Islamic Banking Vs Conventional Banking In Bangladesh

Bangladesh is a country where both islamic and conventional banks contribute to the economic development.

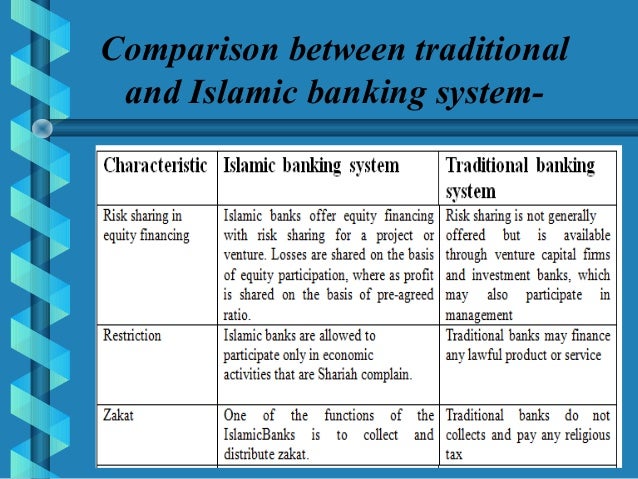

Islamic banking vs conventional banking in bangladesh. Islamic banking is an ethical banking system and its practices are based on islamic shariah laws. It focuses on profit loss and risk sharing than interest based deposit lending followed in conventional banking. Fundamentally the difference between islamic banking and conventional banking is that the idea fairness to the clients is theoretically focused on the idea of islamic banking itself. According to azizul huq a former vice chairman of islami bank islamic banks will eventually overtake conventional banks in the country.

International journal of islamic financial services 1 3 15 36. The study review and compare performance of conventional banks and islamic banks operating in gcc region. It is asset based financing in which trade of elements prohibited by islam are not allowed. For example you cannot take a loan for a wine shop.

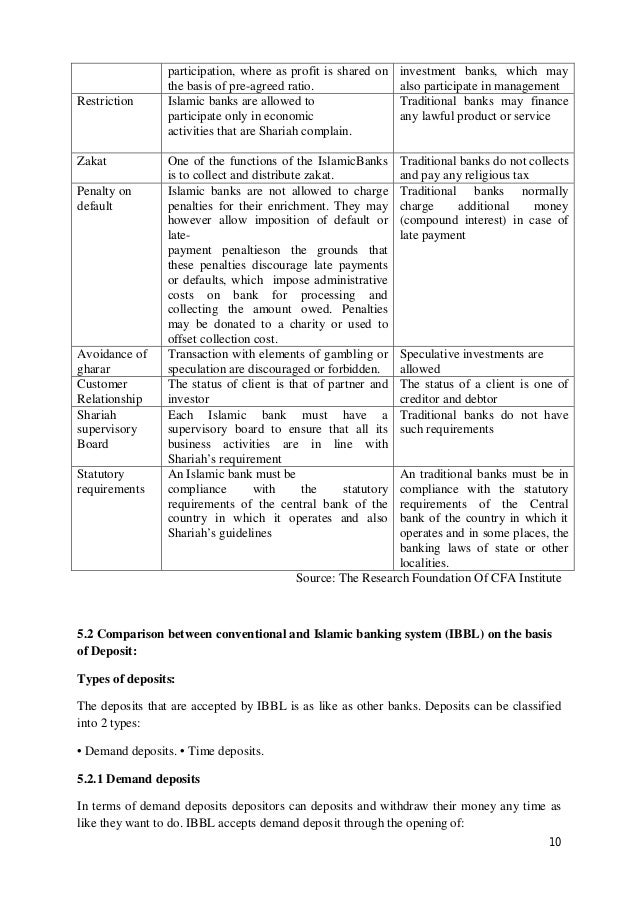

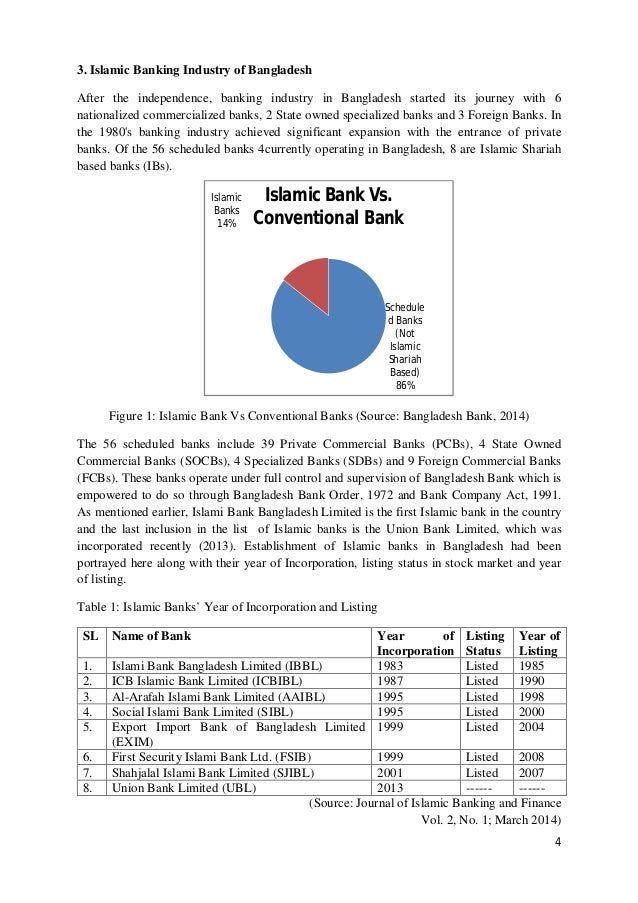

Sharmeen k r hasan and md miah 2019 underpinning the benefits of green banking. 7 5 1 comparison between islamic conventional banking system and challenges 8 5 2 comparison between conventional and islamic banking system ibbl on the basis of deposit 10 5 2 1 demand deposits 10 5 2 2 time deposits 13 5 3 comparison between conventional and islamic. On the other hand conventional banking is. As exim bank was a conventional bank later become a islamic bank it is easy for me to find the difference between the islamic banking system and conventional banking system.

