Islamic Banking Vs Conventional Banking Ppt

A comparison of islamic and conventional banking system asset liability management sources and uses of funds similarities dissimilaritiesqazi waqas zulqarnain nouman 1 2.

Islamic banking vs conventional banking ppt. The rapid expansion of islamic banking has been mainly through islamic branches in conventional banks rather than in pure islamic banks yueh 2014. Differences in islamic and conventional banking. Evidences suggest islamic banking is very much practiced like modern conventional banking with certain restrictions imposed by sharia and addresses the large number of business requirements successfully hence perceiving islamic banking as totally foreign to business world is not correct. Sir mansoor ali shahani submitted by.

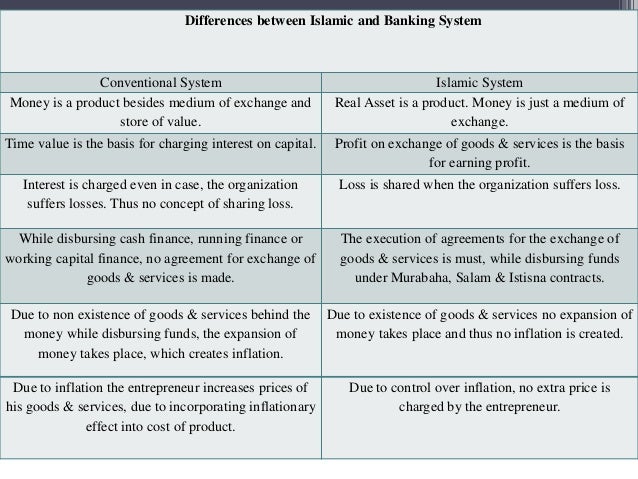

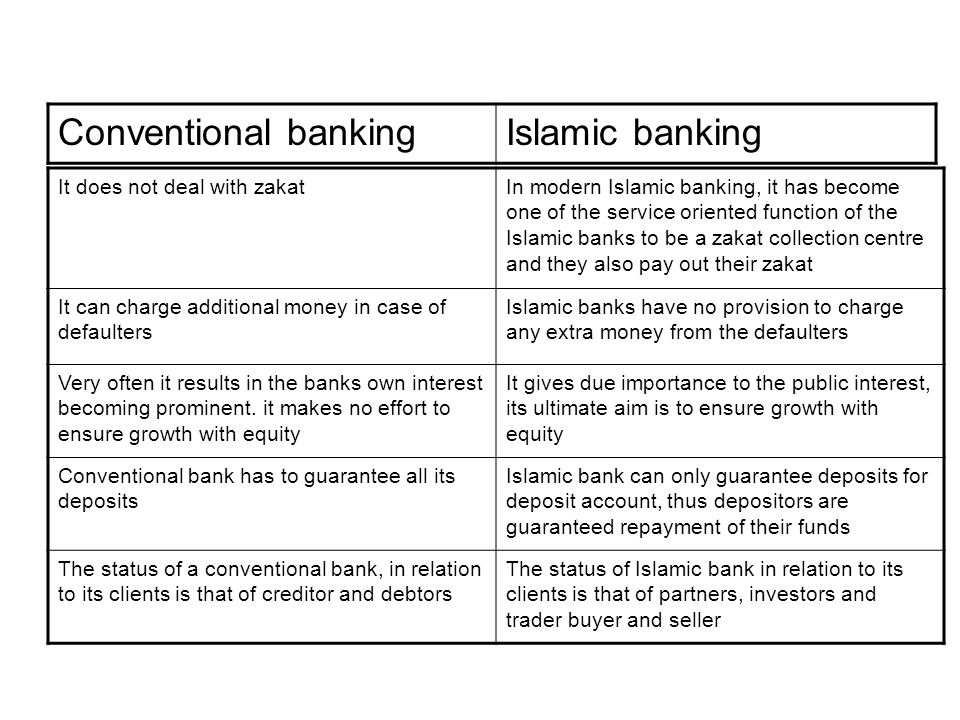

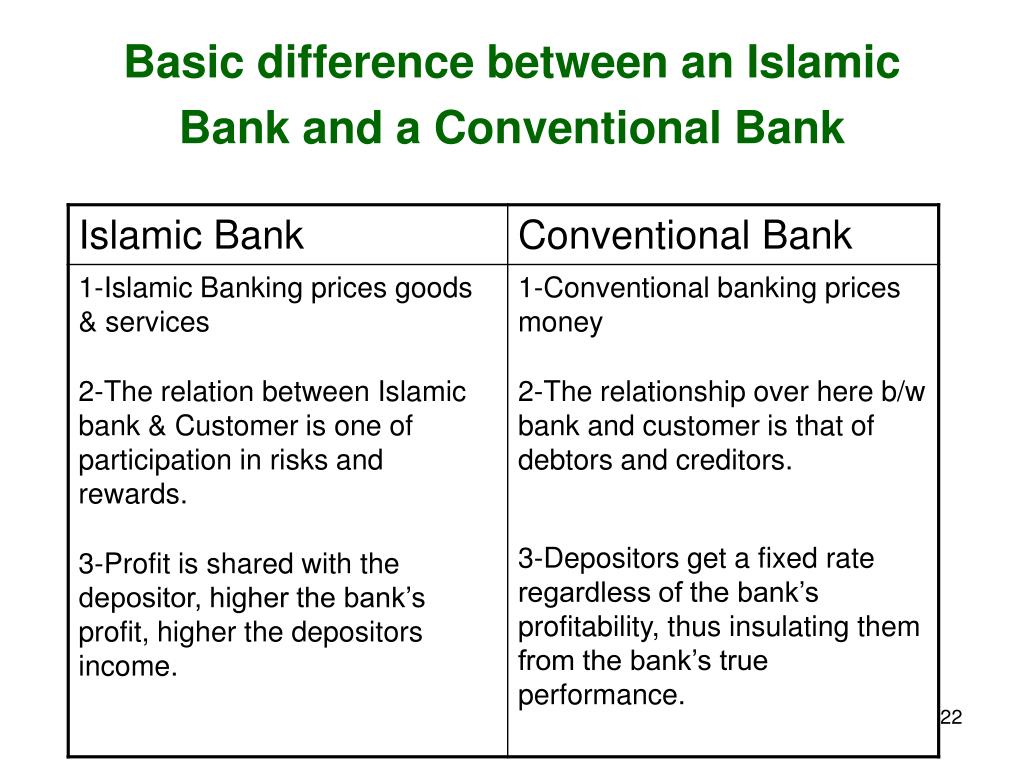

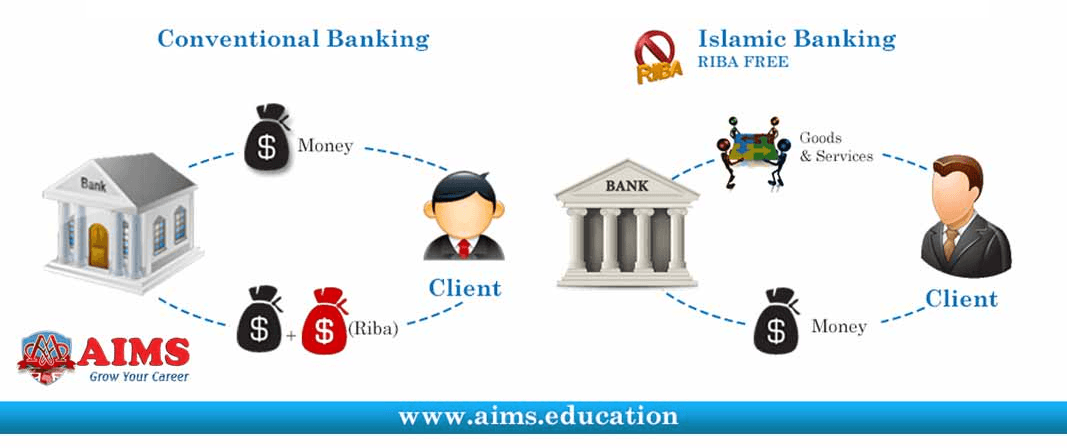

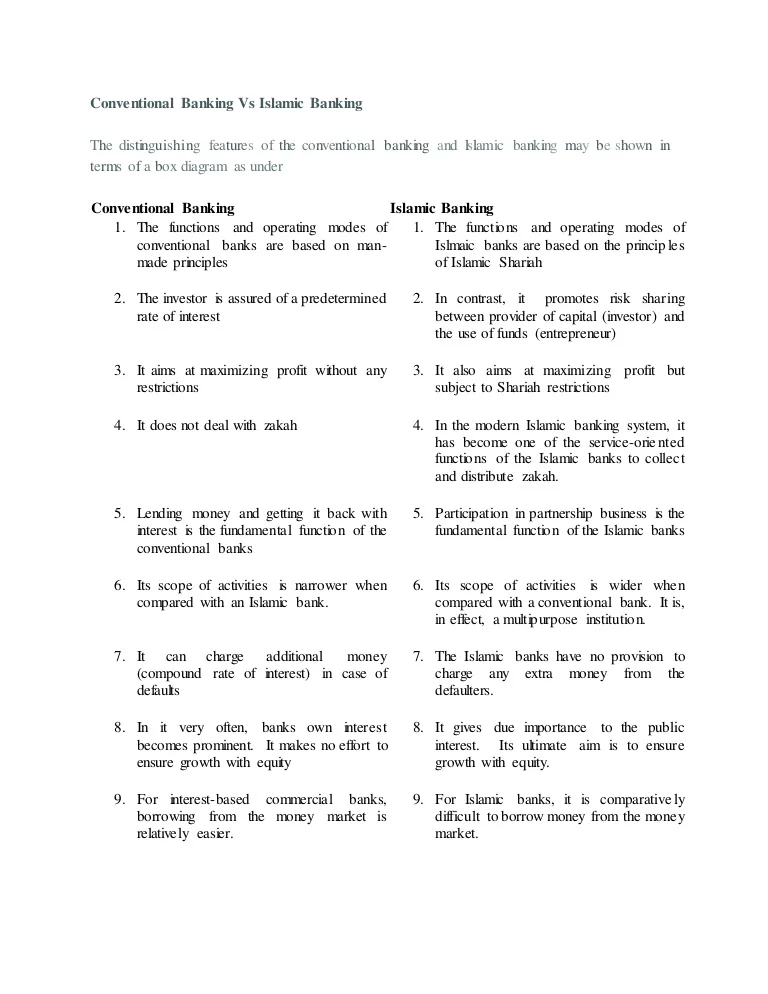

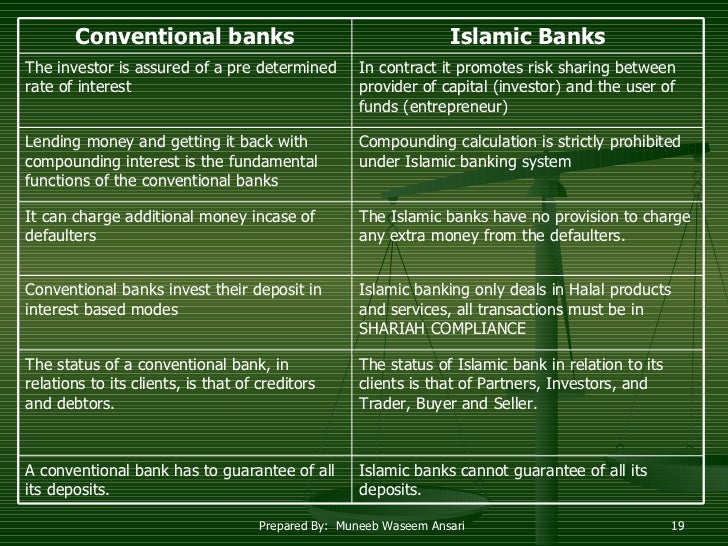

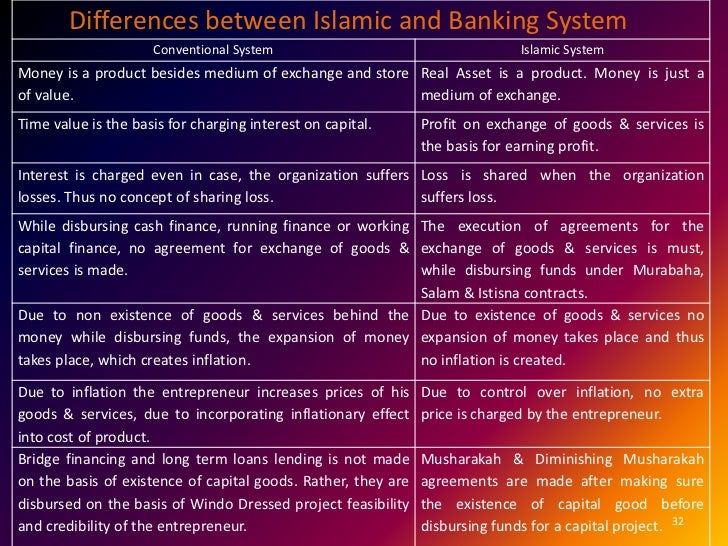

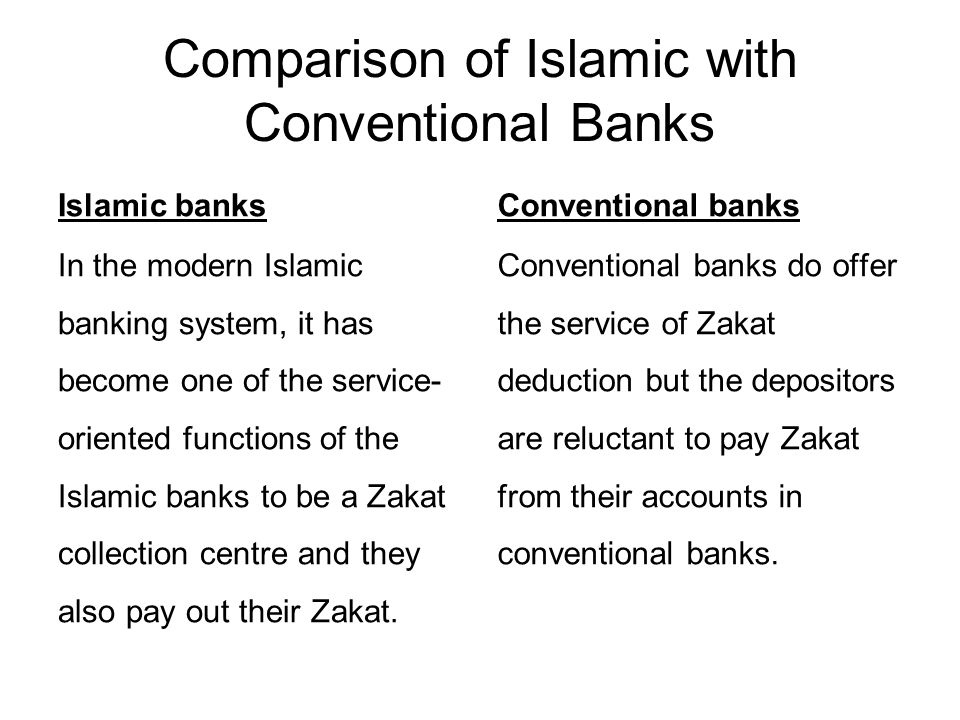

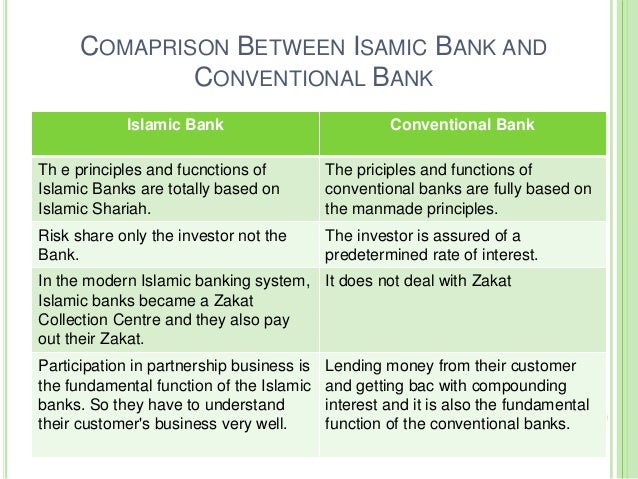

