Non Resident Tax Malaysia 2019

You ll still need to pay taxes for income earned in malaysia and will be taxed at a different rate from residents.

Non resident tax malaysia 2019. 3 6 double tax agreement dta and protocols means an agreement and its. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. 2019. According to lhdn foreigners employed in malaysia must give notice of their chargeability to the non resident branch or nearest lhdn branch within 2 months of their arrival in malaysia.

Delete whichever is not relevant income tax no. 10 december 2019 page 2 of 42 3 5 non resident person in relation to the payee is a person other than a resident person. In malaysia for a period of less than 182 days during the year shorter period but. Understanding tax rates and chargeable income.

In malaysia for at least 182 days in a calendar year. An individual will be considered non resident for income tax purpose if the individual is physically present in malaysia for less than 182 days during the calendar year regardless of the citizenship or nationality. Visitors this year. Passport no.

10 2019 inland revenue board of malaysia date of publication. Vi distribution of income of a family fund family re takaful or general fund under section 60aa of the ita withholding tax under. Green technology educational services. The 182 days period can be consucative period or not.

If the individual is resident in regard to malaysian tax law the individual. 2018 2019 malaysian tax booklet 20 tax residence status of individuals an individual is regarded as tax resident if he meets any of the following conditions i e. You are regarded as a non resident under malaysian tax law if you stay in malaysia for less than 182 days in a year regardless whether you are malaysian or not. 2019 lembaga hasil dalam negeri malaysia return form of a non resident individual under section 77 of the income tax act 1967 this form is prescribed under section 152 of the income tax act 1967 name.

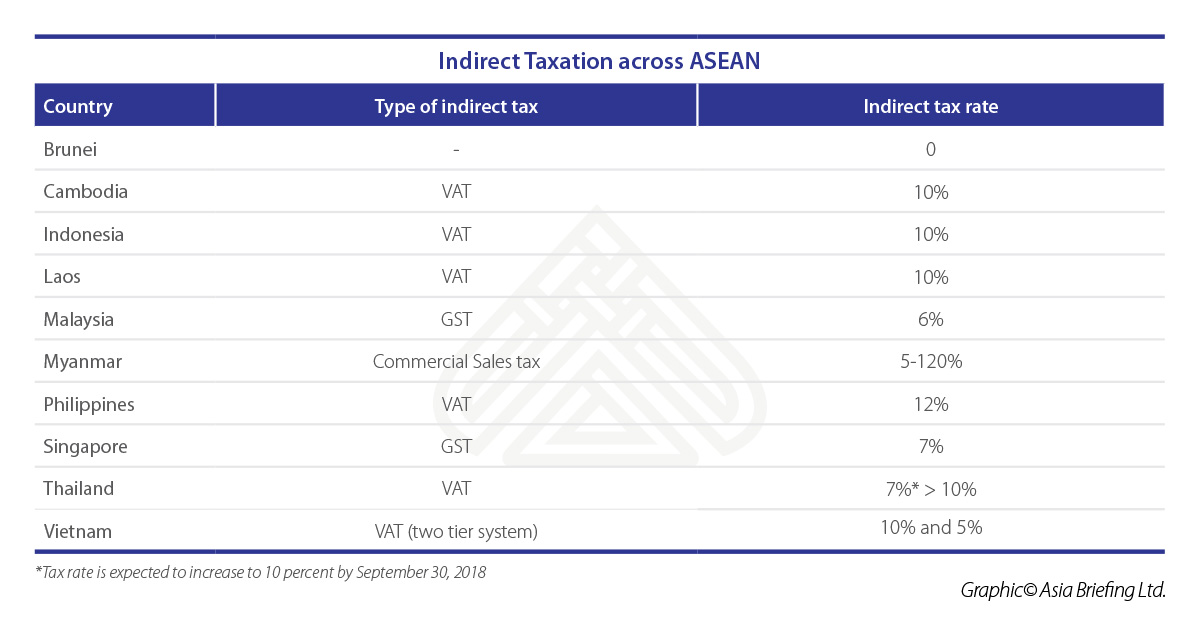

Inland revenue board of malaysia date of publication. You are considered as a non resident under the malaysian tax law if you stay less than 182 days within malaysia within a calendar year regardless of your citizenship or nationality. 6 december 2019 page 7 of 19 item resident non resident ita final tax at the rate as specified in part x of schedule 1 ita. Income taxes in malaysia for non residents.