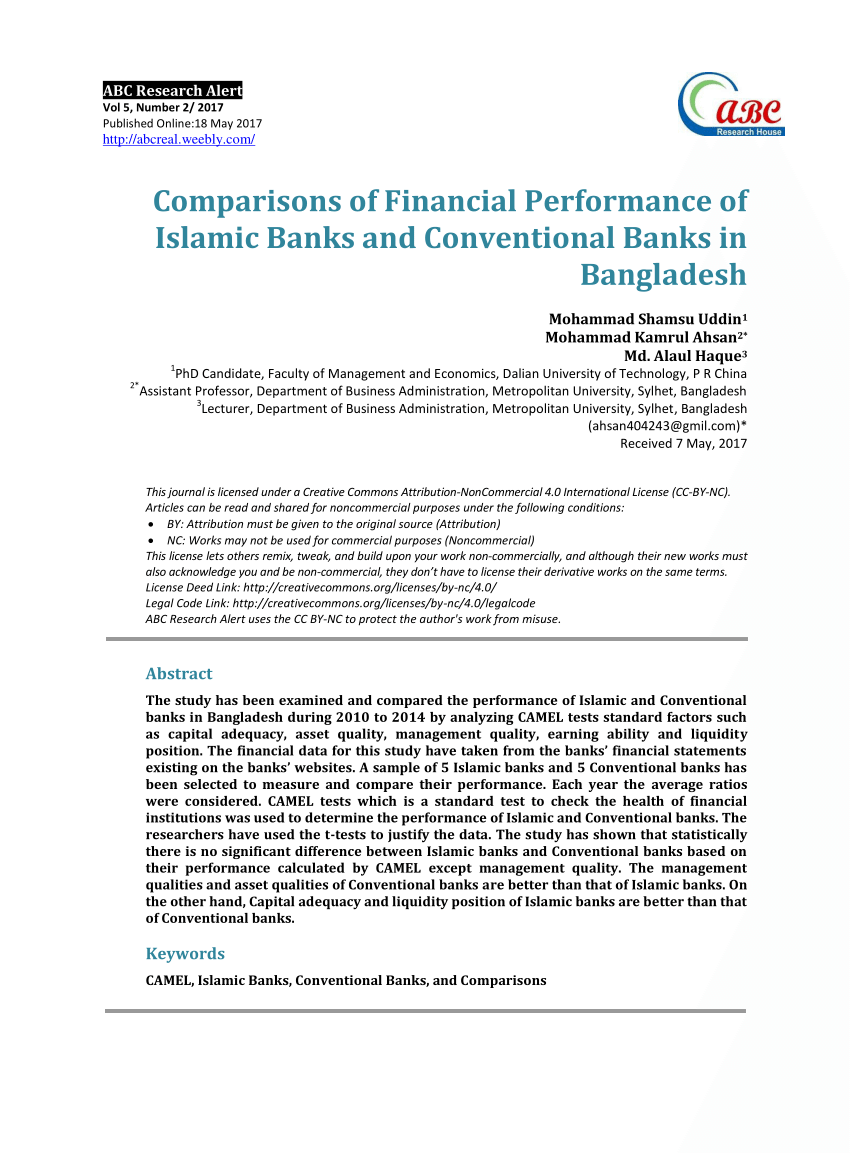

Therefore each conventional bank has its closest islamic equivalence in terms of capital and size taken from the same country. Although relatively new in bangladesh and contributing to a small portion of the banking. The main objective of this report is to find the difference between islamic banking and conventional banking. Overview of islami bank bangladesh limited ibbl and city bank ltd.

Performance problems and prospects. For specific and detailed analysis and comparison for this report i choose exim bank bangladesh ltd which was a conventional bank at past now become an islamic bank. Conventional banks aim to maximize returns and minimize risk. Sarker maa 1999 islamic banking in bangladesh.

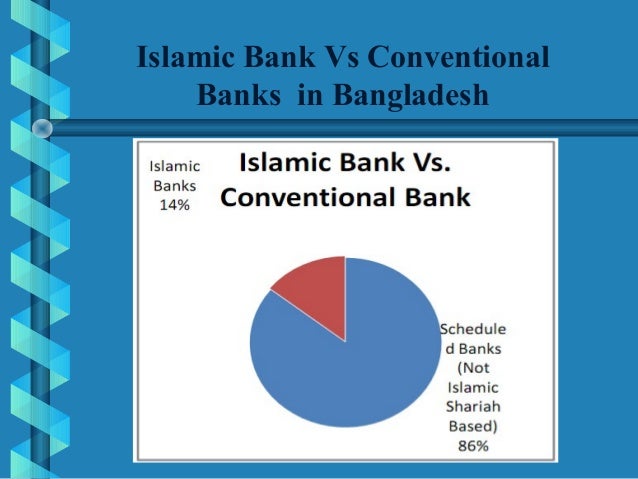

The bank s interest comes before the client s as opposed to the islamic banking system. Following up on these impressive figures islamic banking in bangladesh still has a lot of room to grow in the future. Currently islamic banks only have a 20 market share. Islamic banking is considered as alternative to conventional banking.

Conventional banking cherishes a long history while islamic banking gained importance in last few decades. There are several islamic banks in bangladesh. Later in 2004. A comparative study between islamic and conventional banks in bangladesh.