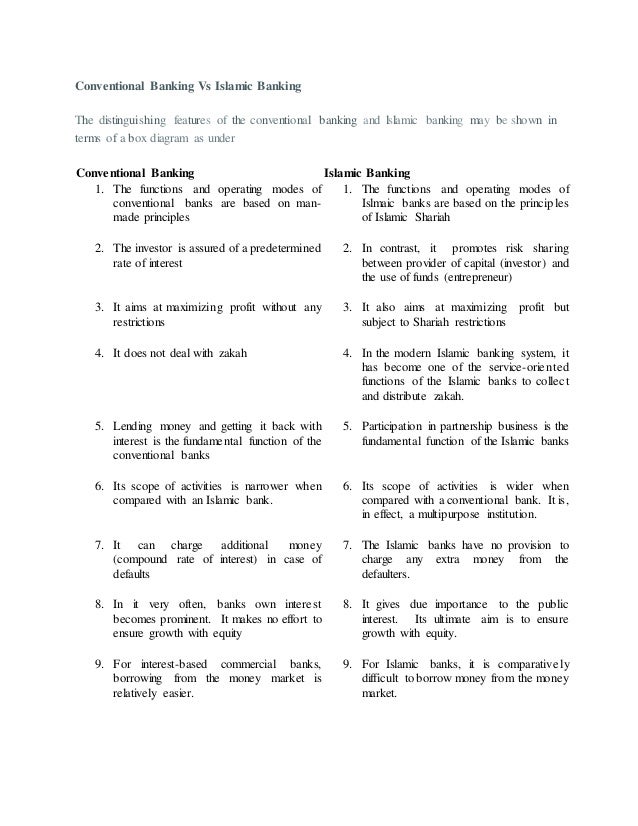

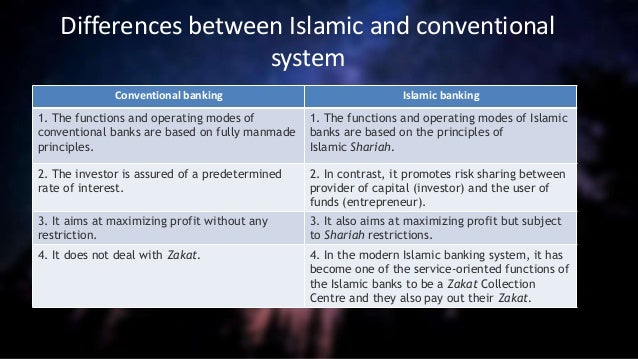

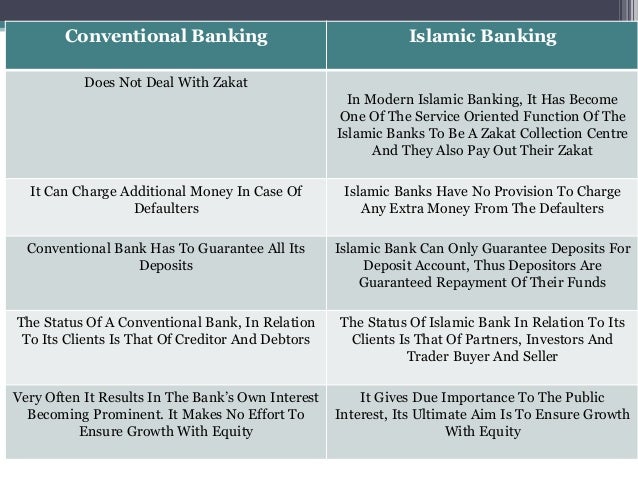

Qazi waqas zulqarnain nouman 2 3. Conventional banking loan contracts characteristics. Fundamentally the difference between islamic banking and conventional banking is that the idea fairness to the clients is theoretically focused on the idea of islamic banking itself. Interest in completely prohibited in islamic banking.

Islamic banking and finance is the property of its rightful owner. Islamic banking is an ethical banking system and its practices are based on islamic shariah laws. The bank s interest comes before the client s as opposed to the islamic banking system. On the other hand conventional banking is.