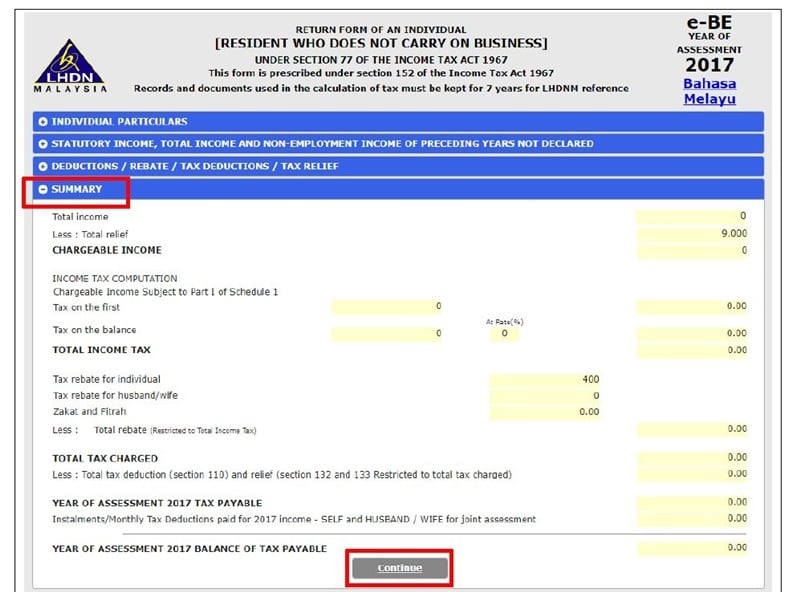

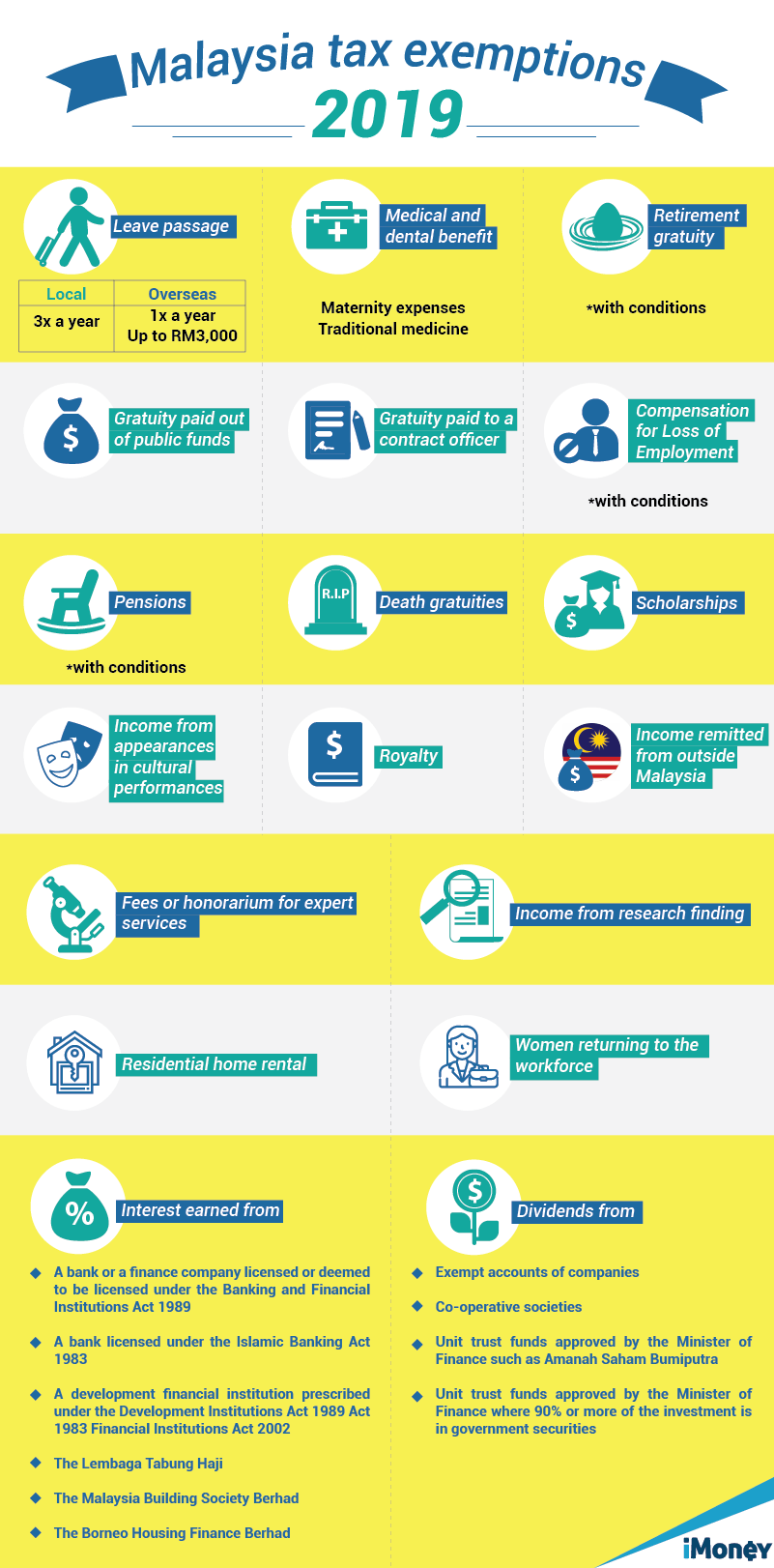

Here are the income tax rates for personal income tax in malaysia for ya 2019. So for those that fall under the non resident tax rate here we have overview of all the tax rates. Headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor.