Islamic Banking Vs Conventional Banking In Pakistan

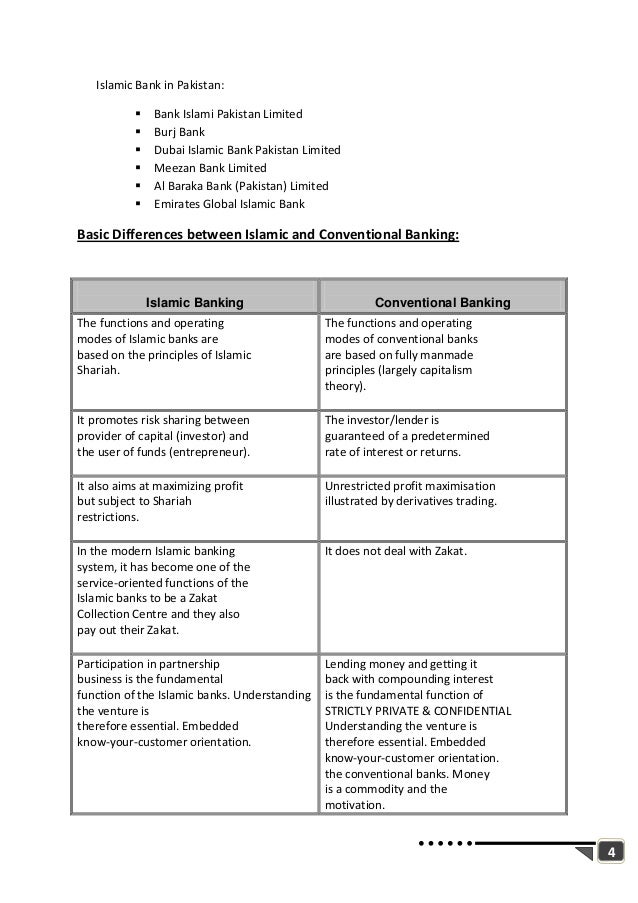

So for june 10 six full fledged islamic banks and 13 conventional banks with independent islamic branches are operating in pakistan.

Islamic banking vs conventional banking in pakistan. Return on assets return on equity and profit expense ratio. Presence of over 900 islamic banking branches in pakistan spoke volumes of the confidence reposed by the masses. A pakistani researcher rashid 2007 studied the performance of islamic banks in pakistan and compared the profitability liquidity and solvency ratios of an islamic bank meezan bank and eight conventional banks in pakistan and used three ratios for the profitability. It is still way better than conventional banking.

As per the state bank of pakistan bulletin the islamic banking industry is currently growing at the rate of about 14 8 percent with the assets of islamic banking institutions having reached pkr 1 495 billion and the deposits recorded at pkr 1 281 billion. In islamic banking profit are distributed out of profit earning by bank for the month as per decided weightages. Here below we are going to discuss in detail the islamic banking and conventional banking in pakistan. Figure 1 depicts the growth in assets deposits and financial disbursements of ifis working in pakistan sbp 2010 growth in islamic banking industry in last six years is marvelous in pakistan.

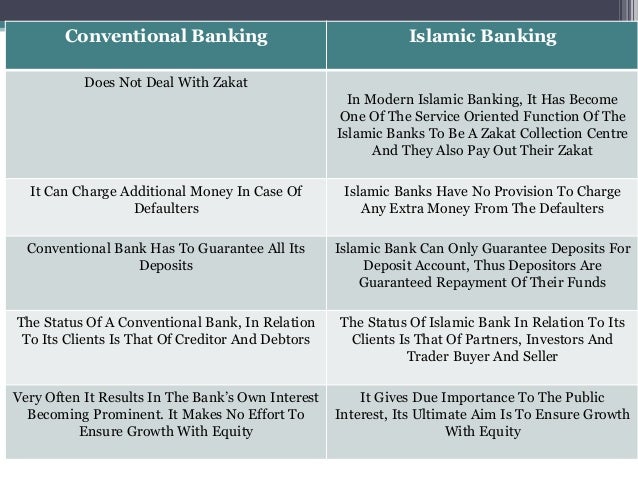

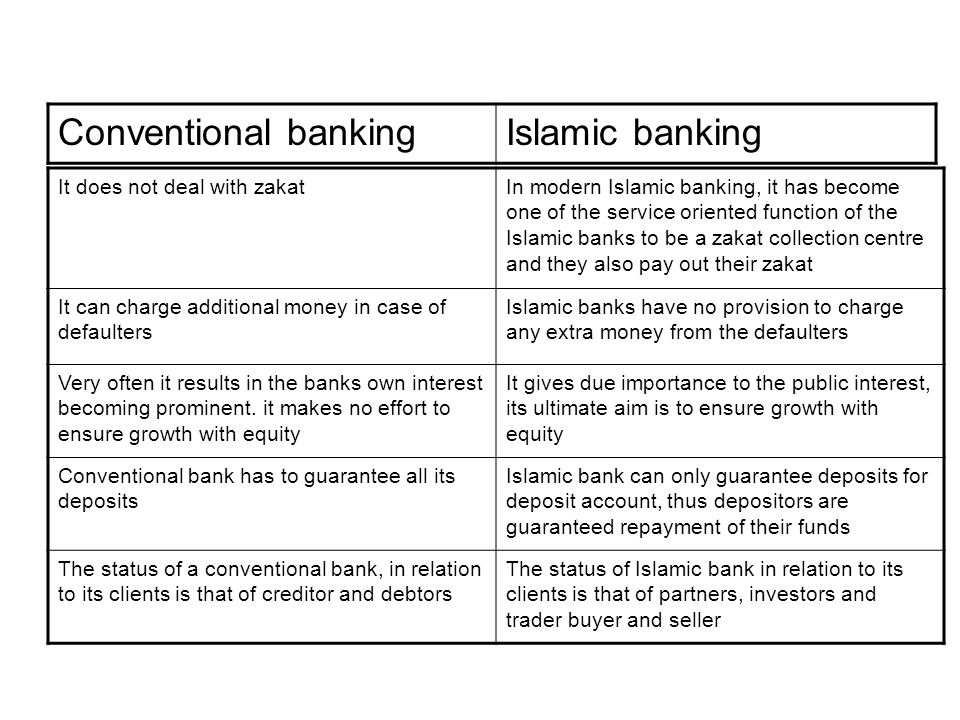

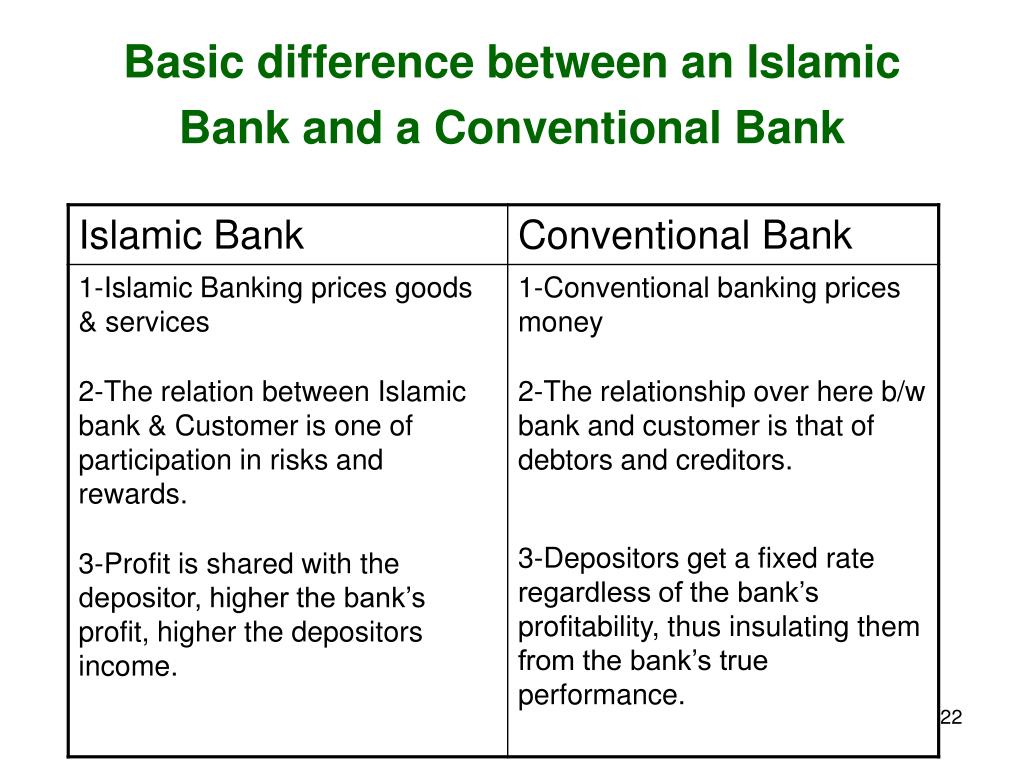

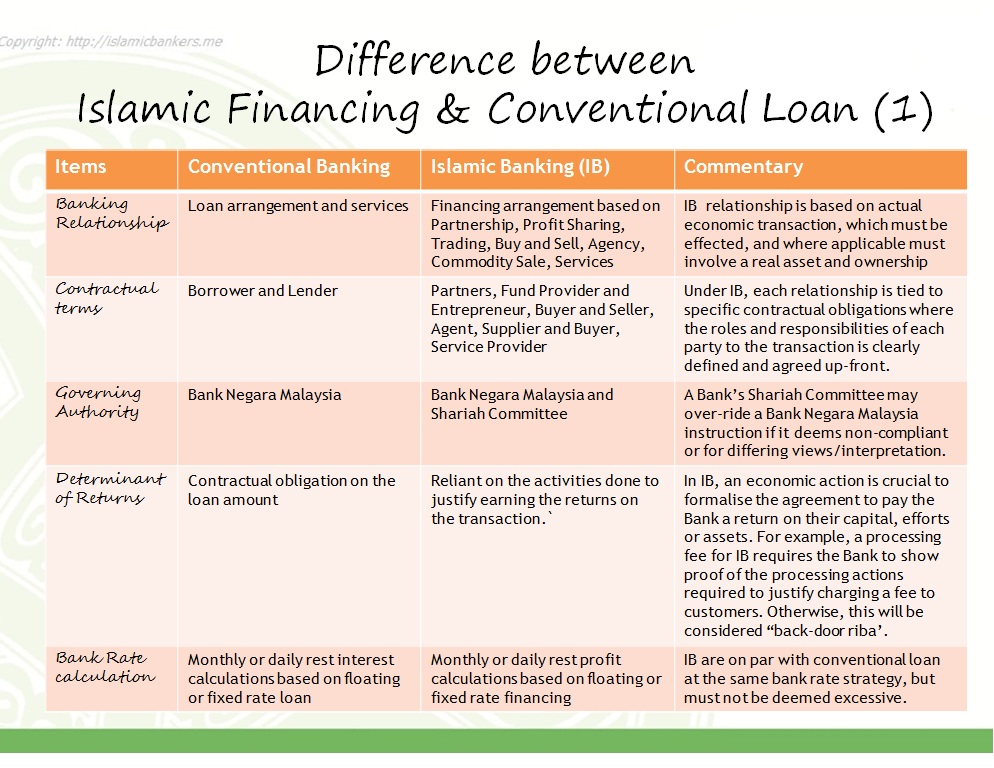

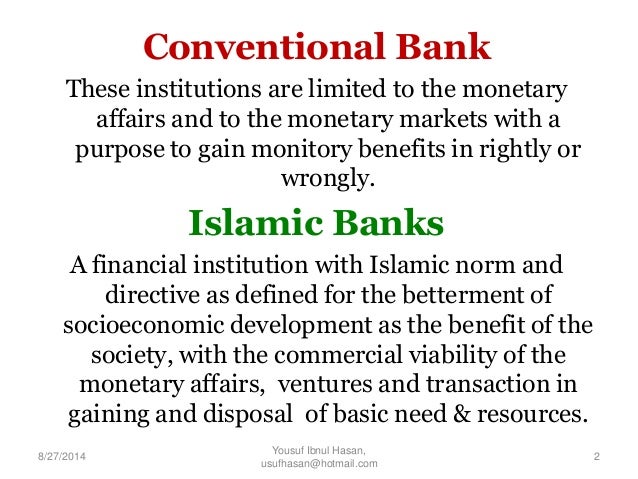

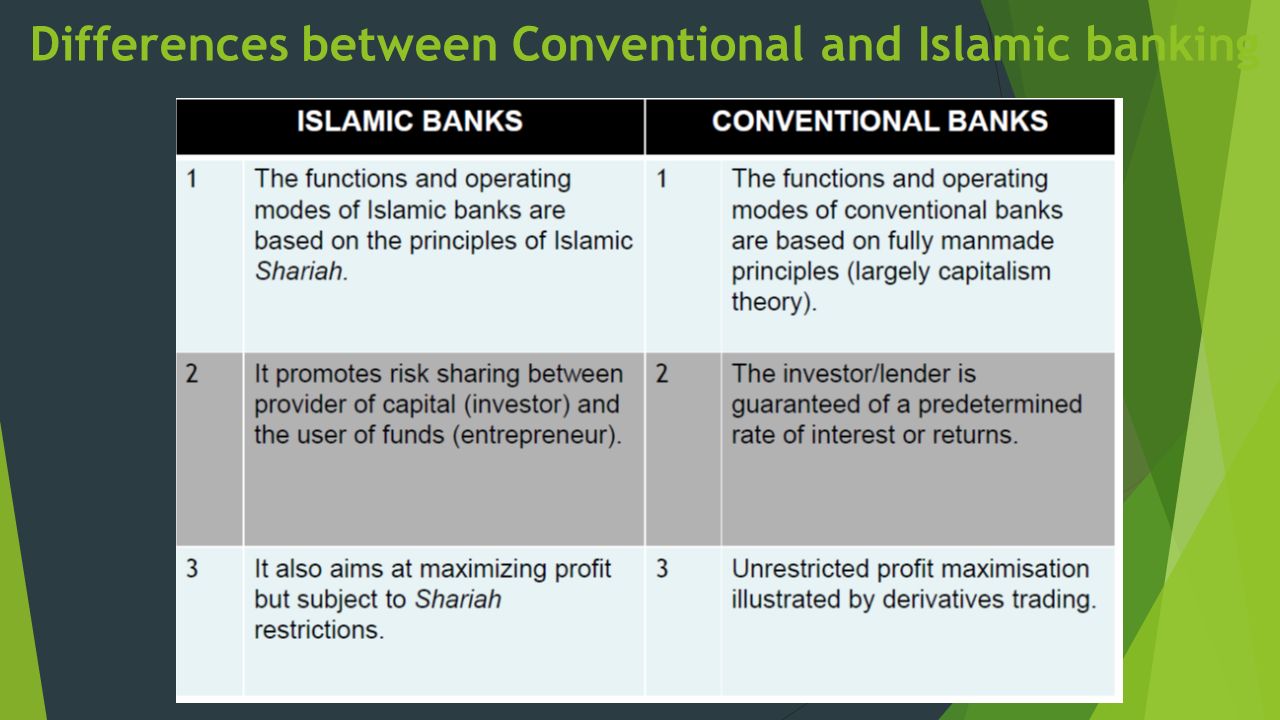

The principle of islamic banking is based on islamic law or shariah which is truly based on quran and hadith. There are so many islamic banks are present in pakistan. It is asset based financing in which trade of elements prohibited by islam are not allowed. Islamic banking is an ethical banking system and its practices are based on islamic shariah laws.

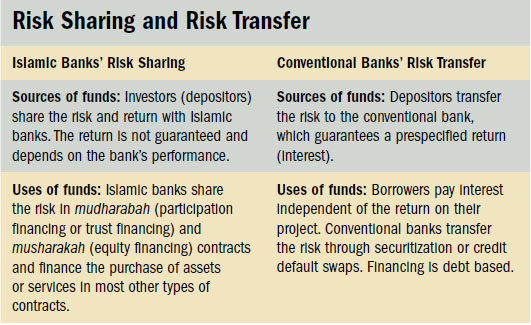

In islamic banking leasing ownership remains with bank and risk and reward bear by the bank as owner of asset. On the other hand conventional banking is. In conventional banking fixed rate of interest being given to depositors.