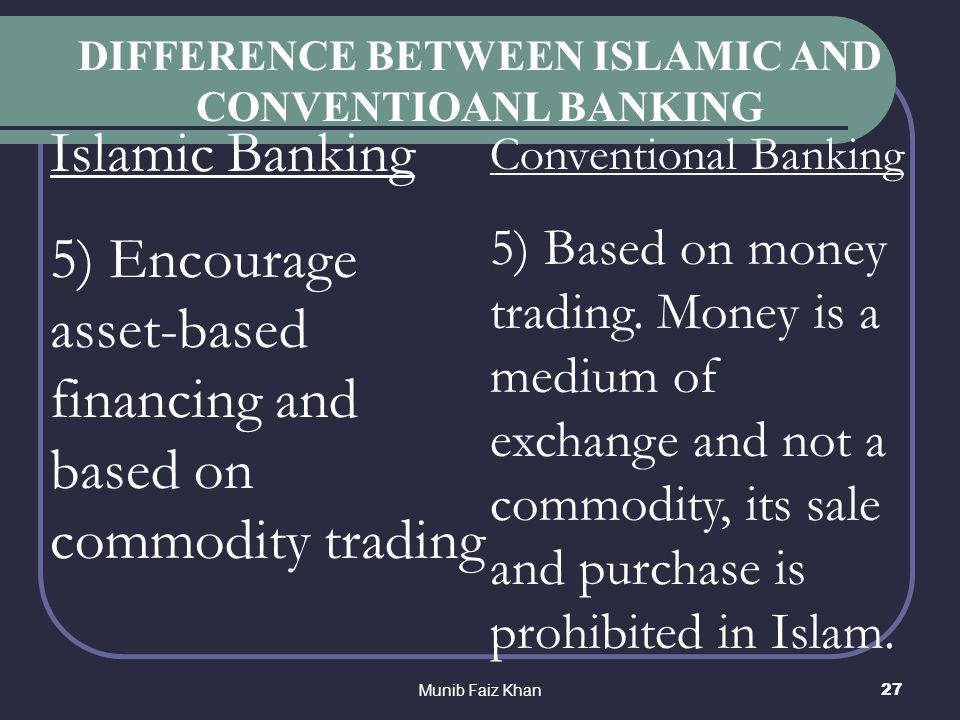

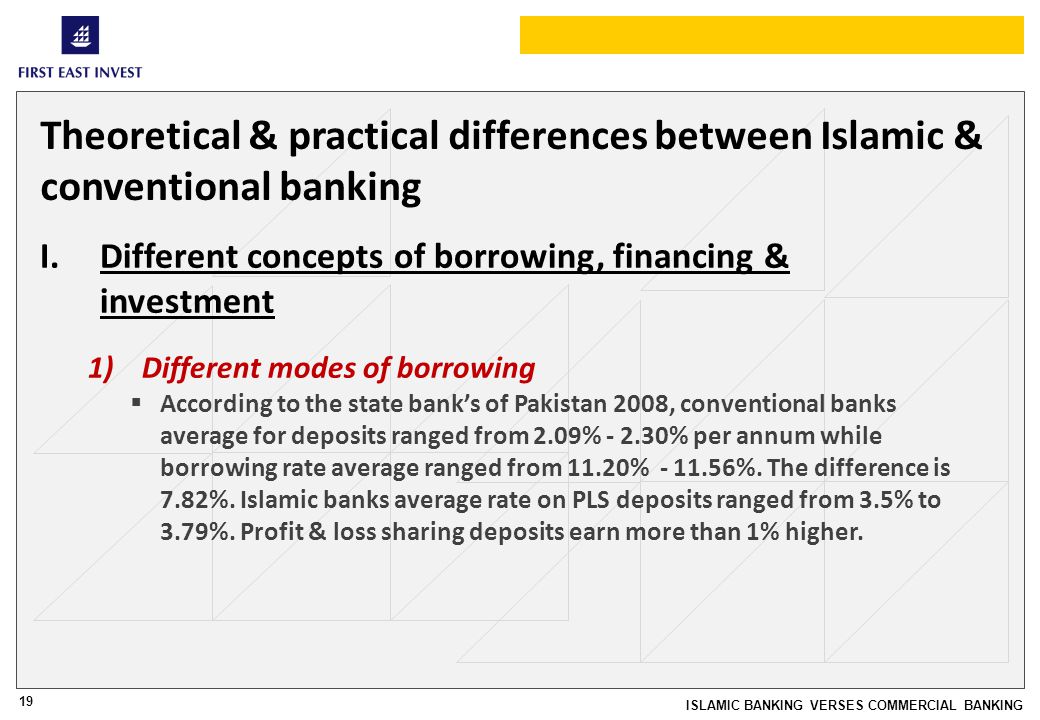

Moreover regarding islamic banking system that the interest rate is considered prohibited and all operations are under islamic law shariah while conventional banking system. The powerpoint ppt presentation. Income through interest 3. Conventional banking exploring the latest innovations in islamic capital fundings tuesday 5th october 1999 sheraton imperial hotel.

Conventional banks aim to maximize returns and minimize risk. Islamic v s conventional banking 2. I institute of business management term report islamic v s conventional banking corporate business law submitted to. It is asset based financing in which trade of elements prohibited by islam are not allowed.

