What Is Shariah Compliance

Shariah compliance in islamic banking in bangladesh.

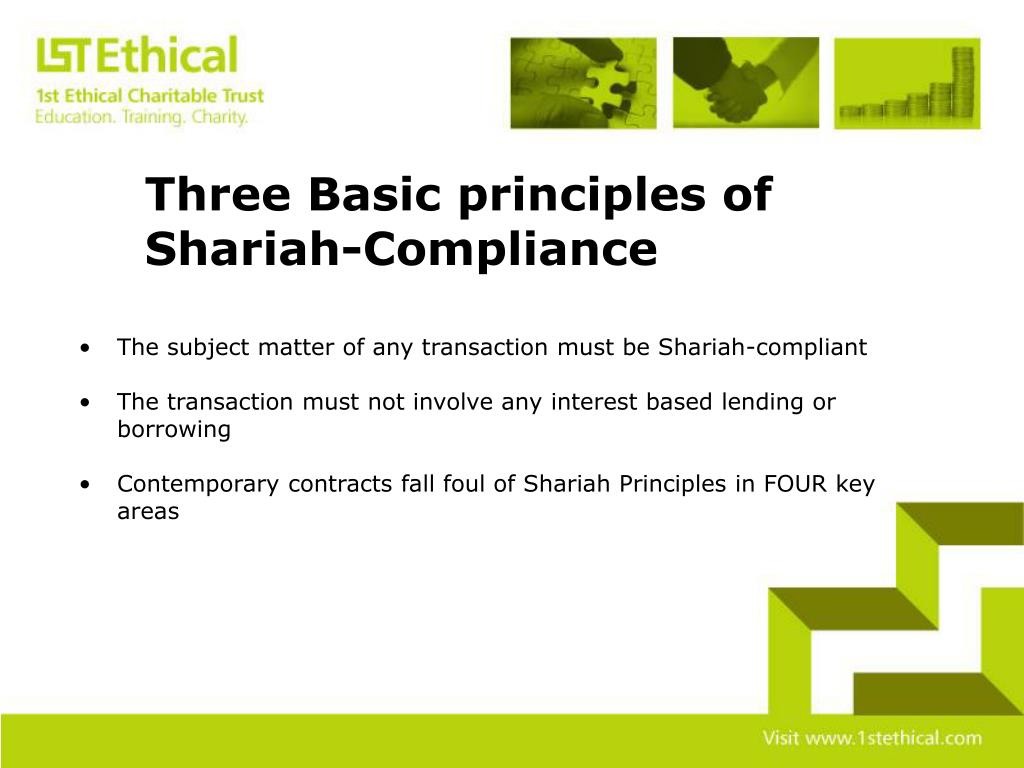

What is shariah compliance. The shariah compliance concept is difficult to implement and takes a lot of effort to successfully execute. The shariah compliance of a product is determined primarily by looking at the shariah compliant status of its underlying contract. Sharia compliance in bitcoin what it s all about and why exchanges like beldex seek muslim traders. Islamic accounting systems and practices final.

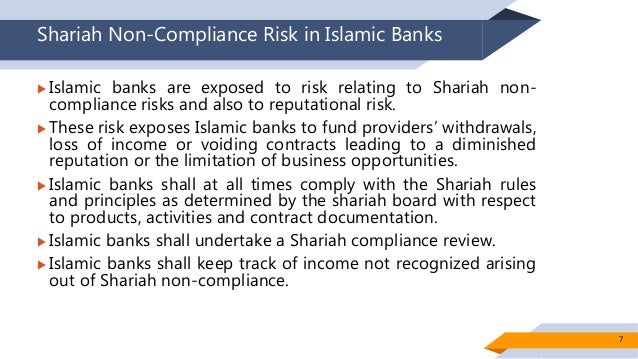

Funds with shariah compliance have many requirements that are compulsorily adhered to. Once a product or transaction is flagged as potentially shariah non compliant in a shariah audit it is referred to the bank s shariah board to determine if the transaction is batil or fasid. Abu dhabi islamic bank reports net profit of aed 1 12 billion for the first nine months of 2020. Our promise to be shariah compliant is not just empty words.

Some of the requirements for a shariah compliant fund include the exclusion of investments which derive a majority of their. There is a clear obligation on the wealth manager who makes a personal recommendation or exercises its discretion to trade to ensure that the recommendation or trade is suitable for a client. The risk reward profile of shariah compliant investment funds is mirrored in the increased focus of european regulators on suitability of products provided by wealth managers to their clients. Money is a critical part of everyone s life and for.

The industry is projected to be at 3 4 trillion us dollars by 2018 at igloo crowd we understand the need for an alternative investment for muslims in the uk which is transparent easy to understand and certified as shariah compliant. The islamic finance industry has experienced massive growth from across the globe. Shariah compliant funds have many requirements that must be adhered to. Sharia compliant finance is a fast growing line of business among banks and investment houses because investors are eager to work with booming oil economies.

Compliance of aaoifi standards by the islamic banks in bangladesh. This panel of shariah experts ensures full compliance of all shariah compliant investment funds.