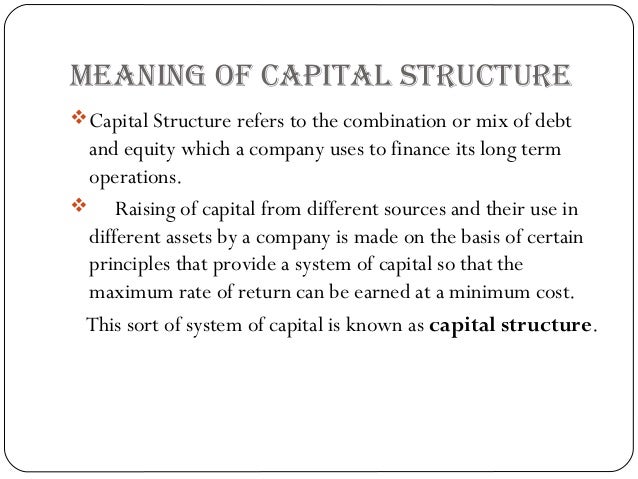

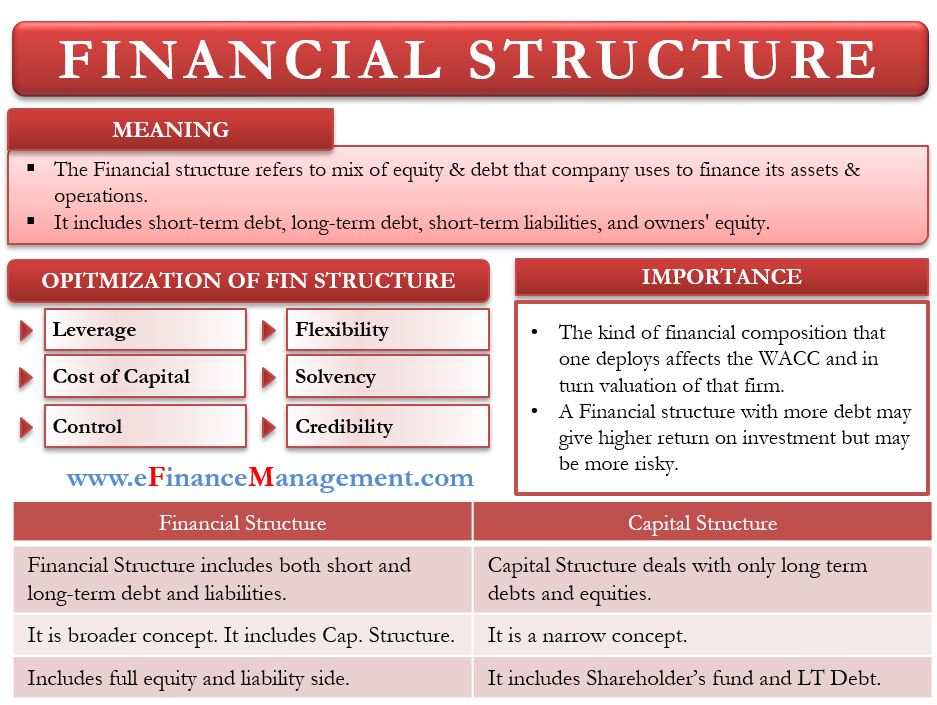

According to gerestenberg capital structure of a company refers to the composition or make up of its capitalization and it includes all long term capital resources viz loans reserves shares and bonds. The term capital structure refers to the relationship between the various long term forms of financing such as debenture preference share capital and equity share capital. The above assumptions and definitions described above are valid under any of the capital structure theories. The capital structure puzzle is unravelled and a clear.

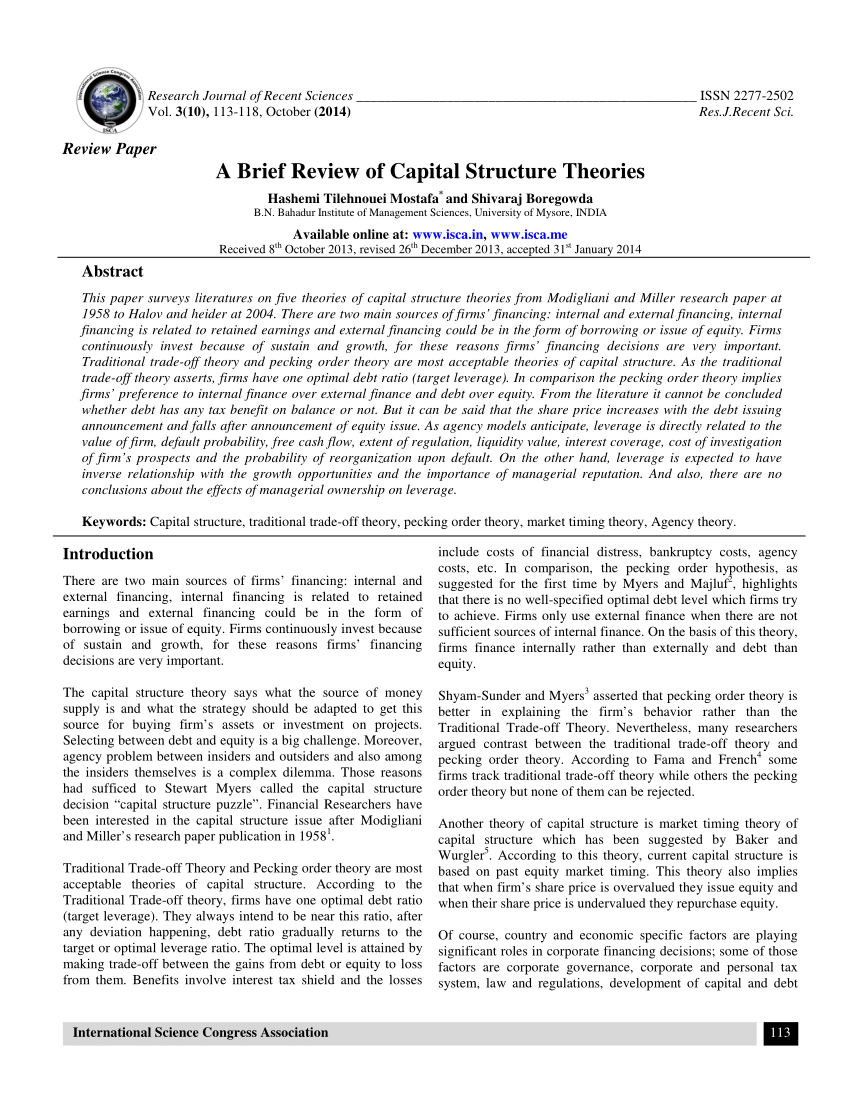

Now as the proportion of debt increase in its capital structure the value of the company changed. The modigliani and miller approach to capital theory devised in the 1950s advocates the capital structure irrelevancy theory. This theory is best explained with the help of an example illustrated by a graph. As i have read countless analysts including professional economists offer solutions to the financial crisis i have become more convinced of the importance of capital theory.

The goal of this chapter is to discuss the various theories that help to explain the determination of capital structure. This suggests that the valuation of a firm is irrelevant to the capital structure of a company. Some of the important definitions are presented below. The four important theories of capital structure are.

Whether a firm is highly leveraged or has a lower debt component has no bearing on its market value. In this approach to capital structure theory the cost of capital is a function of the capital structure.