History of islamic banking iv conventional banks open islamic windows. Pawan kumar 20141 17537 ali zain 20141 17049 sagar 20131 16436 sarib khan 20141 17909 sadiq raza 20141 17663 submission date. Risk management in islamic vs. Islamic vs conventional banking 1.

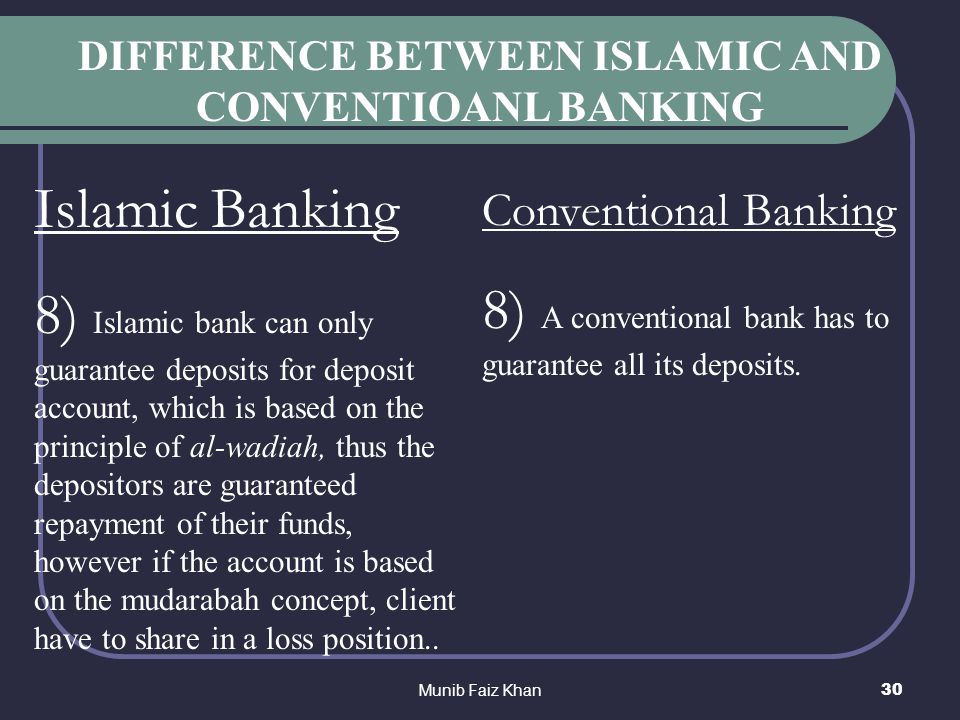

No risk of underlying assets 2. Promotes risk sharing between provider of capital investor maximizing profit but subject to shariah restrictions. Islamic banks offer financing leasing facilities to their clients to fulfil their business requirements on the basis of following. Late payment charges on delayed payments and shall constitute bank s income.

Conventional banking practices are concerned with elimination of risk where as islamic banks bear the risk when involve in any transaction.